Phoenix rises in 2020; all altcoins (including Bitcoin Core) will be 50+% attacked/destroyed

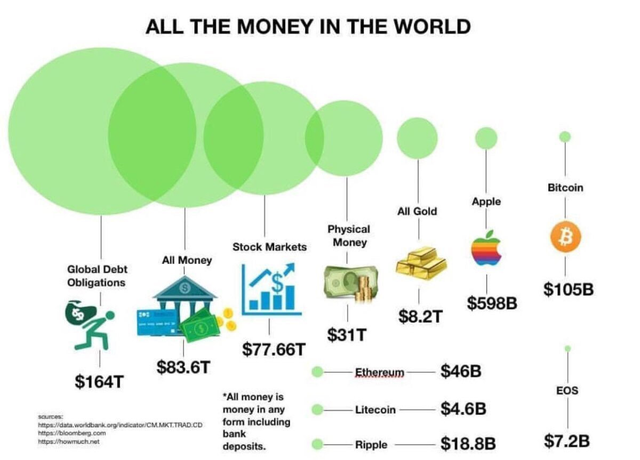

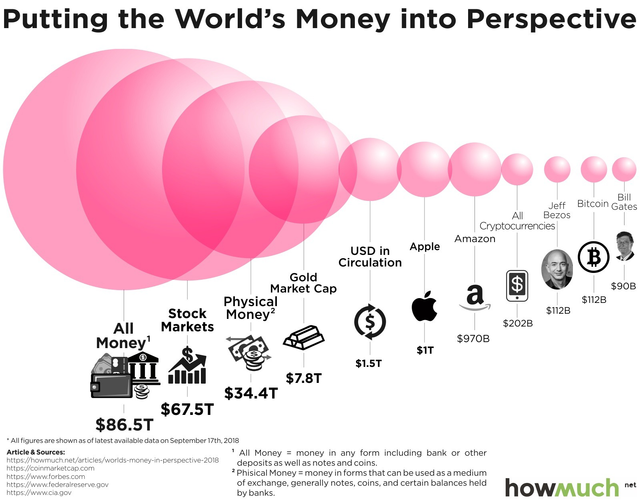

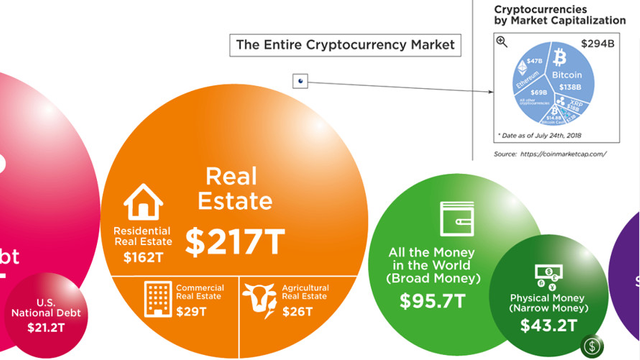

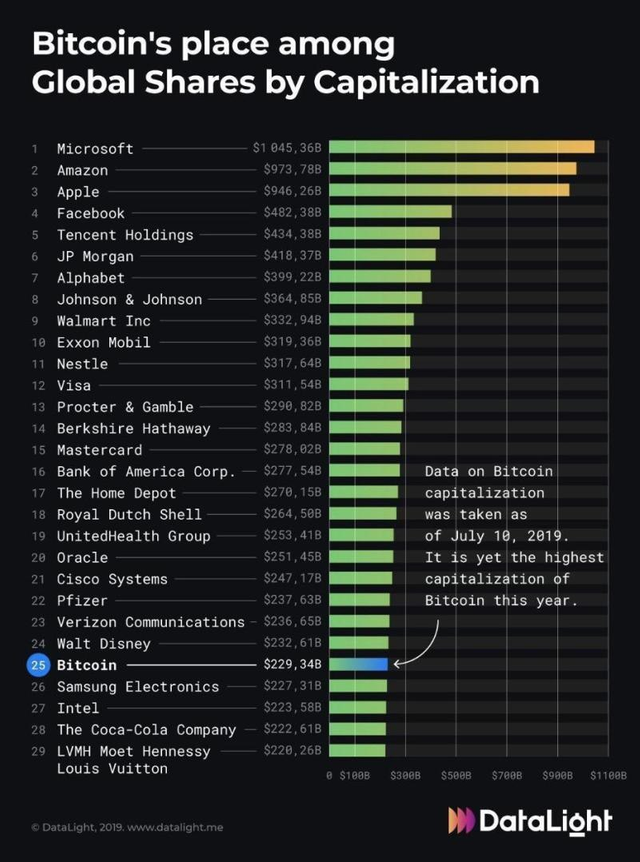

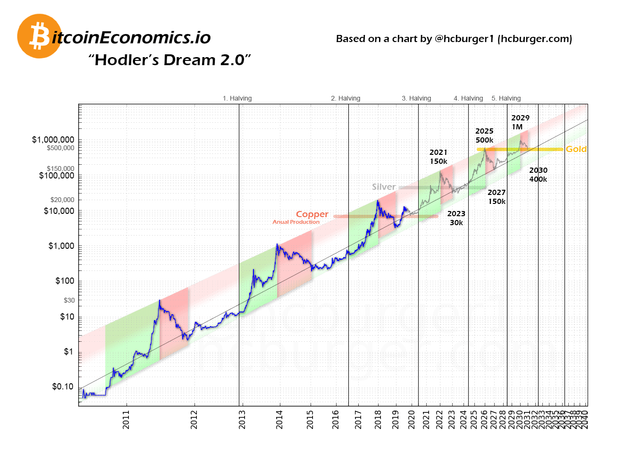

Legacy Bitcoin is the Phoenix! In 2020 it will rise again catapulting to $1+ million leapfrogging above gold’s market capitalization with the imminent 7 million Bitcoin SegWit donations to miners (c.f. also) funding the acceleration in mining difficulty and thusly price.

Legacy Bitcoin isn’t BCH, BSV nor any fork of Bitcoin such as the scam BitcOn Core. Bitcoin addresses beginning with bc1 or 3 instead of 1 aren’t legacy Bitcoin and will likely be worth-less (~$0) after May. Even if your addresses begin with 1, your hodlings might still be effectively “confiscated”.

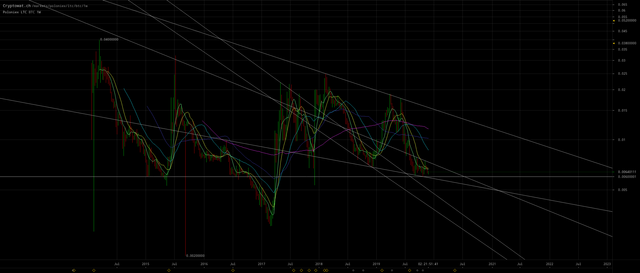

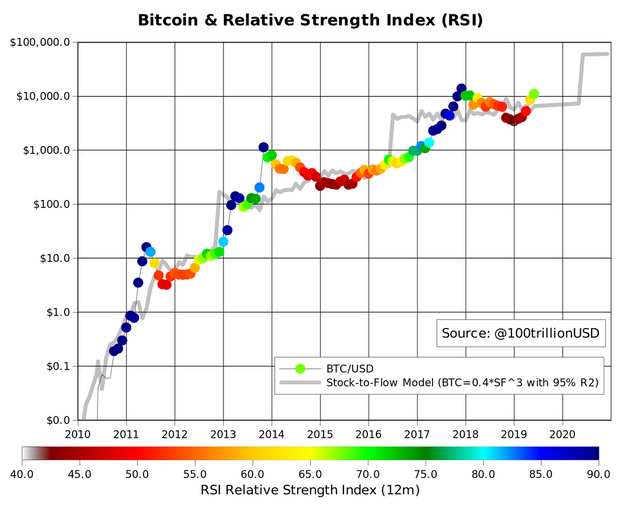

(click to zoom to source)

(click to zoom to source)

(click to zoom to source)

(click to zoom to source)

(click to zoom to source)

