The Future of Bitcoin is up to Millennials.

Imagine a world where the use of paper money is almost absent. Governments are no longer in control of all currencies. Sending money overseas does not take weeks to clear, and the associated fees are nonexistent. The central banks are no longer in control, and the citizens have complete control over their money, and everything is decentralized. That world is not too far away from now, but it still seems like a sci-fi movie. With the advent of cryptocurrencies, the story above is now possible. Cryptocurrencies like Bitcoin are helping make our financial world a more efficient place. Bitcoin is a decentralized digital currency that no government has control over. The technology behind it is called blockchain, and it keeps a transaction ledger. Since 2009, cryptocurrencies have netted growth without being in the spotlight of being considered mainstream. In 10 years, cryptocurrencies will be mainstream because of money transfer convenience, millennials acceptance, and public figures support.

Every year millions of people working abroad send their money back to their home country. Wire transfers are essential to their lives, but they come at a cost. In “Wire Transfers: What Banks Charge” (Tiernry, 2017) the average fee per outgoing international transfer is $44 ($25 for domestic) and incoming international transfer is $10 ($9 for domestic). In this age, everything is progressing at lightning speed, besides the financial institutions. Bitcoin can help these people send their money all over the world, practically free. The interactive chart on www.bitinfocharts.com continuously tracks the average cost for Bitcoin transactions. Currently, the transaction cost to send Bitcoin is $1.88. Once these people start adopting Bitcoin to transfer their money back to their home country, they would be potentially saving over $50 per transfer. When the wire transfers are conducted not only does the transferee have to deal with high fees they also have to allow 1-2 days for the money to be cleared and assessable on the 3rd day (transferwire.com). That is a problem, having the wire transfer held in limbo is an issue and an outdated process. Bitcoin takes minutes for the transaction to complete. Replacing wire transfers with cryptocurrencies not only saves time but also saves money.

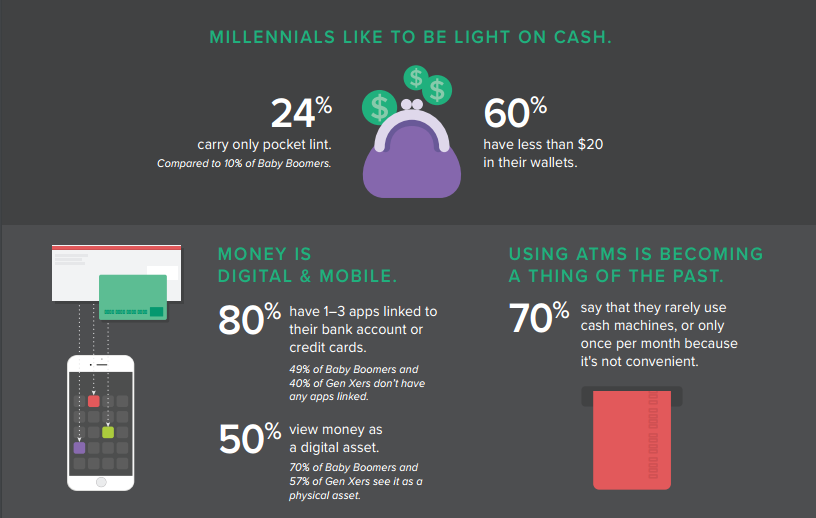

Millennials remember the difficult times during the crash in 2008. Finding a job was nearly impossible; they had to be frugal with their money. Now, millennials are going against the grain with how they view traditional money, saving more and using less credit. Cryptocurrencies are seen positively by millennials, and most cryptocurrency holders are millennials. Diana Crandall recently wrote an article for Forbes Magazine that researched why millennials viewed cryptocurrencies so positive, here is what one interviewee said: “All of my net worth is in cryptocurrencies because I see them as the best way to escalate my ability to be financially secure and pay off my student loans” … “I like the idea of decentralization, the fact that there’s a lot less corruption and political ties. That idea appeals to me … Not having to go through banks. Having financial control over our lives again.” (Meet The Millennials Saving For Retirement Using Bitcoin, 2017) That was only one millennials view. However, most millennials agree with him. According to the research reported in www.coindesk.com, the study concluded that “[Millennials] could be the driving force behind mainstream adoption of the digital currency in the future” … “32% [of millennials] said that they expect to use [digital currency] by 2020.” (Report: Millennials and the Wealthy Most Likely to Use Bitcoin, 2014). If millennials believe that cryptocurrencies have a store of value and use them more, it will become increasingly popular.

The cryptocurrency industry has grown exponentially, and billionaires like Mark Cuban, Bill Gates, and John McAfee support the movement. Year to date industry growth has nearly been 800%. Some may argue that cryptocurrencies are in a bubble like Tulip Mania of the 1600s or the Dot-com crash of the late 1990s, but it is not. Less than 1% of the world’s population is aware of cryptocurrencies and a fraction of that amount own or trade them. People are using them as a hedge against inflation that is plaguing fiat currency. Wall Street just recently celebrated its 200th birthday with a market cap of 21 trillion; Bitcoin celebrated its 10th birthday with a market cap of 132 billion.

Many roadblocks will be in the way towards mainstream adoption. Cryptocurrency growth will continue to peak peoples interest over the next few years and turn naysayers into believers. Media coverage will increase, and as more celebrities enter the realm, it will make it more appealing. Most of all people will continue to lose faith in their governments. Events like what is happening in Catalonia, Spain will continue to happen all over the world. When areas seek independence, cryptocurrencies will help them break away financially. Cryptocurrencies will become mainstream, and it is not about how, but when.

Tierney, S. (2017, September 08). Wire Transfers: What Banks Charge. Retrieved September 30, 2017, from https://www.nerdwallet.com/blog/banking/wire-transfers-what-banks-charge/

BitInfoCharts. (n.d.). Retrieved September 30, 2017, from https://bitinfocharts.com/comparison/bitcoin-transactionfees.html#3m

Support Center. (n.d.). Retrieved September 30, 2017, from https://transferwise.com/help/article/1654253/basic-information/how-long-does-it-take

Crandall, D. (2017, September 28). Meet The Millennials Saving For Retirement Using Bitcoin. Retrieved October 02, 2017, from https://www.forbes.com/sites/dianacrandall/2017/09/13/meet-the-millennials-saving-for-retirement-using-bitcoin/#62ffe17970fa

Report: Millennials and the Wealthy Most Likely to Use Bitcoin. (2014, October 30). Retrieved October 02, 2017, from https://www.coindesk.com/study-millennials-wealthy-consumers-bitcoin/

Pollock, D. (2017, August 28). Cryptocurrency Market Cap Up Nearly 800 Percent In 2017, Bitcoin Accounts for Half. Retrieved October 02, 2017, from https://cointelegraph.com/news/cryptocurrency-market-cap-up-nearly-800-percent-in-2017-bitcoin-accounts-for-half

Complete Bitcoin Price Chart with Related Historical Events. (n.d.). Retrieved October 02, 2017, from https://99bitcoins.com/price-chart-history/

This post was resteemed by @steemitrobot!

Good Luck!

The @steemitrobot users are a small but growing community.

Check out the other resteemed posts in steemitrobot's feed.

Some of them are truly great. Please upvote this comment for helping me grow.

Resteemed your article. This article was resteemed because you are part of the New Steemians project. You can learn more about it here: https://steemit.com/introduceyourself/@gaman/new-steemians-project-launch