Bitcoin Fork: Beginner’s guide to understand bitcoin fork

Beginners and newcomers, you must have seen the cryptocurrency table on Coinmarketcap. Rank 1 is Bitcoin, rank 4 is Bitcoin Cash, 26this Bitcoin Gold. Whenever there is a split in the original blockchain, it becomes a new fork. Try searching Bitcoin fork on Google and you’d see how many times the core bitcoin blockchain has been forked.

In this guide, we will explain the forking, the whole process of forking and the reason why forking happens.

Without further ado, let’s begin the guide by explaining a bit about Bitcoin and set a background for the main show.

A brief about Bitcoin

Bitcoin was the brainchild of an unknown developer named Satoshi Nakamoto. No one knows who this person is, not even if it’s he/she or a group. Till date, no one is able to trace who the person is. In 2008, Satoshi wrote a whitepaper and emailed it to the cryptographic mailing list.

Back then, it was simply a peer-to-peer payment system that doesn’t need a central third party. One can simply send the funds directly to the person they want, without any involvement of any central authority such as banks. The system is completely decentralized, i.e. the data is not stored in a central database, rather it’s across all nodes on the network.

The system proposed by Satoshi runs on Blockchain technology, which is a revolutionary piece of code that does everything without a need of any intermediatory. It’s blockchain technology that enables Bitcoin to be decentralized, P2P, and it’s 100% anonymous. Bitcoin was invented as a digital payment system and it serendipitated to become the first cryptocurrency.

From 2009, the financial authorities have been facing a threat to their existence and Bitcoin started becoming more and more popular among people who frequently sent money across borders. Since this had no middlemen, the transactions were fast, little to no fees(sometimes), completely anonymous, safe and what not. Everyone started loving it and everyone started using it. With all this happening, the demand increased & the Bitcoin price started rising.

The next thing happened after this was a pure magic. Until early 2010, Bitcoin was not seen as a potential threat to the traditional system, like not literally. Everyone thought, it’s a bubble and it will soon meet its end. Just like the internet, people who said this bubbly thing was wrong. Bitcoin became stronger and more and more people started using it.

To understand Bitcoin with respect to this guide, let us tell you how Bitcoin Transaction works.

How Do Bitcoin Transactions work?

There are two main segments happening behind the scenes that make a Bitcoin transaction happen.

- Verification/confirmation

- Adding confirmed transaction to the blockchain.

If you don’t already know, these two segments happen under the supervision of volunteers called “miners”. As it sounds, miners are the node owners on the network that are responsible for the network to run. They spend their time and energy to verify the transactions and add it to the blockchain/public ledger. Details of this process are explained in this post on Mining Cryptocurrency.

The system is designed in such a way that when the miners verify or confirm the transactions, new units of cryptocurrencies (in this case, Bitcoin) is generated and a portion of it is given to the miners as an incentive for their time and energy spent. The network pays the miners because they are responsible for keeping the network running, fresh and secure. If there are fewer miners, the transactions would be slow, as few resources will be verifying the transactions. Furthermore, one of the factors on which the price of bitcoin depends is how fast the transactions are approved. Once the block is added to the blockchain, it cannot be tampered with by anyone, including the owner of the transactions.

Scalability issue in Bitcoin

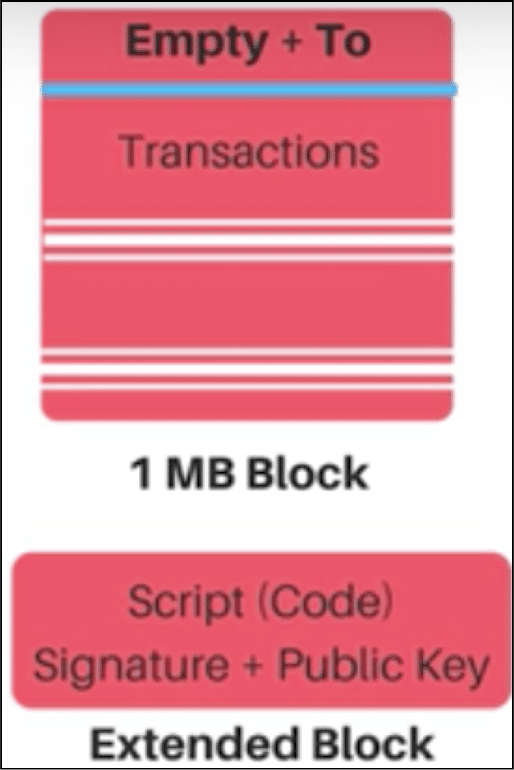

All blockchain have something called block size. Blocksize is the space allocated for the transactions to occupy space in the block. Bitcoin has a block size of 1MB, i.e. each block can accommodate transactions with the total size of 1MB.

