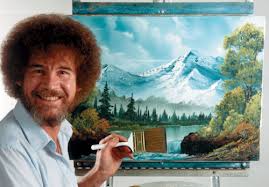

Happy trees (or my crypto mistakes): Noob mistake #3

Noob mistake #3: Not understanding the correlation between BTC and altcoin prices

Early on I thought it would be smart to capture my gains by exchanging successful coins for coins that I liked but had not yet invested in. While I strongly support the idea of taking profits during a boom, exchanging for other booming coins largely defeats the purpose. And yes, I think there’s a better way.

To better explain the problem, let’s say I was invested in Siacoin (SC) when it was on fire. Maybe I exchanged 10% of my holding for LSK (by exchanging SC for BTC and then following that exchange with BTC for LSK). Sounds great except for one problem. BTC and LSK were likely to be booming at the same time (e.g. July 2017 or December 2017). So while I meant to capture my gains of SC while the price was inflated, I instead swapped it out for another inflated coin. Of course when prices corrected, I wasn’t any better off since LSK and SC (and BTC) all came back to earth.

So what’s a better way? I’m sure there are many ways to achieve the desired end but I will describe the one that works for me. If you’re a day trader or have a get rich quick ethos, this approach would not work for you.

What I now do is exchange a set percentage of a booming coin for BTC or ETH on my preferred exchange. I then move the BTC or ETH to Gdax where I convert it to fiat. With fiat available, I wait for the next correction. Since the altcoin market (mostly) moves in lockstep with itself and with BTC, there’s not much reason to chase the market when it’s hot. Instead I have a pool of funds waiting in the wings for a downturn. Then when BTC corrects to $8000 USD (or whatever level I deem to be a bargain), I buy BTC (or ETH). I then have the choice whether to keep as BTC (or ETH) or to exchange for altcoins of my choosing. Since the entire market has likely dropped along with BTC, I am now buying those altcoins at a discount.

We all know that we should buy low and sell high. However, psychology often gets in the way. There is a wealth of data in the field of behavioral economics that shows how most people do the opposite by buying high (FOMO) and selling low (capitulating when the market crashes).

Don’t follow the herd. Instead make a smart plan and follow it without listening to the noise all around. That’s a path to success.

More to come…

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

I just did a similar write up. Glad you caught on to this early on.

We're all going to make mistakes. The key is to learn from them...or better yet to learn from the mistakes that others make. I'll be sure to check out your posts. Thanks for the comment.