Red October: 4 Reasons the World Will Never Be the Same

October has always been a transformative month. For some it is the first month of fall, for some; the start of Q4, in american politics it's time to pull out your political Trump cards before November elections.

For all this year, it will be a paradigm change of the magnitude not seen since the Soviet Red October revolution.

Am I exaggerating? Here's the economic, historical, geopolitical, and technological reasons behind that statement, you be the judge:

-1. Economics: Bull Run or Bull Shit?

For those in the business world, October is the start to the 4th quarter of the year. This means that it's time check the score and finish strong before yearly reports.

So let's recap, what does our economy currently look like? Well if you look at the purely numerical data, it looks pretty damn good.

Housing Market? All time high

Stock Market? Record setting bull run

Unemployment? 4.1% and dropping

You might say, that sounds great, surely there must be a good reason for all of this right?

To say the least, it is a house of cards built on some of the most blatant fraud in human history.

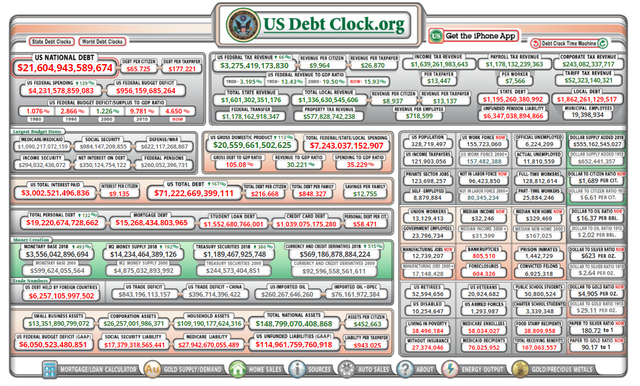

This is obvious when you consider other all time highs in

-Federal debt (up 400% from 2000)

-Student debt (1.5 Trillion, up more than 200% since 2006)

-Credit card debt (highest level since April 2008)

To fully understand how these numbers came to be, and why they represent a massive economic debt bubble primed to burst, we need to crack the history books.

-2. Historical: Boom and Busta Move

It is well known that our economic boom and bust cycle usually takes 8-10 years to complete. The pamphlet above circa 1897 proves as much as it accurately shows the 2008 collapse (take a look at where 2019 is).

In 2008 the global economy came to a screeching halt when Lehman Brothers filed for the largest chapter 11 bankruptcy in human history. The Glass–Steagall Act having been repealed by Bill Clinton in 1999, banks like Lehman Brothers were allowed to invest depositors funds into risky investments, mainly subprime mortgages. Spurred on by extraordinarily lax credit checks, banks were allowed to accumulate millions in new mortgages.

If these mortgages had a low chance of being paid back, why did the banks give them out? Because they were allowed to resell the debt to each other in credit default swaps. Essentially it was a massive game of hot potato as each institution did it's best to resell their risky mortgages before the lenders inevitably default.

When the music stopped, the Federal Reserve had no choice but to bail out several banks, printing a total of 19 trillion dollars out of thin air.

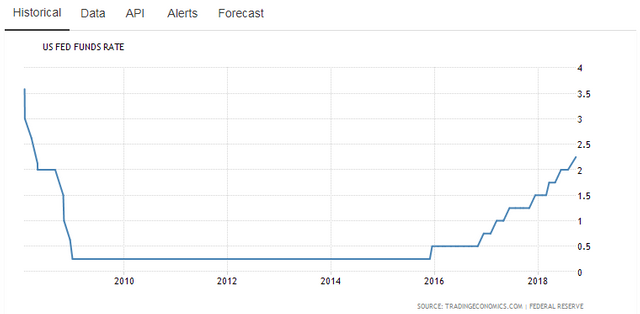

This insane addition to the us dollar supply was then complimented by the lowest fed rates set since the central banks inception.

From 2008 to 2017 the Federal Reserve was issuing new loans (how new money is created) at below 1% interest (traditionally kept from 2-5%, been as high as 20%). Those more knowledgeable on financial topics know that when calculating the time-value of money these rates are actually negative meaning the fed was essentially paying banks to take loans from them.