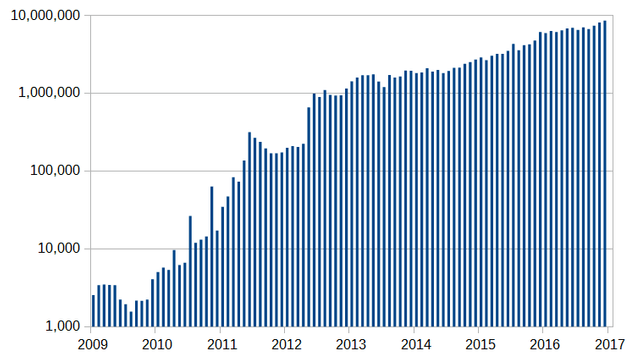

Initially, it was not more of a problem then something weird happened that created a huge problem for Bitcoin blocksize, Bitcoin became famous. With ever-increasing transactions, Bitcoin blockchain network became more and more occupied. You can see from the graph below and see the number of transactions per year.

Unlike the initial days, Bitcoin is able to handle only 10 transactions per hour. This is the reason at the core of Bitcoin forks that happened in the Bitcoin blockchain network.

The solution to this congested network is increasing the block size. But there’s a problem here. If the blocksize is increased, it will surely increase the number of transactions fees per block but also the number of fees per transaction will increase.

The increased fees will be expensive for the smaller amount of transfers. Furthermore, if this continues growing the common man will never be able to use the bitcoin network and only the big names will be able to use and it is not the purpose Bitcoin was invented to serve.

On the other side, miners might lose the incentive that they are making from the blocks they mined.

If we are to solve the scalability issue, there’s a simple solution to increase the blocksize. Well, it’s not that simple as it sounds.

The Fork Dilemma

The Bitcoin community is populated with a lot of people who are against the size to increase is because they fear the forking dilemma. In 2017, considering the network to be over-populated a group of developers from the bitcoin community came together and decided to fork out to a new blockchain with a bigger block size. This was a hard fork, don’t worry we will explain this in a moment.

Before we explain that, let us explain what fork means. When the blockchain diverges into chains that are either different terms or different features altogether. Imagine the blockchain as the river and Bitcoin forks that happen as streams. There are two types of forks:

What Is A Soft Fork?

Whenever the original stream needs to be updated (in whatever way needed), it can be done in two ways, hard forking or soft forking it. Imagine soft fork as a software update. It’s an update on the original chain with changes in either features or terms.

Furthermore, the soft fork is backward compatible. That is, the soft fork will still run on nodes that were running the older blockchain. If you send funds to a wallet after the soft fork happens, it will still receive the funds. With backward compatibility, we mean that the soft fork will support all the norms and hardware compatibilities as that of the old version.

For example, if an Android app is built for Android Oreo, it will be compatible with devices running Android Pie once it’s available. However, the update that is in the new chain will not be applicable to the older chain.

What Is A Hard Fork?

The hard fork is when a blockchain is not backward compatible and is not affiliated to the old blockchain in any way. The hard fork blockchain is completely new environment and once it happens, there is not turnback whatsoever.

It is optional for the investors and user whether or not to join the new hard fork blockchain network. A hard fork is totally incompatible to each other in all senses. Imagine it like Playstation gaming consoles. Both PS3 & PS4 are from the same company but you can’t play games on both the consoles. You gotta play games on the respective consoles only.

Andreas Antonopoulos describes the difference between hard and soft fork like this: “If a vegetarian restaurant would choose to add pork to their menu it would be considered to be a hard fork. if they would decide to add vegan dishes, everyone who is vegetarian could still eat vegan, you don’t have to be vegan to eat there, you could still be vegetarian to eat there and meat eaters could eat there too so that’s a soft fork.”

Okay, enough of theory. It’s time for us to dive into the main part of the article.