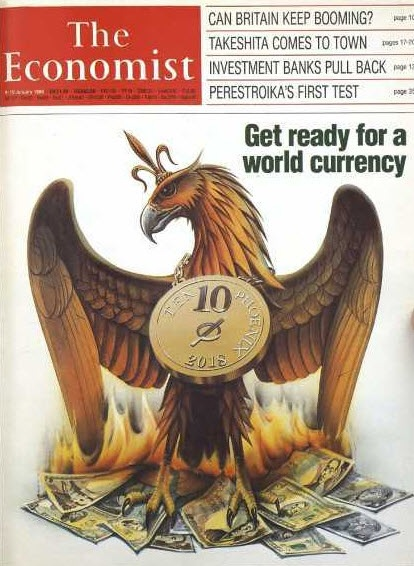

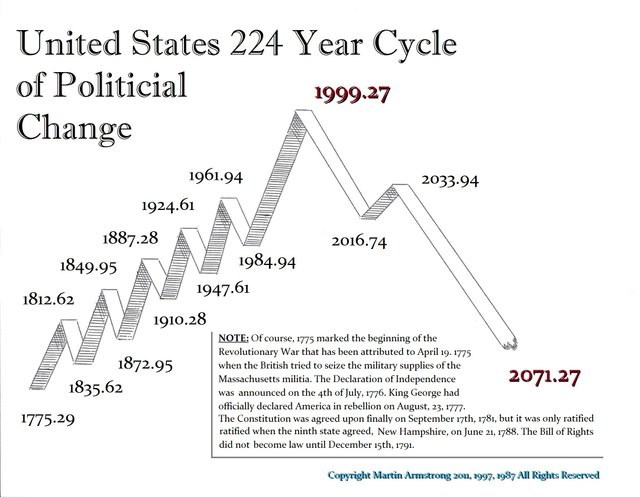

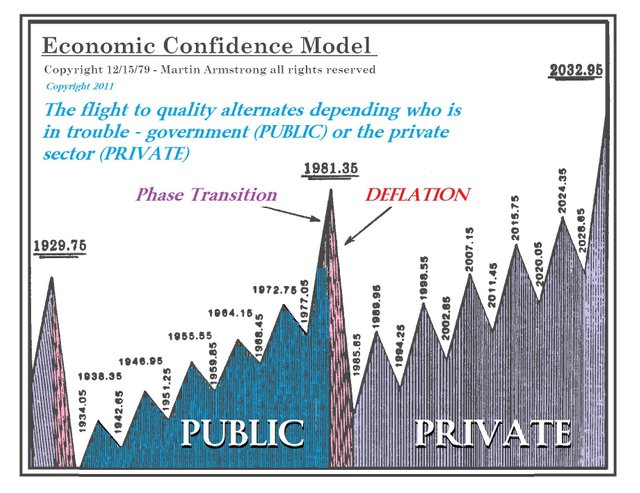

In 1985 trillionaire fund manager Martin Armstrong and in 1988 the Rothschild controlled Economist Magazine in “Get ready for a world currency” predicted the strong dollar vortex monetary crisis and predicted the rise by 2018 of the Phoenix global, standard unit-of-account currency (archived) for international, financial capital flows, which now dwarf trade flows. ←Make sure you click that last link and read the background information.

Tangentially note that Armstrong has also predicted the breakup of the U.S.A. into separately governed regions:

The USA is in its Death Throes

The Phoenix global currency (i.e. Bitcoin) will not be for use by plebs. The plebs will be kicked off, starting in earnest probably May 14, 2020 at the Bitcoin halving event.

(look in the mirror – this is you)

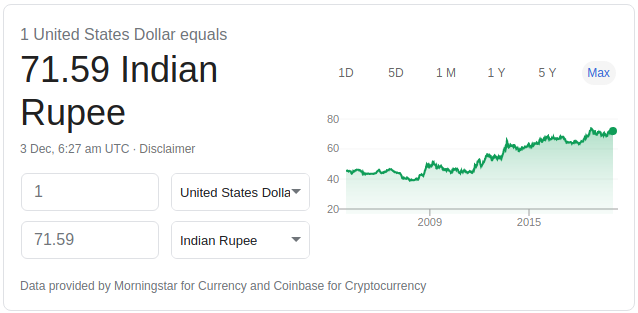

Rather it’s to be the high-powered, international capital flows currency in a global two-tiered currency regime (c.f. also) wherein the masses will use (increasingly volatile!) national currencies and/or a stablecoin backed by the Phoenix.

Global monetary crisis is accelerating

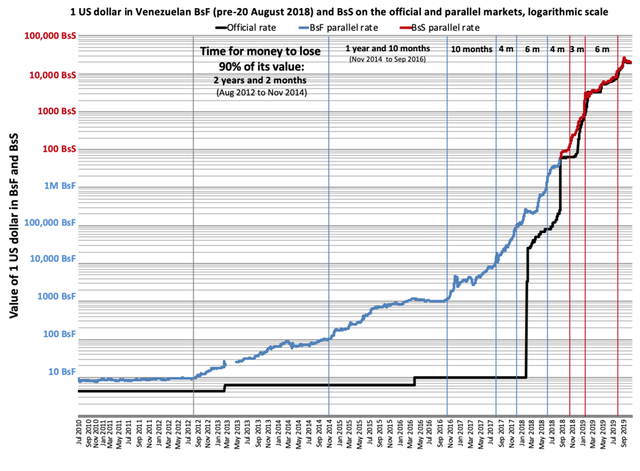

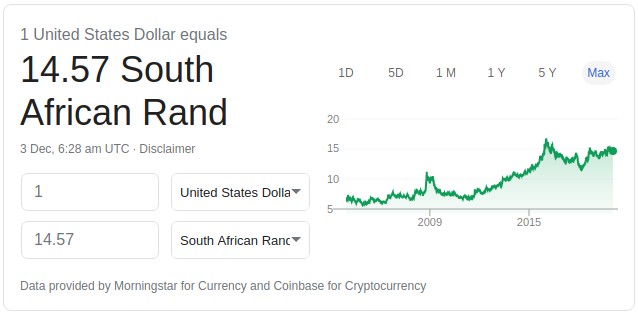

The monetary crisis in “increasingly volatile” national currencies which I warned about 2 years ago, is recently accelerating and the Euro debt crisis will accelerate in 2021:

(click to zoom to source

The mass protests which have weakened the Chilean, Colombian and Bolivian pesos, will also eventually cause the Hong Kong dollar’s peg to the U.S. dollar to fail. These mass protests were an expected consequence in the 1988 Economist Magazine article. Armstrong has also been expecting the protests and separation movements. Even China expert Micheal Pettis expected the reversion of the periphery to the core economy that possesses the standard, international unit-of-account (i.e. currently the U.S. dollar and soon to be the rising Phoenix aka legacy Bitcoin).

Armstrong blogged Money & The Two-Tier Digital Monetary System:

The monetary system that will work is digital and a two-tier system. Each country would then retain its own currency and there would be a world currency used as the reserve to which each nation would exchange to pay another. This will allow each country to remain sovereign and prevent a contagion as we see in Europe spreading from Greece and infecting all of Europe. This is the ONLY way the future can be stabilized. The value of a currency will rise and fall based upon CONFIDENCE in that government and it will be up to the people to be the real check and balance against fiscal mismanagement.

Armstrong’s monumental, epic 2020.05 ECM turn date aligns with coming sudden rise of the Phoenix

Remember the allegory of the Lily pads — humans can’t visualize/perceive exponential change until after it occurs.

