The ICO Market Has Hit the Brakes

The ICO economy succumb to a dramatic decline in Q2 of this year. Such was the extent of the slump that its pushed the average ROI for ICOs into the red for the first time since records began. New figures released this week show the severity of the great ICO slowdown.

Token Sales Are in Trouble

The fact that most ICOs from the last quarter are mired in the red will come as no surprise: anyone who’s glanced at their portfolio in the last 90 days will have deduced that much. New figures from ICOrating.com reveal the extent of the decline but do provide a glimmer of hope for certain segments of the market. A detailed report highlights a number of interesting trends, the most headline-grabbing being the fact that despite an increase in funding, from $3.3 billion in Q1 to $8.3 billion, 50% of ICOs in Q2 failed to raise more than $100,000.

Other noteworthy statistics include:

Only 7% of ICOs from Q2 have been able to secure listings

55% of all ICOs from this period failed to hit their funding target

15% of projects already had a working business, versus 6% in Q1

This latter statistic could be taken as a sign of progress, but as ICOrating.com observes, “The absence of a working business had no effect on fundraising success.”

The ICO Market Has Hit the Brakes

If You Bought into an ICO in Q2, You’ve Probably Lost Half Your Investment

In Q1 of 2018, ICOs made a median return on investment of 49.32%. In Q2, that figure slipped to -55.38%. It’s hard to tell what’s more surprising: the fact that ICOs lost so badly in Q2 or that they turned a modest profit in Q1. Looking back, it’s hard to recall a lot of winners from the start of the year, or indeed from at any point this year. Like the cryptocurrency market as a whole, the ICO industry has suffered from the bloodletting that has seen every major cryptocurrency, bar three, at a loss for the year to date.

ICOrating.com’s research is to be commended for the level of granular detail it provides. Its 64-page report reveals, for instance, that 53% of all dapp-related ICOs failed, which tallies with figures showing that no one’s using dapps at this point in time. For all the hype surrounding security tokens, which were meant to be the breakthrough stars of 2018, it is utility tokens that have still raised the bulk of the funds, and by some distance:

The ICO Market Has Hit the Brakes

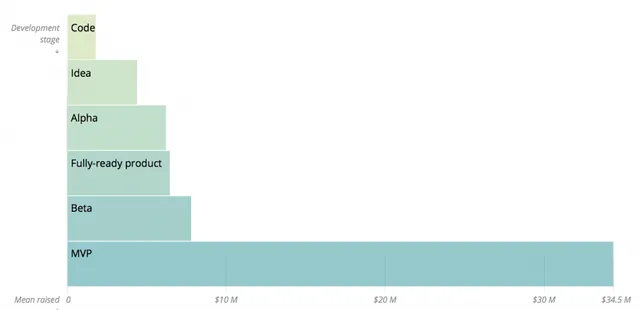

The research also found that projects at the idea stage – i.e comprising little more than a whitepaper and a basic team – raised just $4.5 million in Q2, whereas those with an MVP fared 8x better.

The ICO Market Has Hit the Brakes

Finally, Exchanges & Wallets, Real Assets, and Computing & Data Storage were the top three categories for fundraising during this period. Financial Services, Privacy & Security, and Banking & Payments, on the other hand, all wound up in the red. Q2 has been the toughest three months for ICOs yet. Token sales scheduled to go live in the remainder of 2018 will be praying for more forgiving conditions.

Do you think the ICO market will pick up in the remainder of this year? Let us know in the comments section below.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.clublaura.com/2018/08/10/the-ico-market-has-hit-the-brakes/