Bitcoin Core

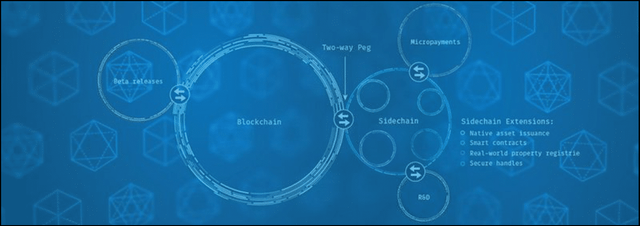

Bitcoin, since the time it became famous, had one big problem, blocksize. The community was against the concept of the hard Bitcoin fork and they came up with a solution, Segwit. At the core of Bitcoin blockchain, Segwit runs as an increased blocksize that stores the signature data in parallel to the transactions in the mail blockchain.

Segwit is commonly known as the sidechain, and this has been in talks of the bitcoin community for quite a while now. Sidechain can be imagines as sidekicks, it goes wherever the motorbike goes. The sidechain joins the main chain by a two-way peg.

Here’s what Bitcoin blockchain & a sidechain looked like initially:

Later, Dr Peter Wiulle, came up with a new feature for the sidechain. As part of this feature, the signature data of all transactions would be separated from the main chain in the process. This feature was named Segregated Witness or SegWit for short. This is what the bitcoin blockchain is using currently. But considering the current trends, it doesn’t to be enough in any way.

Take a look at the pictorial form of segwit, once implemented:

Segwit was implemented as a soft fork (it increased the blocksize too) and not everyone in the developer community was happy with this. This led into the creation of Bitcoin Cash, which is by far the most successful hard Bitcoin fork in the history of cryptocurrency.

That being said, let’s take a look at some Bitcoin forks that streamed out of the main bitcoin blockchain.

Top Bitcoin Forks

Bitcoin XT

BXT was the first hard fork back in 2014 and got a lot of media attention back then. Mike Hearn headed the community of this hard bitcoin fork. He came up with the changes that the original Bitcoin blockchain needed. Bitcoin XT was the working model of the proposals he had. Back in 2014, the transaction rate of Bitcoin was 7/sec and he was aiming to take it to 24/sec. And he was looking forward to doing it by,

- Increasing the blocksize from 1 MB to 8 MB

- Automatically doubling the blocksize every 2 years

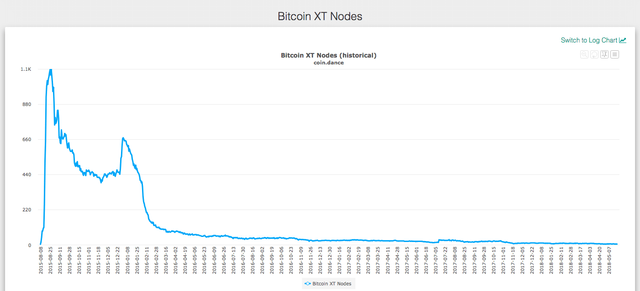

Bitcoin XT got a lot of interest till late 2015 but then miners soon began to drop the software and the threshold was never achieved by early 2016.

Bitcoin classic

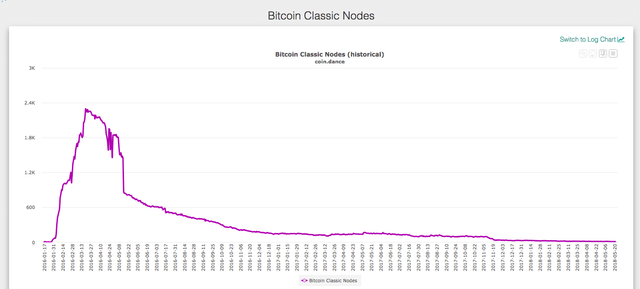

In contrast to increasing blocksize every 2 years, the community members of failed Bitcoin XT felt that an increase in blocksize was the solution but not the way Bitcoin XT did. That way, Bitcoin classic was born with blocksize of 2MB and not 8 MB.

Unfortunately, Bitcoin classic too failed like BXT. Initially, it saw 2000 nodes running the software but it fell gradually and it went down all the way to zero.

In 2017, Bitcoin Classic closed its operations and closed its doors forever.