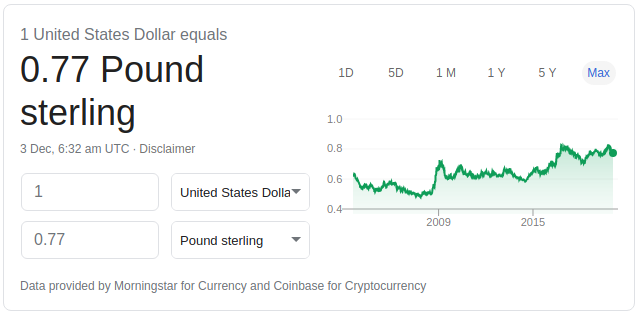

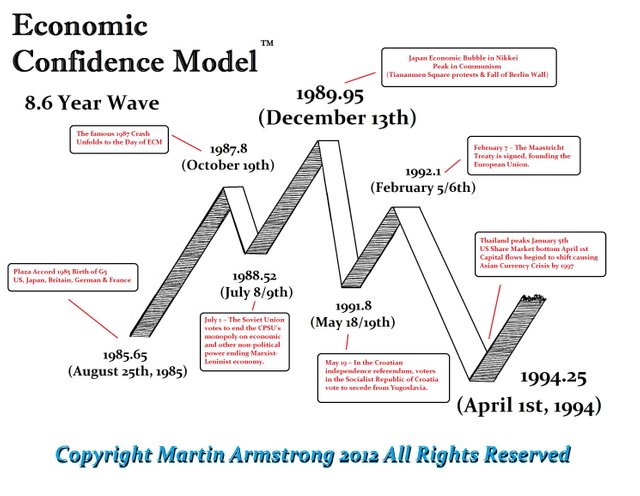

Nearly every turn date on the two prior 4.3 year intervals (8.6 years total) of Armstrong’s Economic Confidence Model (ECM) corresponded to either an ATH peak or the significant crash into or sudden launch out of a cryptowinter low:

(click to zoom to source)

Armstrong blogged that 2015.75 was the peak in and start of the decline in the confidence in governments. And “dramatic political and economic changes going into 2020.05”.

Armstrong blogged on Dec 5, 2019 The Big Bang and the Process Unfolding into 2025:

ANSWER: The cracks in the system will begin to appear next year. This is part of the Big Bang that began

2015.75, andwas the PEAK in government confidence. As this unfolds, it will become clearer as to where to go. […] the collapse in governments is predominantly in the West,which includes South America. There will be rising separatist movements, […] varying pockets of political unrest […] Asia will be the better place in general. They are not embracing socialism or this insane climate change agenda.

Compare the turn dates on that chart above to the live version of the Bitcoin history chart:

So this indicates that since Bitcoin has aligned with the ECM, that January 18, 2020 is likely when Bitcoin will lurch forward towards surmounting new ATHs to be achieved before the May 2020 halving event.

The 8.6 year interval after 2020.05 is going to be Freddy Kruegar-esque horrific, c.f. also, also, also, also, also, also, also, also, also, also, also, also, also, also, also, also, also:

(click to zoom to source)

(click to zoom to source)

(click to zoom to source & explanation)

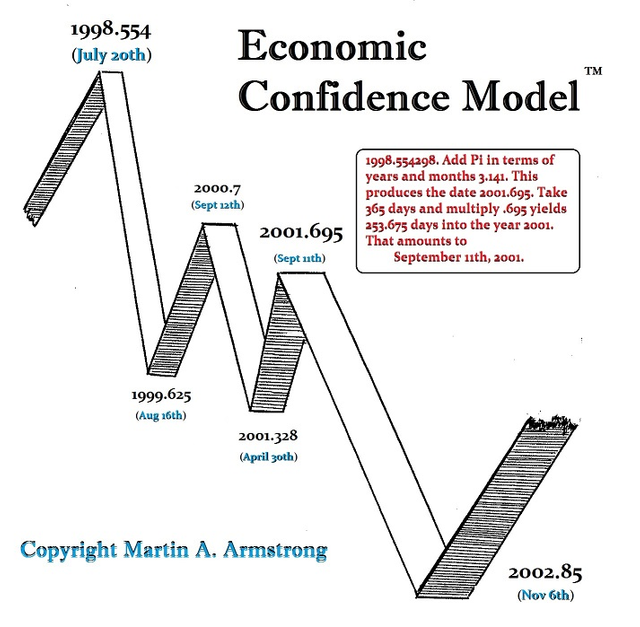

The past performance of Armstrong’s ECM is astounding. Even successfully predicted (decades in advance) the September 11, 2001 “terrorist” attacks:

(click to zoom to source)

In 2020, legacy Bitcoin becomes the “one-and-only” secure proof-of-work blockchain

Paul Sztorc’s blog One Chain to Rule Them All did point out that Bitcoin has the most hashrate, but he didn’t mention the most salient point.

Only one Phoenix can take the monetary crown, because otherwise there’s only confusion and no global standard monetary unit. For example, there’s no competitor to the U.S. dollar as the current international unit-of-account by which all other currencies are compared.

Curtis Yarvin (aka Mencius Moldbug) blogged in 2011 On Monetary Restandardization:

Why and when does monetary restandardization happen?

Moldbug Monetary Theory (MoMT) is a post-Austrian theory of money. It is a minor refinement of Mises’ standardization theory, which asserts that money is standardized by the demand for a standard medium of exchange. Rather, I assert, the demand is for a standard medium of saving.

The coming catapult of legacy Bitcoin will not only destroy the impostor (c.f. also) altcoin “soft fork” Bitcoin Core (which all the witless plebs erroneously “think” is the official Bitcoin, lol), but it will also suddenly raise the Bitcoin Market Cap Dominance to ~99+%.

Proof-of-work altcoins

Thusly Bitcoin’s mining hashrate will be at least two orders-of-magnitude greater than any altcoin’s. Thus rented 50+% hashrate attacks will become trivially easy against all altcoins not just the numerous weaker ones which have already been 50+% attacked.

The cost of Komodo’s Delayed Proof-of-work (dPoW) might become prohibitive.

I feel bad about that, because the idea for dPoW originated from me in private discussions with @jl777, although I always thought it to be only a stopgap measure while researching for a better solution.

Heck in 2008 I also preceded Nick Szabo in describing something like Bitcoin before Bitcoin arrived. I’ve also been a contributor to anonymity research, to non-custodial, decentralized atomic cross-blockchain exchange and to blockchain consensus protocols research. I have rebuked the viability of several of the many technologies promulgated by the corrupt, complicit, scammer, incompetent Core developers:

@OROBTC responded on BCTalk:

@LUCKMCFLY wrote:

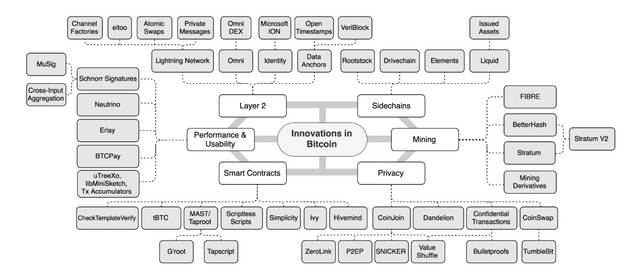

Innovation[Devolution] in BitcoinRelatively new initiatives and show a more complete picture of Bitcoin stack technology.

(click to zoom to source)Very interesting chart on

innovations[the devolution] of Bitcoin. I hope to see many of these adopted as well as articles on how to use them.BTC still needs a lot of work to become more secure, private and easy to use (yeah, I know some of those contradict to some degree). Still, ease of use will help both merchants and consumers consider using BTC. I am here in another country which has very, very little BTC usage, but is has grown since we were here some eight months ago.

Even after I have exhaustively explained it to him many times in both public and private communications, why can’t @OROBTC grasp that the Phoenix isn’t for plebs (i.e. not supposed to be easy-to-use, widely adopted, transaction volume scalable, nor on-chain privacy/anonymity) and the powers-that-be will burn his and the other goldbugs’ fingertips up to their armpits w.r.t. gold bullion and gold coins. He will have to learn the hard way through the rough experience of becoming an impoverished pleb in the NWO.

Again I was a key contributor to cross-chain atomic exchange. And at the linked post in the prior sentence you find the link where back in 2014 I had explained why off-chain anonymity/privacy via CoinJoin (and all derivatives hence) is/are hopelessly and insolubly vulnerable to spam and DDoS attacks. I have also researched and documented why Lightning Networks is garbage. I had also years ago documented why Sidechains are insecure, but I don’t think it’s wise at this juncture to expend the time+effort to try to find my old posts about it.