It is these better than free loans that have lead to the numerical economic "recovery"

Mortgages are again being offered at extremely low rates, with minimal credit checks. Meaning the market has been flush with buyers that have no problem paying whatever price home owners charge. For instance, 8 full years after '08, everyone who filed for bankruptcy had their credit cleared and was therefore eligible for new mortgages. In 2017 more mortgages had been written than any year since 2006.

14.png)

But what about the stock market? Surely a record setting bull run and new all time highs across the board is a reliable indicator of a stable economy. Well unfortunately not as most the growth can be accounted for by corporate stock buy backs and institutional investment, both simply fueled by free fed money.

While the unemployment rate is lower than has been previously over the last 10 years, the quality of the jobs being created has fallen drastically. This has resulted in record levels of debt and nearly 50% of the country living paycheck to paycheck.

As the Fed raises rates higher than pre-crash levels for the first time (up to 2.25% on Sept.26th), it appears as if we're due for another debt bubble burst, what could trigger such an event?

Let's check in to what's going geopolitically:

-3. Geopolitical: Calm Before the Storm

Some people may be familiar with the gif above. Indeed, what IS the storm Mr. President?

Well perhaps he was referring to the ongoing investigation led by Utah Attorney General John Huber.

Huber has been tasked with investigating things such as

- Surveillance of the Trump campaign by Obama administration

- Hillary Clinton's state department and the Russian Uranium One deal

- The Clinton Foundation

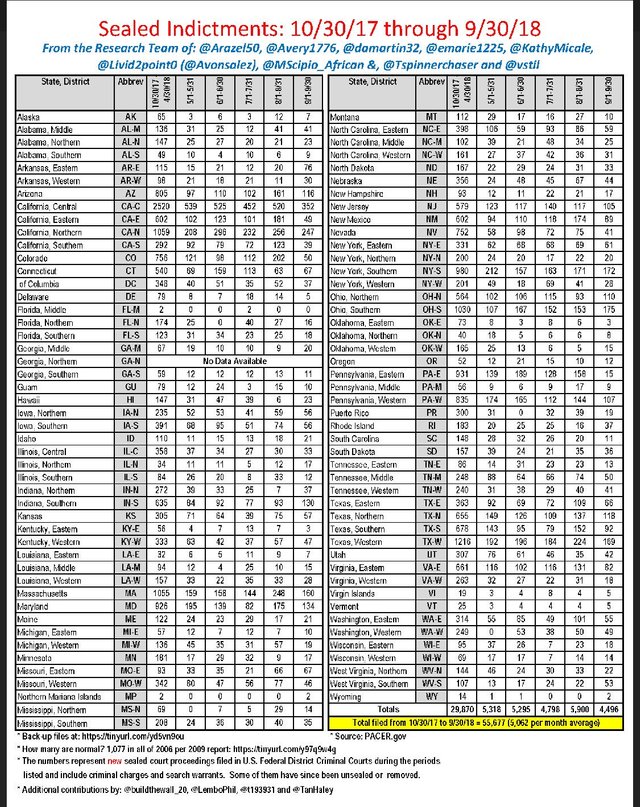

This investigation may explain why Attorney General Jeff Sessions hired an additional 300 assistant attorneys in June of this year, and may also hint at to what the 55,000 sealed indictments out in courts around the country (yearly average = 1,000) might be about.

