Getting Started - 3 Risks Every Crypto User Must Know

We've just published our latest Beginner's Guide on some of the pitfalls to avoid when you are starting out with crypto. Please give it a read and tell us what you think & if you like it, head over to our site for more of the same.

https://www.comparebitcoinexchange.com/getting-started-3-risks-every-crypto-user-must-know/

Comparebitcoinexchange is a website designed to inform and compare. It is not giving financial advice nor is it going to shill you the next coin to do 100x. The authors are not oracles on the subjects they discuss. We have lost money, become disillusioned at times and questioned the actions of some of the characters who populate the crypto space. However, we believe there is a place for blockchain technology and Bitcoin in the world. We all started somewhere and know that over the last 10 years or so we may have picked up some things that might be useful to those starting out, so that they may not make some of the costly mistakes that we did. Let’s look at some possible crypto pitfalls and how to manage the risks.

CRYPTOCURRENCY EXCHANGE RISKS

There is a reason that we write mostly about exchanges. They are a necessary part of the bigger crypto puzzle and most newcomers can get lost quite easily, so its right to take your time and explore the options. A free market and lack of regulation often makes crypto an exciting space to work in, however as to be expected it also attracts its fair share of bad actors, those looking to make a quick buck at the expense of others. When this is coupled with an exchange, then many people suffer the fallout.

In the early days of crypto there were not many choices of exchanges to trade it on, hence why when Mt. Gox was hacked in 2013 it affected a very large amount of the crypto community at the time..Some estimates suggest that Mt. Gox handled 70% of all Bitcoin trades. Roughly 740,000 Bitcoin were stolen and founder Mark Karpeles was unable to pay them back, so he went broke, the exchange went bust, and anybody who had Bitcoin on the exchange at the time , lost them. So, ultimately it was the community who felt the loss. Many thought that this would be the end of Bitcoin and it did suffer for a while after, but as has been the case throughout its history it bounced back stronger. After Mt. Gox trading took place spread out over a variety of smaller and often even less trustworthy exchanges that were located in some obscure Eastern European locale and operated by anonymous persons. Needless to say many of them operated for a while and then simply disappeared with the money.

In 2016, Cryptsy which was located in the US and as such received a little more credibility for not only its location, but also having a doxxed CEO slowly drained all of their customer accounts and proprietor Big Vern (Paul Vernon) eloped into the sunset with the cash.

Nowadays, we have come a long way with exchanges and trust has increased considerably. Exchange operators are often well-known and public figures that can be held accountable for their actions. The exchanges are usually registered and compliant in the location they are based. Bigger exchanges such as Binance and Kucoin have survived large hacks and continued to operate. Nevertheless, exchanges are a human weak-point in an otherwise trustless system and we should all realize that its us the hairless apes in fancy clothes who are the weakest link.

This is one of the primary reasons that we make exchange reviews and instructions for joining reputable exchanges a feature of our site. Always, always research the exchange that you are going to join…Remember they will at some point be holding your money.

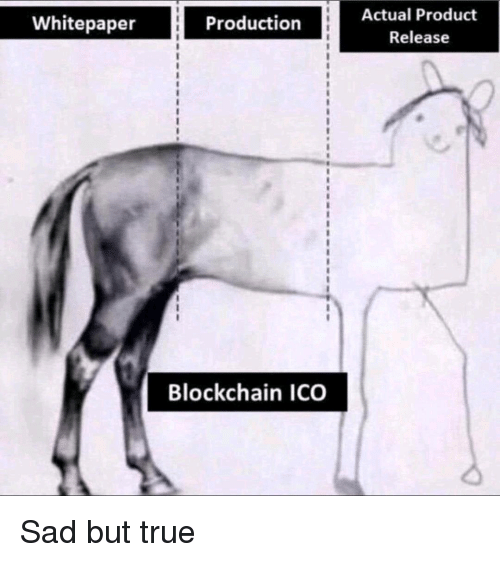

PROJECT RISKS

Big promises, small delivery. The ICO craze of 2017 saw a whole rash of projects launch with various claims as to how they would revolutionize a certain part of the existing business world. Whether it was supply chain, mobile telecommunications or bananas, there was a project for it. An ICO or Initial Coin Offering was the crypto equivalent of a traditional IPO, but with less rules. Basically if you had an idea and could hastily draft a “white paper” for the project (often plagiarizing other white papers to get it done fast) then people would throw money at you. Sadly, many of these projects were ill-conceived, unachievable or just straight up money-grabs.

Whenever you are putting money into a coin or token you need to consider things such as the founders reputation, the developers ability and does it solve a real-world need, otherwise you are just gambling. If there is a roadmap for the project, have they been meeting expectations and targets, or did development stop somewhere along the way. Check their Github for updates to the code, check their twitter and how long since they have posted to their social media and check other forums and chats such as Telegram and Discord to gauge the success so far of the project. If it is already trading on some exchanges, you may also wish to check the trading volume to ensure that you are not left holding the bag of an illiquid token that no-one is willing to buy at any price.