@r0achtheunsavory (aka @realr0ach on BCTalk) responded:

@SuperTA wrote:

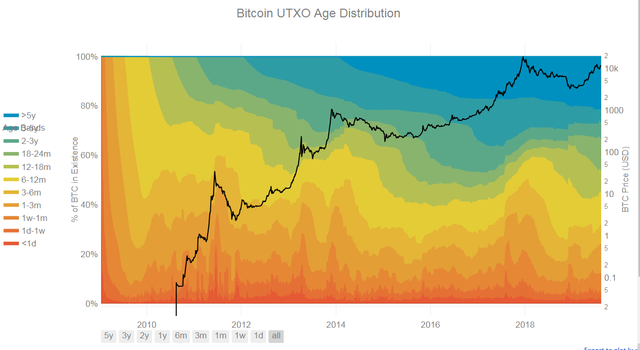

(click to zoom to source)HodlWave Chart

This chart shows you UTXO Age distribution according to the USD price. UTXO age distribution shows bitcoins in a duration of time based on when the coins last moved.

The blue area is over 5 years of not moving bitcoin and the red area is less than 1 day. The top of the blue area represents more than 21% of all bitcoins at this moment.

A non-retard viewing this chart would come to the conclusion all it shows is Bitcoin's failure as a payment system because short term coin turnover has been decreasing instead of increasing or even remaining the same. If you look at the 1 day turnover, Bitcoin was more of a payment system in THE YEAR 2013 than it is now.

@realr0ach is correct. It’s just Gresham’s Law that “bad money drives good money out-of-circulation” — which also applies to precious metals. And it’s intentional, because the Phoenix wasn’t created for the plebs and masses to use as a medium-of-exchange. They’ll get a non-permissonless, 666, stablecoin (e.g. Facebook’s Libra) eventually (circa 2026 – 2032) backed by the Phoenix (aka legacy Bitcoin) instead. @realr0ach’s ignorance of Bitcoin’s Phoenix design and his delusional gold/silverbug fantasies notwithstanding.

Proof-of-stake (aka proof-of-“overlord”-shit) altcoins

Proof-of-stake is only secure and trustless if 50+% of the stakeholders don’t collude. Problem is that 50 – 80% of the wealth is held by as low as 1% of the population. So centralization and gaming of stake control is the normal outcome. IOW, democracy and voting sucks, c.f. also and also. The includes Cardano and DFINITY’s secure beacons (and all other variants of them), because they’re still seeded by and thus vulnerable to the collusion/centralization of the stake holders.

I wrote extensively about proof-of-stake in my analysis of Steem/EOS’s “DPoS” and Ethereum in my four-part blog series Scaling, Decentralization, Security of Distributed Ledgers

. Also I blogged “Consortium blockchains” (e.g. DPoS & Tendermint) can’t Internet scale.

Note there’s only proof-of-work and proof-of-stake. Nothing else is possible. All the fancy, obfuscating names for protocols (e.g. NEM’s proof-of-importance) are still just trust in stake holders thus proof-of-stake. Even Iota’s protocol relies on a centralized “Coordinator” thus is effectively trust in some large stake holder.

Another way of economically abstracting it is that Everything Is Proof of Work. A technological example is that even grinding attacks (aka precomputing attack) on proof-of-stake are thusly computational races a la proof-of-work.

2020 is the end of altcoins 1.0

Consequently 2020 is the year of the end of the concept that any altcoin could ever challenge Bitcoin’s market capitalization dominance. Each individual altcoin will be forever capped to much less than ~1% (think 0.1% or 0.01%) of Bitcoin’s market capitalization. This means the upside for any altcoin is going to be in the neighborhood of a $10 billion market cap at most, if even that.

Although if there was an altcoin design which solved the new security, trustlessness, permissionless, scaling and other technological challenges, it might be possible with Bitcoin at some future $100 trillion market capitalization to imagine at the extreme a $1 trillion altcoin. But how likely is that given for example that Ethereum will be switched over to flawed proof-of-stake. As discussed in the prior section, proof-of-stake can never be trustlessness and permissionless (and this impacts security assumptions also). Even Ripple relies on trust of large stakeholders.

Will there even be an altcoin 2.0 given that most altcoins are thusly already overvalued and not even close to solving the salient technological issues?

One could argue that $1 trillion altcoin will be Facebook Libra and the plebs will trust it. The proposition is that Libra’s Foundation will be trustworthy enough. But that does nothing for permissionlessness, which will be important when Libra’s Foundation is required by the world’s governments to censor and ban activity. That’s why I posit (c.f. also) that something like Libra backed by Bitcoin is the precursor of the Biblical 666 system.

I wrote 5 months ago:

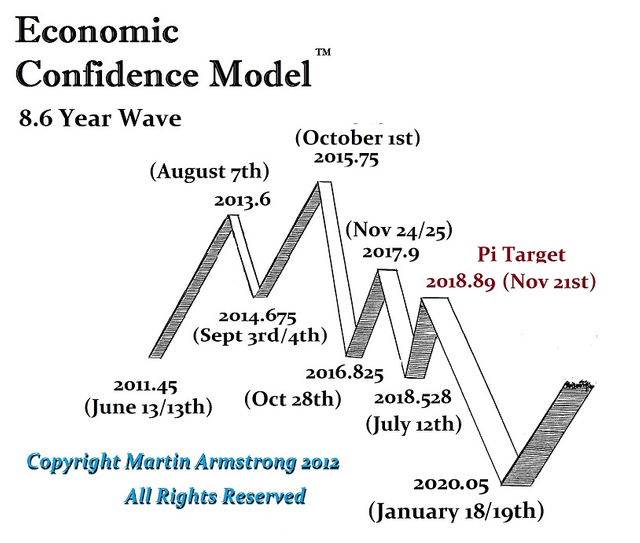

The Rogue Wave

I now posit that cryptocosm will appear to be nearly dead from 2024.35 – 2028.65.Following up the discussion above and in further support of this conceptualization of increasing volatility and collapse for the fake Core BitcOn (which everyone thinks is Bitcoin) whilst the legacy, real, immutable, Satoshi “v0.1” Bitcoin (not BSV not BCH) will continue rising (to $1 million before ~2028 but may not trade on any exchanges) but most people having been fooled and thought Bitcoin had died as the price of the Bitcoin forgery named Bitcoin Core craters to ~$775, it appears that crypto is being intentionally pumped up now for a big crash (perhaps May 2020 at the halving[1]) so that public confidence can be directed towards Facebook’s 666 Libra as the 2020.05 – 2024.35 confidence-in-private-assets wave gives way to the 2024.35 – 2028.65 public wave before the final phase transition moonshot private wave peak in 2032.95. The SegWit donations “attack” (actually a defense mechanism) will cause the ignorant sheepeople to think proof-of-work failed because they’ll incorrectly think the miners attacked Bitcoin (when in fact the miners protect the immutability of Bitcoin’s protocol which is what gives Bitcoin unforgeable costliness). Thus the (foolish) public may turn to proof-of-stake shitcoins including Libra.

Also note the halvings of Bitcoin nearly coincide with the 4.3 year cycle shifts on Armstrong’s ECM. On this coming private wave 2020.05 – 2024.35, the public (e.g. all the greater fools) must be kicked off of real Bitcoin onto some confidence-in-public-institutions (i.e. not trustless, permissionless) 666 shit named Libra. The sheepeople must huddle together idolizing an earthly King (e.g. Core BitcOn then next Fedbook’s Libra) so they (pigs) can be slaughtered. So it appears we have one last hooray rally for the greater fools to pile in on before the monumental 2020.05 cycle turn date:

[…]

@HairyMaclairy wrote:

Bitfinex to introduce 100x leverage...

Armstrong wrote:

So once again, we are looking at the calm before the storm.

Tether has created $600 million out-of-thin air to (and needs to double that every month) presumably pump up the Bitcoin price. BitMex also has 100X leverage, which as discussed in the following video is evidence of a move away from public regulation to privatized Wild West gambling:

(click the images for more details and sources)

[…]

So will Mcafee get his 1M bitcoin before 2021?

Possibly. Click that chart above for the scenario charts I drew in May. I posit those could still apply to the real Bitcoin whilst the Core BitcOn imposter craters to ~$775.

@Biodom wrote:

I am of the same persuasion (two peaks as in 2013): https://bitcointalk.org/index.php?topic=178336.msg51518490#msg51518490

The gist of it: up to 65K (in 2019, early 2020), down to $16.7K (before halving), up again to $300K.