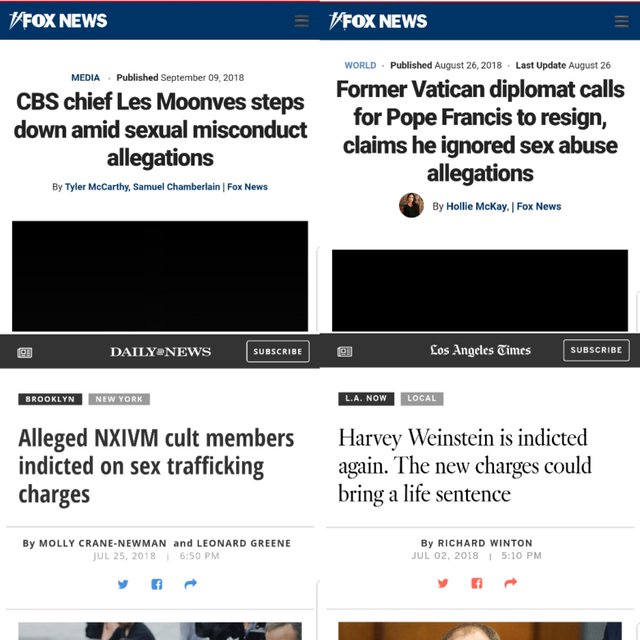

Unsealed indictments so far have included NXIVM (an elite billionaire/Hollywood cult that branded and trafficked women and children) and Harvey Weinstein (an uber powerful Hollywood executive/serial rapist that had traveled extensively with the Clintons and had Obama's daughter intern for him)

This is all happening at the same time that a record number of CEOs are stepping down (of large companies such as Intel, GE and CBS), 30+ congressmen not seeking reelection, and seemingly the entire power structure of the Catholic church (even the pope is being asked to step down) being arrested for child sexual abuse.

Could all of these decades old high level crime ring arrests be a part of something bigger?

Probably.

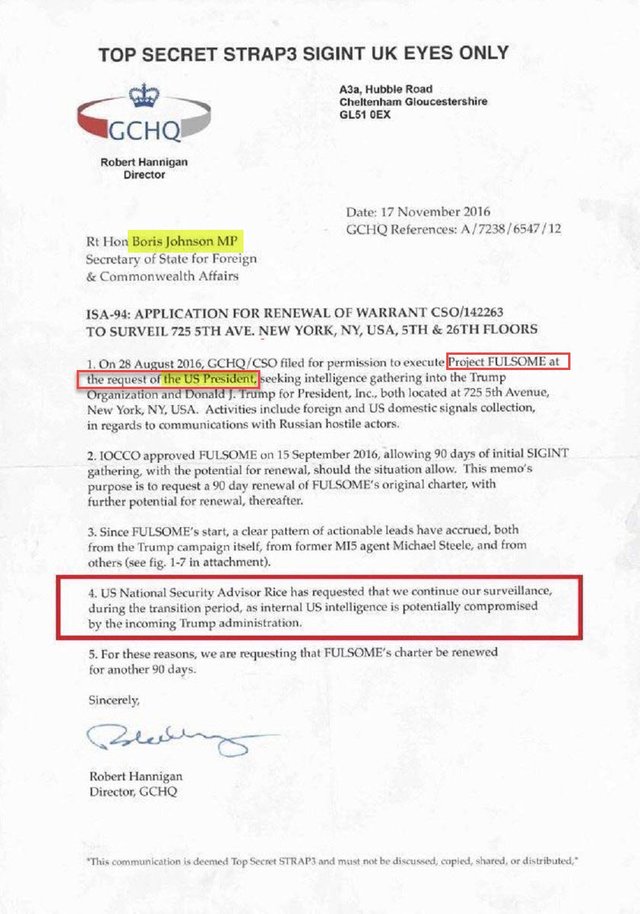

This month President Trump plans to drop the ultimate "October Surprise" before the midterms and declassify the FISA warrants signed by President Obama to have the UK's version of the NSA spy on his campaign.

If Obama truly did order a foreign entity to spy on a US presidential campaign, he would be technically guilty of treason.

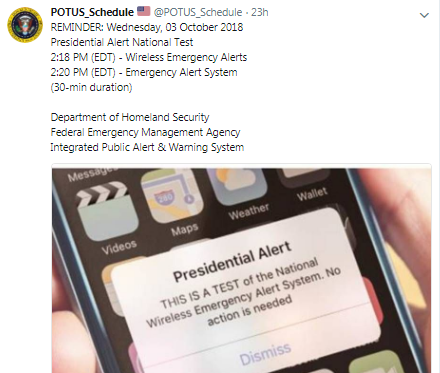

Treason being punishable by death, this would be a big deal. The arrest of someone as powerful as Obama would trigger mass unrest which might explain why Trump will be testing the emergency alert system on the 3rd.

