Regulations And Their Influence On Cryptocurrency Prices

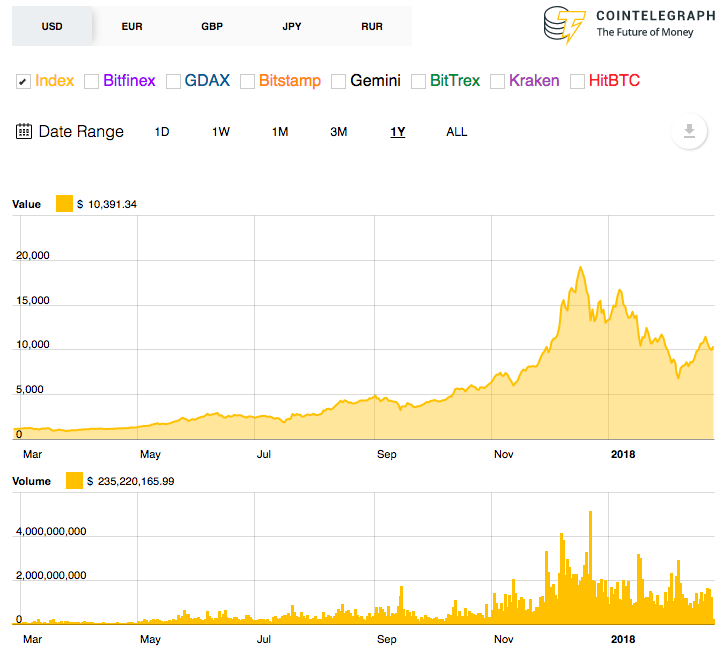

2017 saw cryptocurrencies swing wildly in valuations daily. Despite a mostly upward trajectory, the market remains susceptible to unpredictable and sometimes extreme fluctuations in prices.

While some of this volatility can be attributed to how the current cryptocurrency model was conceived—namely its deflationary nature—and the fact that most coins are still viewed mainly as investment and speculative assets, there have been external factors that drive price momentum as well.

The increased spotlight on Bitcoin and its digital contemporaries led the original cryptocurrency to skyrocket in value. This meteoric rise results in widespread market participation, inviting retail investors in droves to the crypto industry. However, it also focused the gaze of governments and international actors on the industry, a factor that has and could still play a large role in this volatility, especially if past regulatory efforts are any indication.

A prominent example of how regulations can lead to unintended consequences in financial markets comes courtesy of the post-crisis Dodd-Frank Act. Due to the restrictions placed on deposit-taking banks, many prominent financial institutions were forced to reduce their market-making activities in certain asset classes to reach higher capital ratios required by the regulations. In effect, the reduction in market-making liquidity harmed the price discovery process. Especially in the bond market, which is not as liquid as foreign exchange or stock markets, it can conceivably result in a snowball effect that amplifies directional price movements instead of reducing overall volatility.

Despite regulators’ best intentions, cryptocurrencies’ values remain heavily tied to speculation and optimism. For this reason, drastic policy changes can have an outsized impact on short-term direction, as several prominent examples revealed over the past year.

Nonetheless, the long-term impact is slightly hazier, as many of these regulations are only months old. Even so, while they could lead to a more stable market in the future, an abundance of questions surrounding the matter shows just how effective regulations will really be, and to what degree they will impact prices in the future.

Why regulations affect prices

The original boom in cryptocurrencies occurred in an unregulated environment. Even as news outlets and investors paid closer attention to the market, regulators and international actors remained largely distant from the action, and prices continued to soar unabated.

While in 2017 regulatory bodies take their first steps toward reining in the market, the previous near-decade saw cryptocurrencies evolve and grow relatively unrestricted. For regulators, this means attempting to box in a system that grew chaotically mostly by design.

This trend was largely visible thanks to the explosive growth in ICO funding many Blockchain companies attained last year. In 2017 new Blockchain-based companies reach an unheard-of $4 bln in funding even as regulators like the Securities and Exchange Commission began to circle. The capital raising was not without its flaws, with several well-publicized incidents underlining the relative lawlessness of the current model.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/news/regulations-and-their-influence-on-cryptocurrency-prices

Great post :) Thanks for sharing

Enjoy