Perhaps, this would emerge as WO "prediction" consensus.Imagine the demand for

real[legacy] Bitcoin from whales who are dumping that Core shitcoin for thereal[legacy] Bitcoin global reserve currency that will eventually be the reserve backing for Libra. Imagine that only the desperate will be willing to sell anyreal[legacy] Bitcoin for lower than $1 million. The hodling would presumably become even more iron-fisted/feudalistic.My original fractal pattern analysis, speculated that this 2020+ period would coincide to 2010. A reset of the entire cryptocosm to the time when there was only real Bitcoin and no altcoins. It would make sense that is what the powers-that-be want to do before they launch their 666 Libra medium-of-exchange enslavement system for the sheepeople.

So perhaps last chance to dump the 1000s of altcoins is coming soon if Core BitcOn peaks […] $50+k. The cryptocosm collapse to ~$0 (except for real Bitcoin which many people may entirely ignore or not even know exists since it is only for the uber wealthy not for the masses) would fit well with giving the public the illusion that trustless, decentralized cryptocurrency was a Tulip bubble and complete failure.

Eventually the cryptocosm will come alive again but by then the FATF (36 countries) will have so heavily regulated exchanges and “proof of source of funds” KYC, that FOMO speculation may not be plausible?

Essentially 2024 to 2028 appears to be a global monetary reset. And possibly also war. Intense hyperstagflation. Totalitarianism. Chaos. Capital controls. Stripping wealth from everyone, except the powers-that-be.

Remember $1 million Bitcoin price will be a harbinger of misery:

https://steemit.com/money/@anonymint/rise-of-hard-money-is-a-harbinger-of-misery

The powers-that-be have laid out the nearly perfect plan. If starting in 2020 they crash the cryptocosm to remove all funding and interest for blockchains other than projects in the Libra ecosystem, they can kill any desire to spend Libra for cryptocurrencies. That would also cut off funding for critically important developments needed for resistance to their global medium-of-exchange hegemony such as for a revamped Zcash design. Then by 2028, after they have completed the strong dollar vortex and ready to destroy the dollar, then they start to back Libra with (the real) Bitcoin. Then nobody has an incentive to spend Libra to speculate on cryptocurrencies, because Libra will from that juncture forward track the value of Bitcoin (albeit without all the gains in real Bitcoin before 2028) and presumably regulations would be so intense and Libra so widely used that no other medium-of-exchange blockchain project has any chance of significant interest. And by 2028 it should be clear that no other store-of-value can compete with Bitcoin.

[…]

Onboarding is really a key factor. Figure the only way people in the developing world will obtain Libra is if someone chooses to pay or donate to them in Libra. Note with Armstrong’s strong dollar vortex thesis, companies in developing countries may abandon their local currencies in favor of the more stable Libra unit-of-account, which appears to be what Facebook is relying on for their Libra adoption. That’s very difficult for non-backed cryptocurrency to compete with, because the volatility of non-backed, trustless cryptocurrency is incompatible with serious business usage.

[…]

One of the key features for an alternative to Libra is that it must be a two-tiered currency— a hodler store-of-value token distinct from a medium-of-exchange token. Because for one reason the medium-of-exchange token will have “illicit” lineage in many cases and thus probably be rejected by many exchanges. Whereas, hodlers of the store-of-value token could be careful about the lineage of their “proof of source of funds” if they intend to exchange into Caesar’s fiat system at some point in the future.

The main point is the world will bifurcate into Caesar’s economy with Fuckbook’s Libra money system, and the trustless, decentralized economy. It will eventually become impossible to move medium-of-exchange tokens between these two economies because of the fungibility issue. But store-of-value can be move between the two systems, for those token lineages that have maintained “proof of source of funds” trail for Caesar’s system. Libra was the name of the standard weight for measuring money during Caesar’s Roman empire.

[…]

[1] Or the next halving 2024 if Craig Wright is bluffing?

I recently commented about the Biblical meaning of “666”:

The passage ostensibly refers to the seven hills of Rome and/or Jerusalem, which is the great city that (even if surreptitiously) rules over the kings (i.e. top-down enslavers) of the earth.

https://www.biblegateway.com/passage/?search=Revelation+13&version=NIV

16 It also forced all people, great and small, rich and poor, free and slave, to receive a mark on their right hands or on their foreheads, 17 so that they could not buy or sell unless they had the mark, which is the name of the beast or the number of its name.

18 This calls for wisdom. Let the person who has insight calculate the number of the beast, for it is humanity’s number. That number is 666.

0.666 is 2/3. Number of the Beast might be the majority rule over the minority and the Babylonian effects it enables. In Byzantine agreement theory which considers possibly duplicitous voters, 2/3 threshold for the majority is the optimal balance between safety and liveness. 2/3 majorities are apparently the most stable threshold for voting. Too close to 50% oscillates with successive votes potentially working against each other (e.g. UK’s current Brexit).

Humans demand surety. We want insurance for everything. We will not accept the will of God. We herd together to subject (enslave) each other to our demands for surety like dumb sheep who will herd themselves right over a cliff.

Charts already contain evidence of this coming future

Remember I recently pointed out that charts reveal hidden order in deterministic chaos, because for example there are people who know what is going to happen and they are already positioning for it. For example, shorting of airline companies stocks before September 11, 2001 was presaging the 9/11 attack.

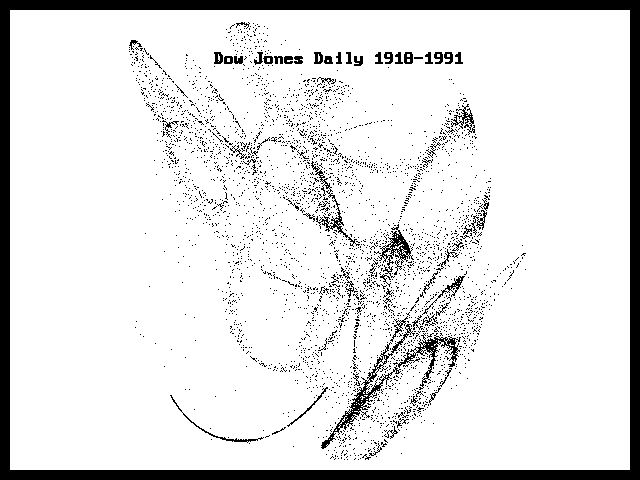

Because of friction there’s local order in chaos and friction gives rise to oscillation:

Armstrong wrote:

The interesting demonstration here is that (1) this is not my personal opinion, and (2) it illustrates that there is a hidden order within what appears to be chaos. Here is the output of our Chaos Modeling for the Dow Jones. This clearly illustrates that there are trading plateaus which exist where the market will trade and then breakout to a new plateau. This is taking the daily data of the Dow Jones Industrials from 1918 up until 1991.

The key here is this plot represents absolute PROOF that there is order behind the appearance of chaos. How can we even predict a turning point unless there is hidden order behind the false image of chaos.

Armstrong wrote:

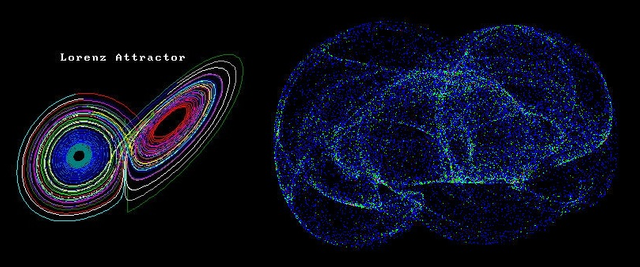

Here is a photo of starlings flying. Not only do they comply with the cyclical movement patterns, but the group is neatly formed that even complies with the science of chaos. Look at this illustration of the Chaos formation of weather data. There are boundaries that confine all movement at the extremes. Chaos was discovered by weather. What on the surface appeared to be random, actually contained hidden order.

Edward Norton Lorenz (1917–2008) was an American mathematician and meteorologist, and a pioneer of chaos theory. He discovered the strange attractor notion and coined the term butterfly effect. His strange attractor illustrated that within what appeared to be random chaos, there was actually incredible hidden order. His discovery has illustrated that predicting the future is highly complicated because (1) we are dealing with a massive amount of variables not a single cause and effect, and (2) this complexity constitutes a nonlinear system that produces the unpredictability yet within defined outer parameters.

