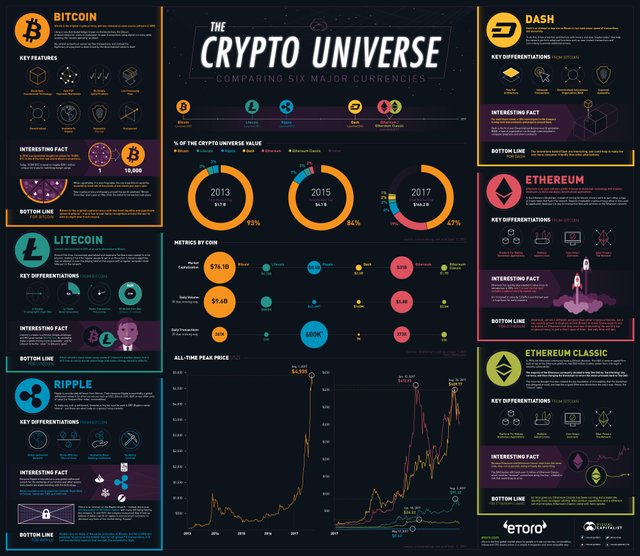

How bitcoin, Ethereum, and the other major cryptocurrencies compare to one another

Rotariu uses Romania's first bitcoin ATM in downtown Bucharest

Unless you’ve been hiding under a rock, you’re probably aware that we’re in the middle of a cryptocurrency explosion. In one year, the value of all currencies increased a staggering 1,466% – and newer coins like Ethereum have even joined Bitcoin in gaining some mainstream acceptance.

And while people like Jamie Dimon of J.P. Morgan and famed value investor Howard Marks have been extremely critical of cryptocurrencies as of late, many other investors are continuing to ride the wave. As we’ve noted in the past, the possible effects of the blockchain cannot be understated, and it could even change the backbone of how financial markets work.

However, even with the excitement and action that comes with the space, a major problem still exists for the layman: it’s really challenging to decipher the differences between cryptocurrencies like Bitcoin, Ethereum, Ethereum Classic, Litecoin, Ripple, and Dash.

For this reason, we worked with social trading network eToro to come up with an infographic that breaks down the major differences between these coins all in one place.

Courtesy of: Visual Capitalist

A description of major coins

Here are descriptions of the major cryptocurrencies, which make up 84% of the coin universe.

Bitcoin

Bitcoin is the original cryptocurrency, and was released as open-source software in 2009. Using a new distributed ledger known as the blockchain, the Bitcoin protocol allows for users to make peer-to-peer transactions using digital currency while avoiding the “double spending” problem.

No central authority or server verifies transactions, and instead the legitimacy of a payment is determined by the decentralized network itself.

Bottom Line: Bitcoin is the original cryptocurrency with the most liquidity and significant network effects. It also has brand name recognition around the world, with an eight-year track record.

Litecoin

Litecoin was launched in 2011 as an early alternative to Bitcoin. Around this time, increasingly specialized and expensive hardware was needed to mine bitcoins, making it hard for regular people to get in on the action. Litecoin’s algorithm was an attempt to even the playing field so that anyone with a regular computer could take part in the network.

Bottom Line: Other altcoins have taken away some of Litecoin’s market share, but it still has an early mover advantage and some strong network effects.

Ripple

Ripple is considerably different from Bitcoin. That’s because Ripple is essentially a global settlement network for other currencies such as USD, Bitcoin, EUR, GBP, or any other units of value (i.e. frequent flier miles, commodities).

To make any such a settlement, however, a tiny fee must be paid in XRP (Ripple’s native tokens) – and these are what trade on cryptocurrency markets.

Bottom Line: Ripple runs on many of the same principles of Bitcoin, but for a different purpose: to serve as the middleman for all global FX transactions. If it can successfully capture that market, the potential is high.

Ethereum

Ethereum is an open software platform based on blockchain technology that enables developers to build and deploy decentralized applications.

In the Ethereum blockchain, instead of mining for bitcoin, miners work to earn ether, a type of crypto token that fuels the network. Beyond a tradable cryptocurrency, ether is also used by application developers to pay for transaction fees and services on the Ethereum network.

Bottom Line: Ethereum serves a different purpose than other cryptocurrencies, but it has quickly grown to displace all but Bitcoin in value. Some experts are so bullish on Ethereum that they even see it becoming the world’s top cryptocurrency in just a short span of time – but only time will tell.

Ethereum Classic

In 2016, the Ethereum community faced a difficult decision: The DAO, a venture capital firm built on top of the Ethereum platform, had $50 million in ether stolen from it through a security vulnerability.

The majority of the Ethereum community decided to help The DAO by “hard forking” the currency, and then changing the blockchain to return the stolen proceeds back to The DAO. The minority thought this idea violated the key foundation of immutability that the blockchain was designed around, and kept the original Ethereum blockchain the way it was. Hence, the “Classic” label.

Bottom Line: As time goes on, Ethereum Classic has been carving out a separate identity from its bigger sibling. With similar capabilities and a different set of principles, Ethereum Classic could still have upside.

Dash

Dash is an attempt to improve on Bitcoin in two main areas: speed of transactions, and anonymity. To do this, it has a two-tier architecture with miners and also “masternodes” that help the network perform advanced functions such as near-instant transactions and coin-mixing to provide additional privacy.

Bottom Line: The innovations behind Dash are interesting, and could help to make the coin more consumer-friendly than other alternatives.

BONUS: Bitcoin Cash

Although not included in the graphic, we also wanted to add a quick word on Bitcoin Cash. This new currency “hard forked” from Bitcoin about a month ago, as a result of miner disagreements about the future of Bitcoin. Here’s a detailed summary of the announcement.

Get the latest Bitcoin price here.

Read the original article on Visual Capitalist.

I've only been docovering crypto over the last month but if I'd seen this straight away it would have saved me a whole lot of time. Thanks for this simple graphic.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.talkmarkets.com/content/currenciesforex/comparing-bitcoin-ethereum-and-other-cryptos?post=149182