BTC Balances on CEXs Increased So Far in March

The peak in exchange balances coincides with the low price of $80,357, generating selling pressure and market volatility.

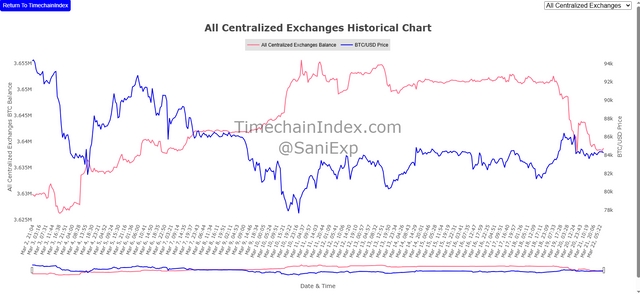

The price of Bitcoin fell 10.67% so far in March, from $94,309 to $84,250, while balances on centralized exchanges increased by 8,837 BTC, according to data from TimeChainIndex. This movement reflects bearish sentiment among investors, driven by the strength of the dollar and global economic uncertainty.

Between March 2 and March 22, 2025, Bitcoin balances on centralized exchanges increased from 3,629,917 BTC to 3,638,754 BTC / TimeChainIndex

Increasing Exchange Balances: Sell Signal

Between March 2 and March 22, 2025, Bitcoin balances on centralized exchanges increased from 3,629,917 BTC to 3,638,754 BTC. This increase coincides with a fall in the Bitcoin price, suggesting that investors are depositing BTC to sell, putting downward pressure on the price.

On March 11, balances reached a peak of 3,655,634 BTC, coinciding with the low price of $80,357. This data is crucial, as it indicates a significant increase in supply on exchanges, which is typically associated with increased selling pressure.

External Factors Impacting the Bitcoin Price

The US Federal Reserve kept the interest rate at 4.50%, while the labor market showed resilience and inflation fell short of the 2% annualized target. This strengthened the dollar and weakened risk assets like Bitcoin.

Furthermore, President Donald Trump's tariff policies raised inflation fears and increased uncertainty in the markets. Coinmarketcap's Fear and Greed Index remained in the extreme fear zone, with values between 19 and 24 points throughout March.

Futures Open Interest Decline

Open interest in the Bitcoin futures market fell from $55.86 billion to a low of $45.72 billion on March 10, reflecting reduced liquidity in the crypto market. However, over the past two weeks, open interest recovered to $53.58 billion, coinciding with a rebound in the Bitcoin price.

Key Outlook and Levels

The Bitcoin price showed resistance at the $80,357 level, which could indicate key support. If this level holds, it could pave the way for a potential recovery. However, volatility and bearish sentiment continue to dominate the market.

The Bitcoin market in March 2025 is reflecting bearish behavior, with an increase in exchange balances and a significant drop in price. The combination of macroeconomic factors, such as a strong dollar and political uncertainty, generated negative sentiment among investors.

In the short term, the Bitcoin price is likely to remain volatile, with possible tests of support and resistance. However, it is also in oversold areas, so it could be forming a bottom that would need to be tested later.

Disclaimer: This content is for informational and educational purposes only. It does not constitute financial, legal, or other professional advice. Please do your research before investing.

Upvoted! Thank you for supporting witness @jswit.

Your post has been rewarded by the Seven Team.

Meet our work

Support partner witnesses

We are the hope!