Within any data series if we are talking about weather or markets, to the uninitiated observer who does not see patterns in charts like the the movement of starlings, they only see trajectories that appear to jump around making hair-pin turns and reversing direction only to swing back and re-reverse without warning. This is the majority who buy or sell because the group in doing so and feel comfort in collective reinforcement.

Nevertheless, their chaotic random appearance of weather or markets with respect to the behavior is like Lorenz’s strange attractor always orbiting within the shape of the system in a orderly manner confined by the outer-boundaries. The strange attractor is the actual map of all the possible states within the system yet conform to the fascinating shape defined by those outer-boundary limitations on all movement.

The entire economy is still a non-linear system that on the surface is massively unpredictable from moment to moment, yet is strangely bound within predetermined confines. This is why I state that you CANNOT predict gold or any market in isolation. Everything is connected and there is a form to this madness.

Armstrong wrote:

Behavior began to appear and this seems to be an emergence that springs from large distributed systems of data. This phenomenon we also experience in our human existence. We may taste some food, then we just have to have it as often as possible for a brief while. We eat too much of it and then suddenly our taste for it declines. The same will happen with a new song we listen to over and over again and then cannot stand to hear it one more time. This is a behavior that emerges and the same appears in computers. It does not make it “alive” but this is actually cyclical development. In any large-scale distributed system of data, there will emerge a cyclical pattern of what data is being referred to most often.

Go to a casino and just watch a roulette table. In theory, every number has an equal chance of winning. But in reality, the numbers will be cyclical. Some numbers will never come up while others repeat. It does not matter what system you look at, it will always revert to a cyclical pattern. This is the secret of nature. Observe the roulette wheel closely. The reason the house changes dealers rotating them is because this changes the cycle on that table. The cycle is not YOUR luck that will emerge from a string of times you might gamble, The house cycle differs with each dealer and that is the key to running the casino. This is why the casino rotates dealers because they fall into cycles and like counting cards, with a keen eye and an understanding of complex cyclical systems, you can see the the patterns emerge. (for your information, if I go to a casino and play roulette, within 15 minutes they come and say they recognize me as a”player” and want my name; casino understand cycles).

What emerges from any system is the unforeseen behavior arising out of sufficiently large groups of raw data. The real father of Chaos Theory was Edward Norton Lorenz (1917-2008) who was an American mathematician and meteorologist. Lorenz was certainly THE pioneer in Chaos Theory. A professor at MIT, Lorenz was the first to recognize what is now called chaotic behavior in the mathematical modeling of weather systems.

During the 1950’s, Lorenz observed that there was a cyclical non-linear nature to weather yet the field relied upon linear statistical models in meteorology to do weather forecasting. It was like trying to measure the circumference of a circle with a straight edge ruler. His work on the topic culminated in the publication of his 1963 paper Deterministic Non-periodic Flow in the Journal of the Atmospheric Sciences, and with it, the foundation of chaos theory. During the early 1960’s, Lorenz had access to early computers. He was running what he thought would be random numbers and began to observe there was a duality of a hidden repetitive nature. He graphed the numbers that were derived from his study of convection rolls in the atmosphere. What emerged has been perhaps one of the most important discoveries in modern time.

Armstrong wrote:

This extraordinary complexity of that created the surface impression of chaos, hides amazing order hidden below. This Chaotic Behavior can be observed in many natural systems, from such things as weather to economics. Our problem has been mankind’s attempt to reduce everything he sees to simple minded one-dimensional cause and effect. This type of explanation of such behavior has restrained our ability to move forward in many fields, the least of which is not social-science that includes economics.

Deterministic Chaos may be the key to everything for within both nature and our social world, we are surrounded with complexity yet we try to rationalize everything to a single dimension unable to cope with the dynamics of the world in which we live.

We can’t employ math to predict where every leaf will fall onto your lawn. But large distributed systems of chaos (including markets or the Bitcoin phenomenon) have a statistical form of topological order which is distinct from random.

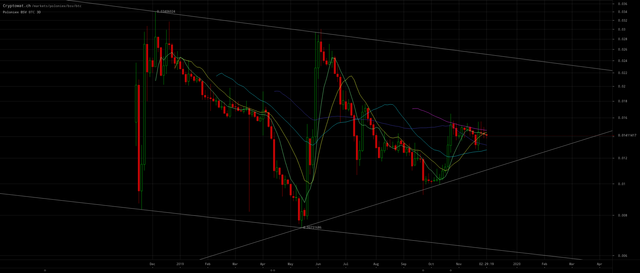

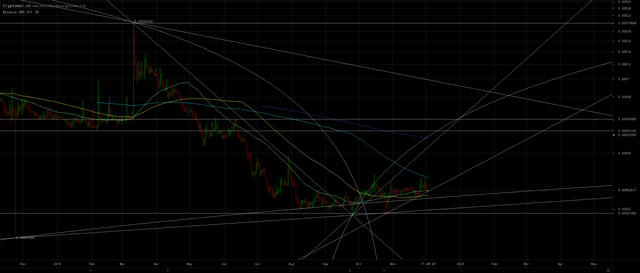

There’s a technical analysis pattern in all the altcoin charts ←click that link and read all my comments on the charts. Paired against Bitcoin, they’re in bullish declining wedges or triangles with the apex near, at, or just after Bitcoin’s upcoming May 2020 halving event — the posited date that the explosive acceleration in the legacy Bitcoin price will kickoff.

(click to zoom to the source and comments for all above charts)

That said bullishness is posited to be relative to a collapsing Bitcoin Core price after the SegWit donations fork-off begins, as I noted:

LTC/BTC appears to be stuck in an eventually bullish triangle until May. Looks like it will back up to

0.07in December or early January and then revisit0.06again.Seems to indicate that LTC/BTC will rally significantly only after the May halving. If Core BTC is declining, this may be no actual again at all in dollars nor in legacy BTC.

[…]

Again we just do not know if this upside will be relative to a plummeting value of Core BTC or a rising value of legacy BTC. If Core BTC declines in dollar value to

1/10, then a 10X increase relative to Core BTC will be a flat dollar price.If the Core BTC chain has stalled due to the attack, then everyone will need to exchange their Core BTC on the exchanges for some altcoin to get it off the exchange. In the case of Litcoin, this presumes it has not also been SegWit attacked otherwise it would have the analogous problem as Core BTC.

Since everyone could exchange for stablecoins instead of altcoins, one would presume the altcoins would be rising in value relative to stablecoins. But what can happen is Craig dumps his Tulip trust Core BTC suddenly for stablecoins. Crashing the fiat price of Core BTC and presumably altcoins even more so. Then everyone else decides to buy the huge dips in the unaffected altcoins, thus their price rising relative to Core BTC, but maybe not even back up to par before the attack in dollar value.

IOW, I think BSV and BCH are still a trap. This is for the plebs to think they did not lose too much. Meanwhile legacy BTC

is[will be] skyrocketing to $2+ million.

If the posited pairing on the above charts is to Bitcoin Core and not legacy Bitcoin, then the altcoins will be crashing relative to legacy Bitcoin after the posited SegWit donations taking fork-off begins presumably at the May 2020 Bitcoin halving event.

For the Bitcoin chart I noted:

(click to zoom to the source and comments for all above charts)

Bullish cross imminent as 50 WMA will cross up through 100 WMA. Massive inertia in the WMA compared to the DMA. Note that rocket from $3.1k to $13.9k was only DMA bullish cross whereas WMA was bearish cross. Now the situation has inverted. The DMA gave a bearish cross first, which lead to this decline, but the WMA is coming up at a massive bullish cross. Thus the coming rocket is going to have much more inertia and duration.

Unlike for LTC/USD, there’s no bearish cross of the DMA below WMA.

See also all the charts in my recent blog Bitcoin’s Whiplash Bear Trap and the very important follow-up comment I posted below that said blog.

Also refer to my recent blog McAfee’s Dick Math: illuminating Bitcoin’s ACCELERATING price because most people instead incorrectly model Bitcoin’s future price non-topologically something like the following (thus the following chart predicts the price much lower and slower than will be the case), wherein I had commented 3 months ago on September 12, 2019:

[…]

The current correction must bottom no later than November. And must start making new highs (not ATHs) no later than start of February.