Bitcoin Unlimited

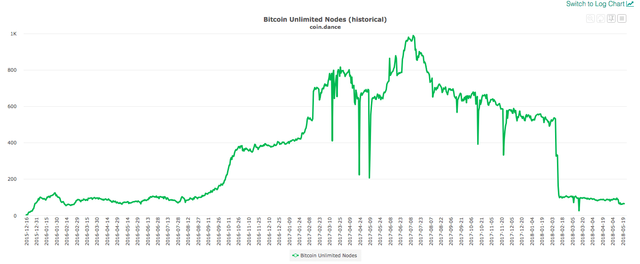

Bitcoin Unlimited, like the previous two hard Bitcoin forks, focussed on blocksize. But unlike the previous two, it did a little different thing. BU grants its user to decide the blocksize, the limit that gets the most consensus will be the blocksize for the network.

Take a look at the active nodes BU has got over the course of time.

BU went through a lot of dips because of a bug in the network. Which even caused Bitcoin.com mine an invalid block on 2 Feb 2017. Apart from this, there have been many issues that the bug caused. BU doesn’t exist anymore as original blockchain anymore. However, BU software works on Bitcoin Cash called BU Cash.

Bitcoin Gold

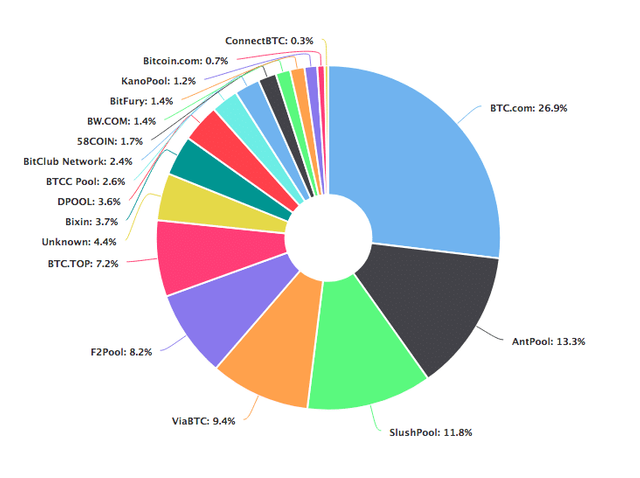

So far, we’ve been seeing forks out of Bitcoin Core Software. Bitcoin Gold is a hard fork of Bitcoin cryptocurrency and not the core software. On 24 October 2017, after block 491407 the hard Bitcoin fork happened. Bitcoin Gold exist because of Bitcoin centralized mining.

Ironically, Bitcoin being a decentralized application of the blockchain technology, the mining part of it was dominated only a handful number of miners.

Bitcoin runs on Proof of Work protocol and does ASIC mining. ASICs are damn expensive and costlier it is, better are the chances to mine more than others. Hence Bitcoin mining went into big name’s court and individual miners couldn’t afford it anymore.

Take a look at the graph showing the mining distribution:

Bitcoin Gold eliminated this like a pro. It’s equihash as proof-of-work algorithm instead of SHA256. This time, instead of ASICs, GPUs were taken in use. A small change made a big impact on the whole community. GPUs are cheap and affordable to individuals and hence doing the needful.

Bitcoin Cash

BCH is the most successful hard fork in the history of all cryptocurrencies. This is how Bitcoin cash defines itself on the official website “Bitcoin Cash is a peer-to-peer electronic cash for the Internet. It is fully decentralized, with no central bank and requires no trusted third parties to operate.”

This Bitcoin fork is purely Bitcoin with most important features added. Features include,

- 8MB blocksize

- No Segwit (who needs it when blocksize is 8MB)

- It will have replay & wipeout protection

- Difficulty level will update quicker than the adjustment found in Bitcoin blockchain.

Here’s a detailed guide on Bitcoin Cash that you will find useful

Final thoughts on Bitcoin Fork

We’re sure this guide has helped you understand the bitcoin fork in detail. This is a bit technical but if you pay attention to the reasons than the concept, you’d understand it right away. As far as forking is concerned, most of the forking that happens is to pump money.

At least that’s what CEO of Coinomi “Unfortunately, most fork-based projects we see today are more of a sheer money grab, Looking back a few years from now we might realize that they were just mutations fostered by investors blinded by numerical price increases — rather than honest attempts to contribute to the blockchain ecosystem.” Forkgenallows anyone to create Bitcoin hard forks. Tools like these make it really easy to fork out and make things worse.

Let’s see what we have in future when it comes to forks. There are forks in other cryptocurrencies like Ethereum too.

What do you think about the forks that are showing up. Let us know in the comment section below. Also, share the content with those who you think will find this article useful.

Originally published at https://www.bitfolio.org/understand-bitcoin-fork.