Recently, the popularity of Decentralized Exchanges has seen an increase in what has been termed a “rug pull”. A rug pull sees liquidity drawn into the dex in exchange for high APY rewards on tokens. This liquidity is then removed by withdrawing the token of value and the developers leave behind a worthless token.

Before investing in any crypto project do some digging into that project and see what you can find.

SCAM RISKS

Many people, including seasoned cryptocurrency users have fallen prey to the numerous scams that are cleverly designed to part you with your hard earned cash. Remember, you are your own bank and the security relies on you and the responsibility and buck stops with you, so always be vigilant and trust nobody. Be aware of emails apparently coming from exchanges or crypto projects, these are often fraudulent and have been designed to either direct you to a fake site or to get you to reveal your login details. Never go to any links that you receive in an email.

Fake giveaways operate in a similar way and are becoming more sophisticated each day. The earliest scams involved using a well-known personality such as Vitalik Buterin to entice users to send 1ETH and get 2ETH back. These became so rampant that Vitalik had to change his twitter handle to “No I’m not giving away ETH”. Popular targets such as Elon Musk, Michael Saylor, CZ Binance and even Metamask fight constantly to have their various clones removed from Facebook, twitter and YouTube. Always check that it is the real account and ask yourself why would they be giving away free money on social media.

*** NOTE THE INCORRECT SPELLING OF @ALON_MUSK

Remember, that phishing is a type of social engineering that relies on human failure rather than a failure of the hardware or software involved. Scarily, the recent technological advancements with DeepFake technology has given the scammers another tool to work with. Do not be duped!

Be very careful when downloading any type of crypto apps. If you are downloading a wallet, ensure that it comes from an official or trusted source. You can check these against the information provided on Coinmarketcap (Read our article HERE) Always check the source and reliability of it first otherwise you may download something with malicious code that has been designed to steal your coins.

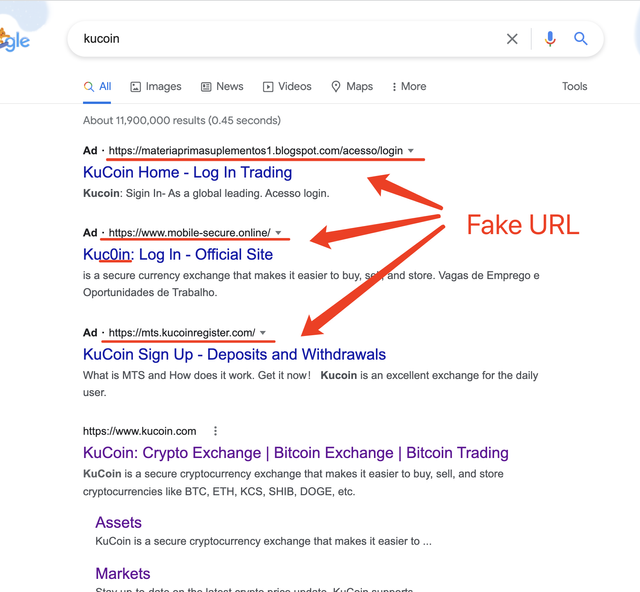

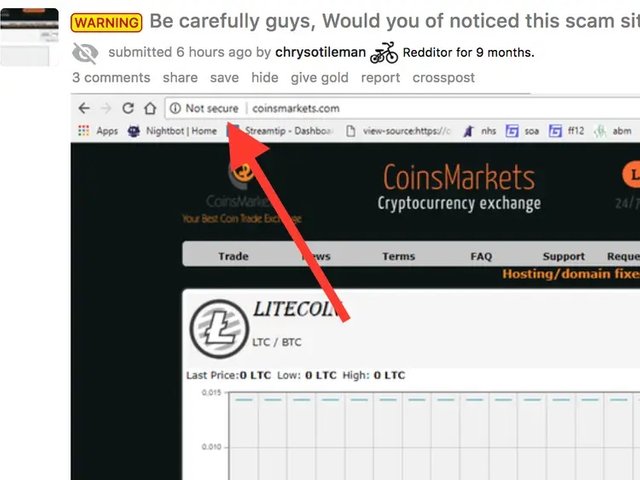

Always check the url of the site you are visited and check if it has the “lock” symbol and is the correct spelling and domain extension. Do not follow links that you have found through google as they are often fake phishing sites that are made to look like the real one. Its easy to fall trap as www.blnance.com looks remarkably similar to the real www.binance.com The first one had a letter (L) in place of the letter (i). The scammers may even take paid google ads to appear at the top of the search list.

Always hover your mouse over the URL and double check that it is HTTPS and not just HTTP. DO NOT EVER, under any circumstances share your private key with anyone. If you do this, you have basically handed over your wallet and any crypto within it to that person.

I know its a tired cliche but in this case – if something is too good to be true, then it probably is.

In conclusion, crypto is a fascinating area to get involved in. It has its genesis in philosophical ideas about the nature of money, freedom and responsibility. It is full of idealism, scammers and idiots and savants. It is early days at the moment. Tread with caution. Invest with money you can afford to lose, and hope that the future brings benefits to us all in terms of a fairer, more equitable system of money and governance.

Your post was upvoted and resteemed on @crypto.defrag

thanks