[…]

P.S. I think Bitcoin will bottom on the current correction $7 to $9k […] Then start moving up again. Possibly might not exceed $13k again until start of 2020. I am expecting a rocket shot to $50k starting roughly February.

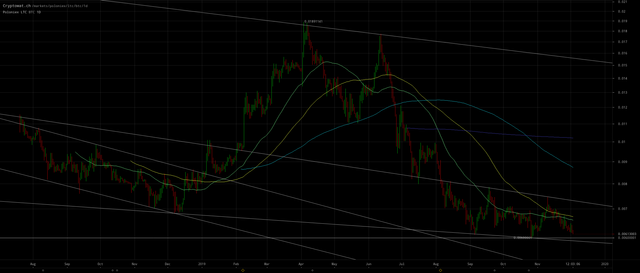

No significant altcoin season, except perhaps for exceptions such as Groestlcoin (GRS)

The prior section seems to indicate that the major altcoins are not going to gain the significant appreciation relative to Bitcoin rocketing out of this whiplash $6.5k bottom, that they did gain coming out of the prior whiplash $3.1k bottom at the start of 2019.

We can compare the prior case early this year (2019) to the current case on the LTC/BTC pair chart:

(click to zoom to the source)

After LTC/BTC bottomed by December 2018, there were 3 surges up spaced roughly 2 months apart. These tended to more or less plateau between each surge, thus leading to a very high final peak ~0.019 by start of April — two months before Bitcoin peaked.

Whereas, for the current period which bottomed by early September, each of the two (so far) surges up spaced roughly 7 weeks apart have been followed by a decline back down to triangle or declining wedge support. Thus not accumulating any significant gain. There’s likely one more surge up to ~0.071 to come probably in December or early January before it drops to lower lows before the May 2020 halving.

Whereas, the current chart period of GRS/BTC is considerably more near-term bullish, although proportionally only about 80% of the surges in period at the start of this year.

(click to zoom to the source)

A plausible spike peak value of 0.5 – 0.6 (i.e. a double in Bitcoins from current levels) is indicated sometime in December or by early January by the proportionality of the surges, the positions of the displayed moving averages, and the annotated trend lines. Then it will be all downhill from that posited peak, until at least the May 2020 halving.

2026 – 2032 is the end of the U.S. dollar strength/dominance

The strong dollar short vortex will peak sometime towards the later half of the coming decade. What will replace the dollar and cause it to weaken?

Likely a stablecoin such as Facebook Libra transitioning the backing from a basket of national currencies predominantly dollars, towards a backing reserve mostly of legacy Bitcoins.

This will happen because USA has abused its advantage with the dollar being the standard unit-of-account and because the strong dollar short vortex will wreck havoc on the world, driving massive stagflation and rising interest rates especially outside the USA. Bitcoin will be seen as a more fair alternative to any single national currency. And otherwise who would decide which basket and weighting of national currencies is impartial.

But this decline in the dollar’s value after ~2026 will not be due to hyperinflation or a loss of public confidence in the dollar, but rather by removing the dollar’s hegemony as the global standard unit-of-account.

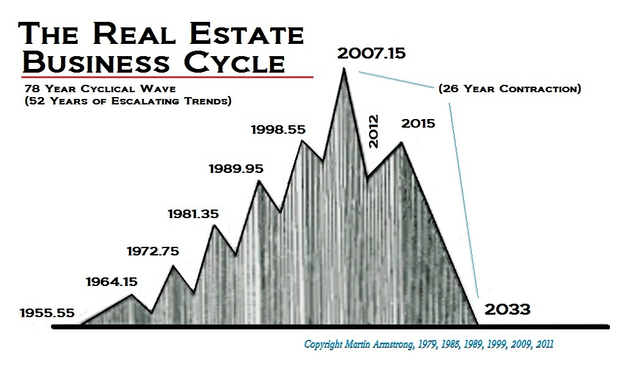

Thus gold will not rise above $5000 (c.f. also, also, also, and also) which is only a triple from current prices (not including the losses due to the 28+% CGT that must be paid by Americans on the gain, and with taxes going much higher after 2033). So after the delusional goldbugs sell their gold for maybe a net ~200% gain (if they even sell and if their gold is not confiscated when they attempt to sell/transport, by Civil Asset Forfeiture and other AML issues), there is nothing else they will be able to invest in while the dollar’s PPP value declines precipitously. Armstrong’s chart for global real estate shows a decline until 2033 at least because of rising interest rates which will make mortgages more expensive reducing demand (in additional to the general stagflation implosion of the global economy). What part of virtually nobody in the world will return to using physical barter do these goldbugs fail to comprehend? What part of QE is not “money printing” (c.f. also), not inflationary nor the precursor to hyperinflation, do these goldbugs refuse to comprehend? Hyperinflation only occurs in total collapse of public confidence. And the Quantity Theory of Money (QTM) is nonsense (c.f. also and also).

In short, what delusional goldbugs fail to comprehend is that the international standard unit-of-account will be shifted over to legacy Bitcoin with a 100+X increase in the value of legacy Bitcoin in 2020. And then perhaps another 10X increase in the value of legacy Bitcoin before year 2033. Gold and U.S. dollars will not appreciate by even 3X net. The replacement of the U.S. dollar by the legacy Bitcoin as the global standard unit-of-account transitioned between ~2026 – 2033 will thus devalue all things priced in U.S. dollars accordingly.

Asia’s governance and economic progress will not fail into hyperinflation. The Western governments will also muddle through, employing QE for government bonds (only, while private sector interest rates skyrocket) and high taxes to pay for everything. If there’s any hyperinflationary collapse of any government (e.g. Venezuela) then every currency and asset outside will appreciate relative to that hyperinflated currency. But that will not help goldbugs in the West retain their global standard of purchasing power parity (PPP).

Essentially the wealth of the Western middle class is being reclaimed by the global elite that manage the sheepeople, and that notional wealth is being transferred into legacy Bitcoin in earnest in 2020. The wealth of the world is being concentrated to the 1% and the middle-class is being eviscerated. The global elite are cashing in their chips and exiting to greener pastures. America’s hard-fought Christian independence from the King of England is being reverted. The order of the world is being restored to the rightful owners, because the people refuse the Lord’s commandments, especially 1 Samuel 8. I wrote about Jesus recently. And I blogged extensively about religion including my comments below that linked blog.

So goldbugs by circa ~2033 will have been properly devalued by to perhaps ~3% – 10% of their wealth as measured today. Lol.

I warned about this outcome back in 2010:

End Game: Gold Investors Destroyed

End Game, Gold Investors Will be Destroyed

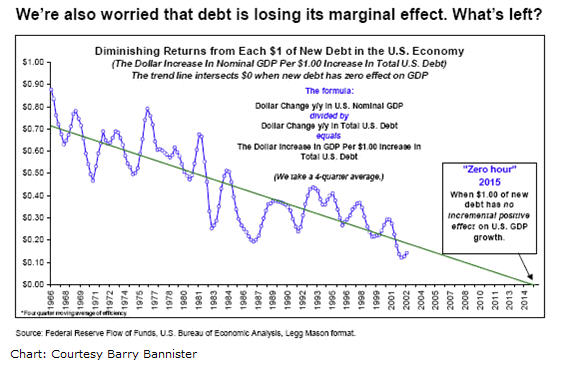

QE exchanged one form of money (i.e. bonds can now be traded as money) for another form of money. Thus money supply wasn’t increased. It injected liquidity by decreasing the interest rates, thus increasing the value of extant bonds. It enabled the debt bubble to continue its largess but at the cost of “pushing on a string” in terms of economic growth because government borrowing crowded out the private sector and the marginal-utility-of-debt had declined so severely, except initially in developing markets but those became overheated eventually. The Minsky Moment was kicked down the road and made much worse when it does come.

QE is essentially a transfer of wealth from the middle class to the wealthy, because those with the most liquidity who invest in the best assets accumulate the wealth that is being siphoned off from the middle class.

