Mining Bitcoin Just Got Harder Then Ever

Bitcoin mining has become a big thing with browser mining lately but not only that just last month I reported that mining it was becoming harder and harder.

Normally when the price falls of a cryptocurrency you see a fall off of the mining being done on it. However Bitcoin has been opposite as of the last few months. Even systems like hashflare are producing no profits at all now since their fees are higher then the amount of bitcoin that is being generated.

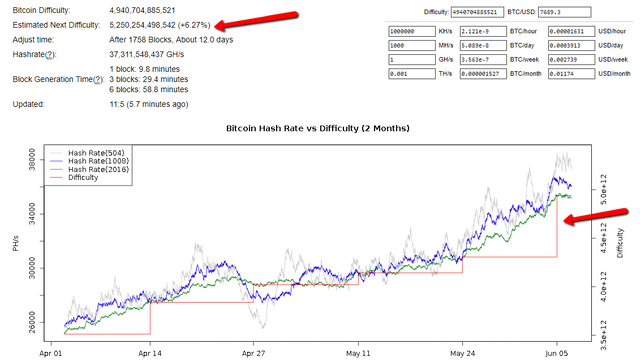

The last difficulty increase was massive jumping from a little over 30,000 PH/s to 37,000 PH/s one of the biggest jumps we have seen in a long time.

This seems to be a combination of ICO projects which are launching even more miners such as Envion, Miner One, Giga Watt, ICE Rock mining, Moonlite. But even larger companies are tapping into this even heavier such as Hive Blockchain which is partnered with Genesis Mining, Hut 8 which is a partnership with Bitfury and Long Blockchain which purchased over 1,000 Bitcoin miners.

We have even seen counties get involved in bitcoin mining taking over large abandoned buildings and setting up massive mining rigs such as that in Russia.

Because of this mining not only is becoming obsolete for bitcoin but just about any other coin.

Ethereum has taken some major hits but has leveled out around the 3 P/Hs level

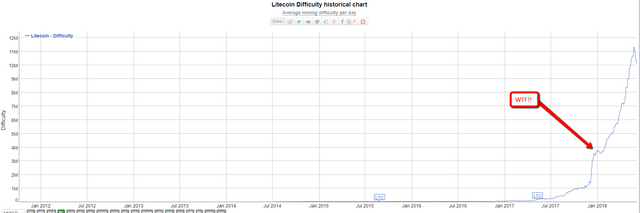

Litecoin has spiked in mining difficulty since 2018 I mean just look at this chart it is nuts.

To me mining seems dead unless the value of these coins shoot up again such as bitcoin being worth 25k or more.

It seems to be more centralized then ever.

And it seems like other systems such as POS or something yet brainstormed could be the future of cryptocurrency to give everyone an even playing field.

Seems to me like hybrid POW/POS blockchains are going to be the future. Similar to what Ethereum's Casper Hybrid FFG will be like. This adds a second layer to security and makes blocks final preventing a 51% attack.

Also, DPOS is future like Steem and EOS. I think over time as Proof of Stakes system develop, this will become the new norm. A POW work blockchain that gets mass adopted could be very secure since that would mean lots of different addresses and miners competing for the block rewards and trans fees. For example, you have a POW chain that had a 1 billion transactions a day at 1 penny trans fees, that's $20 million per day just in transaction fees to miners. You'd have many miners all over world competing.

I still dont see how DPOS is better as it is limited to just a few masternodes that are voted on. It seems like you can manipulate that pretty well as a majority of people do not vote.

It's a trade off for high scaling. 21 BP's with 150 on standby. That's very decentralized enough. The most important thing is going to be user experience which requires mass on-chain scaling. I believe EOS is launching with nearly 1 million transactions per second. I also believe dapps will need to be blockchain agnostic in the future so they can run on at several major public API chains - interoperability.

A good crash could calm down some miners.

Resteemed! People need to understand this. Cloud mining is particularly unprofitable as well.

The bright side to this is that mining difficulty increasing helps maintain the network secure and makes potential attackers think twice before investing in an attack.

Bitcoin mining became centralized because of the tech improvements of like 1000% every few months. This also gave China the advantage because they are a big silicon producer.

Bitcoin mining tech has now run into Moore's Law, which means an increase of only about 2X every 18 months. This will decentralize BTC mining, but it will take a few years.

Also, BTC will certainly go up a lot in the future.

I'm not worried about mining centralization or the price of bitcoin.

Interesting posts, indeed mining is not profitable currently I have used Hashflare for quite some months thankfully I was able to reap the benefits. I will be interesting to see where bitcoin is heading, hopefully up

Coins mentioned in post:

Unprofitable miners will leave the market, leaving only the most profitable ones

It's been a nice run and maybe we have a big jump and mining can hang on for a couple more months/years - but I can't imagine the average person mining too much longer...

But there are still other coins to mine...

Mining isn't dead. The difficulty level drops as less efficient miners leave the market. The supply curve doesn't shift with bitcoin. Supply will be the same no matter if it's one miner or a trillion. What will make mining tougher is the regulations restricting power usage. Companies who are already mining will maintain profitability under grandfathered licenses while new companies will not be allowed in. I talk a bit more about it here: https://steemit.com/cryptocurrency/@stoadvisors/incredible-returns-with-mining-tokens-my-fundamental-analysis-of-wtt