Bitcoin: For the Working Class!

I had a conversation about Bitcoin with a coworker as we were demo-ing the top floor of a house we're redoing. He knew very little about it--and what he does know, he thinks is an off the wall idea of a currency. I've been interested in and investing in crypto for a few years now. My discussion with him made me want to give a non-technical, layman's account of what cryptocurriencies are in relation to the U.S. Dollar.

So, one Bitcoin goes for about $600.00 as the time of writing this. 600 bucks? Shit! I guess I've missed the boat on that one, you say? Well, here's the thing, it doesn't matter much if you plan on buying Bitcoin at this exact moment. Yes, there have been some pretty wild price swings but in the long run Bitcoin is a deflationary form of money.

Ok, what does that mean for me, you then say? Deflationary forms of money are limited in supply--there's a fixed amount available. In Bitcoin, there will only ever be 21 Million Bitcoin, and they can be divided out to nine decimal places. As long as people use Bitcoin as a popular currency, it is going to generally go up in value. It's the opposite of the currency you are already working for: the U.S. Dollar.

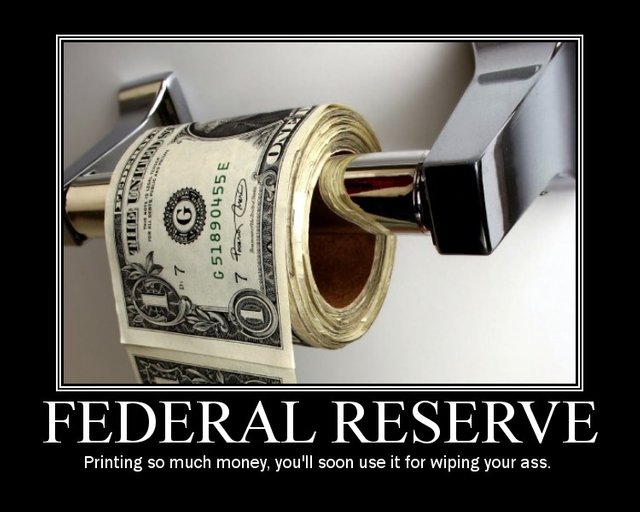

Dollars (U.S. Federal Reserve notes) are endlessly printed out of thin air, generating debt for the U.S. government. They borrow this money so they can pay for things like bailouts, wars, and struggling social programs. I will depress you by explaining just how this loan is paid back to the Federal Reserves in a second.

Cash from the Fed is dumped into banks, and that money is loaned out to investors like the big firms on Wall Street all the way down to the small entrepreneur who has an idea about how to expand his/her business and ordinary home owners and car buyers. Investors build, pay U.S. dollars to their workers, and then those workers hurry up and stick all that cash right back in the bank! Ha ha! Just kidding: Those workers realize that that money ain't worth shit sitting in a bank--so they pay their bills and whatever's left they spend on consumer goods or, if they can afford it, real estate.

Ok, time to depress you a little by talking about China and the American culture of buying from places such as Walmart. Remember when I said money will be paid back to the Federal Reserves by the U.S. government for borrowing money in order to keep afloat? Well, it's the U.S. taxpayer that will be forced to pay it all back via the income tax...eventually. In the meantime, any borrowing from the Fed will result in what's called a U.S. Treasury bond. Who in the hell would buy some country's debt and why, you say? Well, that's where China comes in...They buy T-bonds so that they can unload cheap products--sold through places like Walmart--for U.S. Dollars. China will use those dollars to buy oil for itself because the U.S. dollar is the reserve currency of the world. Most counties that need oil--and most countries do--must exchange their local currency for U.S. Dollars in order to buy oil from other countries. We've come full circle!

Wall Street has an interest in pumping up the money supply. They do not want a nation of savers. They want you out there spending! Spend, spend, spend! And you DO spend, because your money is worth less all the time. Once the money is printed from thin air and finally gets to you, you'd much rather spend that $70 bucks on a Dale Earnhart collectible memorial plate then have it do nothing but losing purchasing power.

That's where Bitcoin comes in. It doesn't fall endlessly out of the Fed's asshole. When you have a Bitcoin, the fluctuating value can make you a little seasick, but as more people jump on board the boat gets bigger, it takes the waves much easier, and it actually helps calm the sea. It's limited in supply so as it does become part of the financial system the price will rise, you'll see the value increase, and you will naturally want to make fewer trips to Walmart.

If Bitcoin grows will Wall Mart go away? Of course not. They and everyone else will make better products in order to get you to part with your ever increasing in value Bitcoin. You will work, get paid, and your money will become more valuable all on it's own.

All this is of course dependent on how easy it is to adopt. It has to get to a point where it's truly easy and reliable to give Bitcoin (or other cryptocurrencies) to someone non-technical like your average work a day person, or your grandmother. That's why there's places like Steemit and other crypto currencies, sites, apps, devices, and ventures that will come to fill the void. So, you don't have to buy Bitcoin right now--because you will be happy about being paid in Bitcoin in the future.

Of course, you could always buy some now. Who knows how high it will get? But then, the seas are still pretty rough, and no one knows which of the cryptocurrencies will come out on top.