(click to zoom to source)

(click to zoom to source)

(click to zoom to source)

Armstrong blogged European Banks to be Prohibited from Dealing in Repo?:

QUESTION: […] Can you explain how the Fed’s QE fits into the cycle of things. It seems to me that their interference in the markets is disrupting/altering the cycle […] instead of having low yielding bills on their books have zero coupon cash, which they then seek yield and put into the shares markets. It seems pretty clear and appears to extends the cycle. Can money printing just cause the 8.6 yr cycle for instance to extend to say a harmonic of that, 17.2 or 25. 8?

ANSWER: No. The Repo Crisis is on time. Our forecast for the start of the Liquidity Crisis was after Labor Day in September. The Fed is trying to prevent short-term rates from rising. They are not engaging in Quantitative Easing for the sake of “stimulating” the economy.

Things are getting bad and the rumor behind the curtain is that European banks will be prohibited from participating in repo for year-end. That is how bad things are getting.

So the cycle appears to be coming on time. All the implications are far too great to cover in a blog, which is why I have created a a report on the repo crisis that is around 150 pages.

Armstrong blogged Tell a Lie Often Enough it Becomes the Truth – How Lies Now Defeat Gold & Dollar:

Gold had soared to reach record highs at $1,920.30 an ounce back in 2011 on the propaganda of hyperinflation coming because of Quantitative Easing (QE). Now with QE coming to an end, why buy gold? We see the same nonsense setting the euro up ripe for the slaughter. The prospect of QE ending at the European Central Bank (ECB) has been sending the euro up, yet once again to the delusion that all will be reversed and higher interest rates will save the Euro.

Armstrong blogged Can We Stop the Government Borrowing & Just Print Without Inflation?:

Hence, 10 years nearly of ECB quantitative easing failed to reverse the deflation. There is a lot more to this complex mix than meets the eye. The debt is actually where money parks and thus it is reducing economic growth otherwise that wealth would be investing in the economy and you would see greater price advances.

[…]

The government borrowing competes with the private sector reducing economic growth

[…]

The entire system will go crazy and as interest rates rise, the debt will explode. As central banks raise interest rates, a new phase of inflation will emerge. Some will blame Trump’s tax cuts. But this is all about the interest expenditures will begin to crowd out all other areas of spending.

Armstrong blogged ECB & The Failed QE Stimulus:

The Federal Reserve was established in 1913 with the directive that to stimulate they would buy directly corporate paper – NEVER government. When banks were reluctant to lend, the Fed would buy the corporate paper and that would prevent unemployment. Thanks to World War I, the structure of the Fed was altered and they were directed to buy government bonds. That directive was never reversed. Today, while most central banks have stuck to buying mainly government or quasi government bonds which do not directly stimulate the economy,they have failed to comprehend the significant difference between buying corporate debt issues compared to government

Armstrong blogged QE & Its Failure:

Central banks can no longer manage the economy, for the money does not remain in isolation. Additionally, as I pointed out in Rome, they may have negative interest rates, but that does not pass through. You cannot borrow money from a bank at negative rates.

Armstrong blogged Quantitative Easing & the Illogical Conclusion:

If we follow the logic here, QE is supposed to “stimulate” the economy by reinventing inflation. But does this only create cost-push inflation or asset/currency-inflation rather than demand-inflation that marks economic growth? The first two forms of inflation reduce the living standard as net disposable income shrinks. Demand inflation requires confidence as people invest expecting to make more in a boom, not punishment. This type of stimulus will widen the gap the socialists talk about between rich and poor for it will only create asset inflation. So it is hard to follow the logic that QE alone, while hunting money for taxation, will have any stimulus impact other than eroding the economic base.

Armstrong blogged The Paradox of Inflation/Deflation:

The hyperinflationists are linear-thinkers. They build everything upon the idea that an increase in money supply MUST result in rising prices and thus inflation. They assume a one-dimensional fixed relationship and cannot see the binary aspects of DEMAND that produce the bull and bear market trends. To them, they are locked into this primitive archaic thinking process that there must be a single relationship that is constant. They cannot grasp for an instant the dynamics of the real world.

In the case of Germany, it was a communist revolution where many wanted to join Russia and outlaw all private wealth. Money fled the banks and was hoarded or left town out of fear they might succeed. Capital moves ALWAYS in anticipation. This trend of a flight of capital resulted in the collapse of the German monetary system as was the precise case in Russia for the very same reasons.

[…]

This is the real strength behind the dollar – the currency of the dominant EMPIRE. It is the lack of ability and confidence in the currencies of other nations such as Russia, China, and even developing now in the Euro. The net result has nothing to do with money supply compared with CONFIDENCE in the government. Germany makes this fatal mistake of imposing austerity upon the rest of Europe assuming it is only money supply. This theory is destroying Europe tearing it apart at the seams.

[…]

This is WHY even Christianity rose NOT because people saw the light or crosses in the sky as Constantine pretended when he faced a Christian army. Romans prayed to the various gods and nothing happened. They turned to Christianity out of desperation – not conversion. Constantine used this religious turn for two material gains. First he declared there was ONE GOD and thus as in heaven it should be on earth – ONE EMPEROR. He issued coins showing himself with the sun god Sol who was seen as the supreme god who was invincible – Sol Invictus (“Unconquered Sun”).

Secondly, Constantine confiscated all the wealth in the pagan temples to fund building Constantinople. He then issued special reduced coinage to celebrate the founding of the NEW CAPITOL of the Roman Empire. He was thereby restoring CONFIDENCE that this would be a new beginning – IT WORKED. This is why we too must crash and burn. CONFIDENCE will only be restored with a new reformed government. The question becomes – what will that look like?

[…]

So the whole shift to Christianity was the direct result of Valerian being captured that shook the very foundation of Rome itself. Romans were then praying for security that did not come so they change gods.

I've been thinking about the Segwit donations attack and wondered why the legacy bitcoin MUST go up in value when / if this happens. The reason is this...

The miners who begin this attack will of course want to keep what they've taken so they won't be sending back to addresses held at a "3" or "bc" which would be incredibly stupid. They will send them to non-segwit addresses. This will drain hundreds of thousands of bitcoin within a few hours to the legacy chain pumping up the value of the legacy chain while draining the value of the soon to be forked chain. The panic that ensues will likely see the initial value of the forked bitcoin core tank at first. Can it recover? Would the initial confusion cause the legacy chain value to go down at first, just not as much as core? Maybe a bit or not at all due to the massive concentration of new BTC on the legacy chain.

The elites won't have to worry about the transparency of the base layer. Only those of us with no connections to power will have to worry. So the rest would be kicked off into LN or other chains assuming they survive.

I'm still wondering though what will happen long term as history has shown that a single currency would be an anomaly. What if an alt season returns and it avoids the legacy BTC chain and heads over to something like Monero? If capital controls are in place, how many services are you willing to pay for online that cost more than a fraction of one's physical needs?

If the state isn't able to seize the means of production in time, the risk of a privacy coin taking over BTC as the main unit of account increases. I suspect we will have two worlds, one surveillance based digital panopticon ruled by some future Amazon government entity, and those few outside (the 144,000?).

Right. Political power. But no, they have the law the way they want it.

I understand. 0.5.3 being run by the miners with their own mempool filling up with segwit donations with the largest UTXO's first in line. "Draining" was just a metaphor to describe the flow of value away from the segwit chain.

What is Bitcoin core? vs just Bitcoin?

Do you think people need to be specified that we're not talking about a coin with less than 3% of a BTC in value BSV+BCH+BGD ect when talking about just Bitcoin?

My blog posits that for all of them, they will each be worth-less than at most

~0.1%(and cumulatively for all of them, less than~1%) of legacy Bitcoin by the end of 2020.No need to differentiate between any of the altcoins when all of them are going to be hopelessly insecure and worthless compared to legacy Bitcoin.

Read also the blog Is Charlie Munger right about Cryptocurrencies?.

A lot of reading you need to do:

Thanks for the awesome articles. Do you think that Paul Le Roux might be Satoshi or he might be the person who mined the first million bitcoins and that Craig Wright is in possession of his hard drive and he is trying to brute force the password for his encrypted hard disk? Thanks

Congratulations @anonymint! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

The Bitcoin Halvening is happening

I think I discovered the source of the rampant use of the term “halvening” instead of ‘halving’ to describe the 50% decrease in Bitcoin minted block rewards every four (4) years: