Investors massively withdraw BTC from exchanges

Confidence in the reigning cryptocurrency intensifies as the balance on centralized exchanges falls to historic lows.

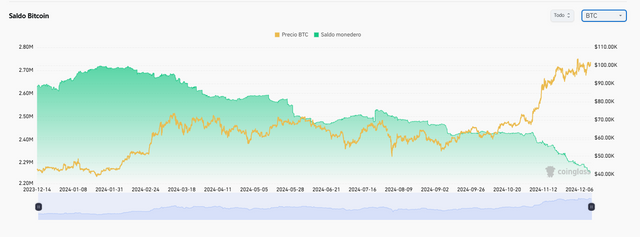

Demand for Bitcoin is skyrocketing as balances on centralized exchanges are reduced to just 2.25 million BTC, a significant drop compared to last year. As BTC remains on the rise, institutional and retail investors are rushing to withdraw their funds in search of safety.

As BTC balances on exchanges shrink, its price continues to rise / Coinglass

Investor confidence strengthens

According to data from Coinglass, the balance of Bitcoin on centralized exchanges fell by 132,565 BTC in the last 30 days, reaching a low of 2.25 million BTC. This decline in balances reflects a growing confidence by investors in BTC, who are choosing to move their assets to self-custody wallets.

A Bull Market Fueled by Scarcity

As BTC balances on exchanges shrink, its price continues to rise, closing this Friday with an increase of 1.42%, standing at USD 101,424.25. This bullish movement is supported by the expectation of less regulation with the arrival of the new Donald Trump government. In addition to the imminent reduction of interest rates by the US Federal Reserve, scheduled for December 18.

The impact of stablecoins on the ecosystem

Another factor that boosts the demand for BTC by investors is the explosive increase in the market capitalization of stablecoins. This reached a record of USD 202.09 billion. The popular stablecoin USDT leads the market with a capitalization of USD 140.40 billion and represents almost 70% of the total. The growth of stablecoins indicates a strong inflow of liquidity into the cryptographic system, which contributes to the escalation of prices of bitcoin and other cryptocurrencies.

Significant USDT growth on exchanges

Coinglass data shows a considerable increase in USDT balances on centralized exchanges. The accumulation has grown by 281% in the last year, from $13.50 billion to almost $38 billion. This growth is especially notable since Donald Trump's election victory, who shows a positive approach towards bitcoin.

Rising users and diversity in the market

The number of stablecoin holders continues to increase, reaching 133 million, led by USDT (81.7 million holders) and BSC-USD (25.8 million). Although USDC grew at a slower pace with 18 million holders, smaller stablecoins such as PYUSD and USDe are gaining traction, indicating a diversification of the market.

As the balance of bitcoin on centralized exchanges continues to decrease and its price remains high, confidence in the cryptocurrency seems stronger than ever. Investors are making strategic decisions by moving their assets to a safer environment, while the stablecoin market continues to attract participation and liquidity. This outlook suggests that the cryptocurrency ecosystem is poised for an exciting and potentially lucrative phase.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves risk and thorough research is recommended.

Upvoted! Thank you for supporting witness @jswit.