Could the FISA and these indictments being released trigger a stock market crash/a global loss of faith in the dollar as a result of many high power politicians and executives being arrested?

Maybe.

If the stock market and US dollar seemed to no longer be safe havens for the global market, where would those investments start to flow?

For that we must investigate the advancements in fintech technology made over the last 10 years.

-4. Technological: Satoshi's Spooky Vison

.jpg)

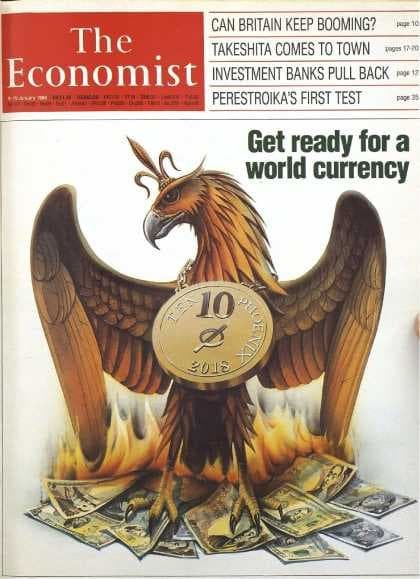

Above is an issue of the central bank owned Economist magazine from 1988.

Yes, that is a Phoneix standing on top of a burning pile of fiat currencies, and yes, the coin in it's mouth does have the numbers 10 and 2018 on it.

Yes October is the 10th month, and yes it is the 10th anniversary of the financial collapse.

October 31st also happens to be the 10th anniversary of the release of Satoshi Nakamoto's prolific Bitcoin whitepaper.

At this point you're probably laughing as you realize I'm trying to tell you that the dollar is about to collapse and be replaced by Bitcoin.

But is that idea really so far fetched?

For that we need to examine why the US dollar has value.

In 1971 President Richard Nixon took us off the gold standard, removing the ability for people to trade dollars to the bank for the precious metals they were supposedly backed by.

So why did our allies and countries around the world still want to trade us real products and services for paper we print for free with no backing?

A combination of oil and bombs.

In 1974 Nixon signed a deal with OPEC, (the oil rich middle eastern nation group) agreeing that the United States would sell weapons to, and use their military to protect these nations. In return these countries had to agree to only accept us dollars for their oil, and agree to invest in US treasury bonds.

Thus was born the Petrodollar system.

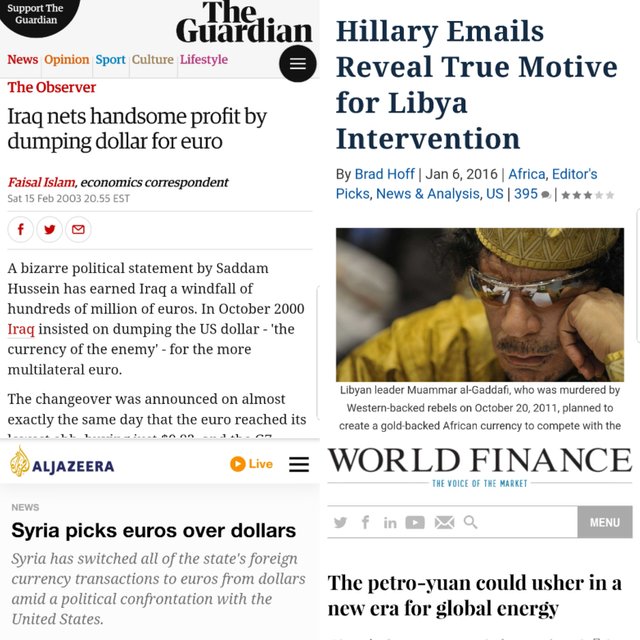

In order to maintain their empire, from this point on the US would destroy any country trying to sell it's oil in anything but USD.

