Bitcoin failed in Monday (January 4,2021) exchanging as the broadly unpredictable digital currency pulled back following an astounding new-year rally

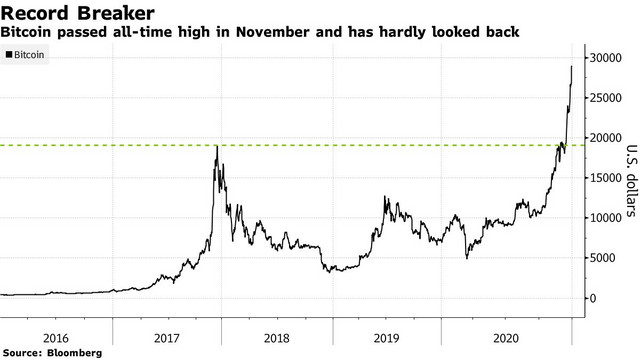

Costs fell as much as 17% in the greatest drop since March prior to recuperating. The misfortunes are little with regards to Bitcoin's more extensive meeting, with a half hop in December alone. After an explanatory 2020, the computerized cash had begun the new year with a blast, flooding as high as $34,000 and hitting untouched highs on Sunday.

Bitcoin was down 7% to $31,227 as of 12:59 p.m. in London.

"The present selloff is an update this is a generally new resource, profoundly unstable, and still yet to discover its spot on the lookout," said Adrian Lowcock, head of individual contributing at Willis Owen Ltd. "There are many (major) obstacles for it to defeat for it to be a valuable standard resource."

As ever in the realm of crypto, it's difficult to pinpoint the proximate reason for the most recent episode of unpredictability. Bitcoin is up over 300% over the previous year, driven by a theoretical fever from retail and institutional financial specialists on the conviction that cryptographic forms of money are arising as a standard resource class and can go about as a store of significant worth.

As ever in the realm of crypto, it's difficult to pinpoint the proximate reason for the most recent episode of instability. Bitcoin is up over 300% over the previous year, driven by a theoretical fever from retail and institutional financial specialists on the conviction that cryptographic forms of money are arising as a standard resource class and can go about as a store of significant worth.

Devotees to Bitcoin have highlighted the market's stock limitations and as far as anyone knows wild cash printing by national banks as key drivers of bullish account. Others state that cryptographic forms of money are an air pocket really taking shape and another sign that insane danger taking has taken over worldwide business sectors.

"Hot Nasdaq stocks, Chinese web plays and promising biotechs out of nowhere appear to be dull contrasted with the activity unfurling in the digital money space," said Louis Gave, fellow benefactor of Gavekal Research.

Following a year that is seen Robinhood financial specialists arise as an amazing market influence, some are puzzling over whether little dealers could move out of innovation stocks and into cryptographic money theory.

"Bitcoin's developing business sector cap needs to come to somebody's detriment," said Gave. "Will the negligible retail dollar begin to swear off 2020's Robinhood dears and rather move toward the thundering crypto market?"

The more vulnerable dollar could likewise be assuming a job in Bitcoin's irate climb, said Paul Hickey of Bespoke Investment Group. "The last time the dollar saw a bigger half year decay was in the second 50% of 2017," he said. "That is likewise the very time that Bitcoin initially began to go standard."

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!