Either through economic sanctions, threats, or just flat out invasion, countries like Iraq, Libya, and Syria had their economies stomped out of existence.

This may be the reason that countries like Russia and China have been stockpiling gold and why China launched a gold backed Petro-Yuan to trade oil with.

This current Petrodollar system is essentially slavery, and believe me these oppressed nations desperately wish to be free.

Enter Satoshi, clearly very aware of the flaws of the current system, he linked this article in the first ever (genesis) block of Bitcoin.

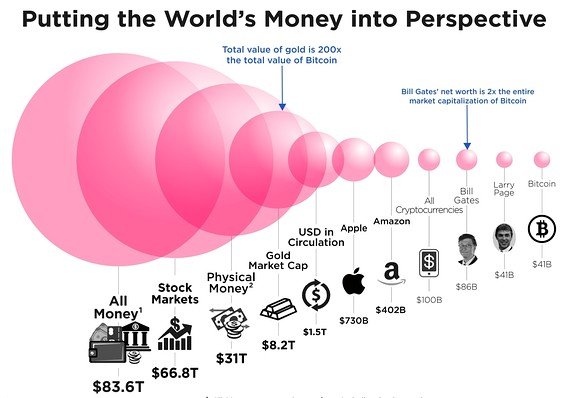

Bitcoin is essentially programmed to be the digital equivalent of gold. Like gold it is not printed, controlled, or dependent on any government. Like gold it is impossible to destroy the decentralized Bitcoin network. Unlike gold, its total supply is known, it can't be counterfeited (no need to test for purity), and can be transferred from peer to peer anywhere in the world in minutes.

So why hasn't it taken over already? Well mainly because the majority of liquid capital in the world hasn't been given easy access to it yet. That all changes November 5th when the NYSE's parent company ICE launches Bakkt. Bakkt will include futures contracts backed by physical delivery of Bitcoin. This will be the first time that the 70 trillion dollars on Wall Street has direct, regulated access to Bitcoin's tiny 150 billion dollar marketcap.

This will be the first time the dollar/central banking system has failed while a global sound money system exists.

When the debt bubble bursts this time, the Fed will have to decide if they will let the whole economy fail, or print trillions more dollars. In either case, the USD emperor will be exposed as truly having no clothes and all investors will have an easy on ramp into Bitcoin.

Bitcoin will effectively become a fiat sink drain, as the banks desperately print money to bail themselves out of the biggest debt crisis of all time, it will all be poured into Bitcoin as the only available safe haven.

Whether it happens this month, next month or a year from now, the writing is on the wall for the old world order. Our fiat fueled central bank controlled economy and empire has been on life support for 10 years, what ends up being the event that pulls the plug is anyone's guess.

Peace, Love, Anarchy,

Fantastic write up! It has a bit more conspiracy theory than I personally enjoy, but it throws in enough educational history to make for a really great read. Well done!

Haha, yeah was going for a more speculative thriller, I do stand by all the statements made, probably gonna add some more references

Posted using Partiko Android

This has the making of a nice book, nice write up bud.

Thank you sir 🤜🤛

Posted using Partiko Android

Great article...I'd love to talk with you more about this...my email is [email protected]!

Much Love!

Thank you sir, I'll have to send you a message!

Posted using Partiko Android

Why not talk out in the open ?

Incredible information gathering brother. I know we've talked about each of the aspects of this article, but this has to be the most clear conscience and organized train of thought I've seen so far.

Thank you good sir, means a lot 🔥

Posted using Partiko Android

Well put together acticle , wow :)

Thank you! Glad you enjoyed!

Posted using Partiko Android

Congratulations @bchainbastards!

Your post was mentioned in the Steemit Hit Parade for newcomers in the following category:

I also upvoted your post to increase its reward

If you like my work to promote newcomers and give them more visibility on Steemit, consider to vote for my witness!

Because they were forced to do so by the Community Reinvestment Act. Probably part of an overall plan to crash the banks and the market, which would lead to more government control.

Interesting, wasn't aware of that, thanks!

Posted using Partiko Android