BTC-BTCFUTURES: AN ANTI-LOVE STORY - Part II

Hey Steemit,

Here is you Black Swan, so

So, where did we leave off with the (anti) love story?

Here’s a short recap of the first part of the article:

• At the end of 2017, CME and CBOE decided to introduce futures on BTC on their respective markets

• Both CME and CBOE designed a standard structure for such futures (with slight different features: learn more about the specifics of CME and CBOE BTC futures here: https://www.blackswangate.com/blog/btc-btcfutures-an-anti-love-story-1-of-2)

That said, we would now like to assess whether futures’ introduction has in fact influenced BTC’s price.

In order to do so we took into account trades executed on the BRR (Bitcoin Reference Rate) exchanges: Kraken, Bitstamp, Gdax and itBit. In particular, we focused our analysis on the price gaps registered over two different time frame periods: November 2017 and June 2018.

Let’s start with November 2017

Below you can see BTC’s price daily highs and lows raw data and charts recorded on the four exchanges used as a reference for the BRR:

.jpeg)

.jpeg)

At a first glance it’s easy to notice that values differ significantly. In particular, the average spread between different highs values among BRR exchanges averaged 83.12 USD (i.e. 0.996%): enough of an opportunity for profitable arbitrage trades.

Data regarding the average difference occurring between the highest low and lowest low of the same period provide further support to our argument.

As shown below (BTC price lows chart – November 2017), consistent difference in values occurs, widening considerably as the end of the month approached.

.jpeg)

In this case the BTC daily lows registered an even bigger average difference with respect to BTC daily highs: 88.49 USD, i.e. 1.11%.

That said, let’s now assess whether futures introduction have indeed influenced BTC’s price on the BRR exchanges.

What happened after futures’ introduction?

Using the very same method, we took into account June 2018 as a reference month for trades executed on the BRR exchanges.

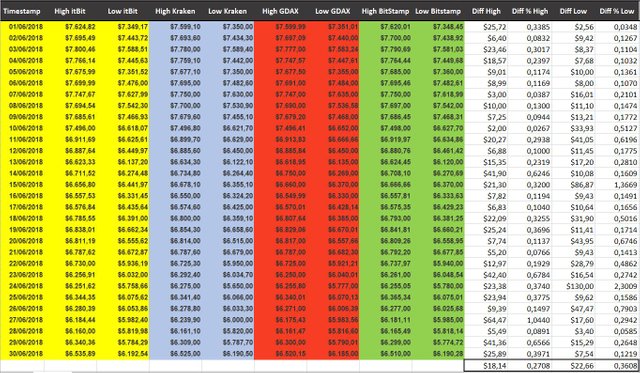

Here you find June 2018 BTC daily highs and lows raw data and charts:

.jpeg)

As we can see from the June 2018 BTC price daily highs chart, virtually no difference between values occur, thus creating a trend line almost perfectly overlapped. Analyzing the raw data we can determine an average price difference of 18.14 USD, i.e. only 0.27% (more less one fourth with respect to November 2017): clearly too little of a spread to represent a profitable arbitrage opportunity, especially if we consider fees.

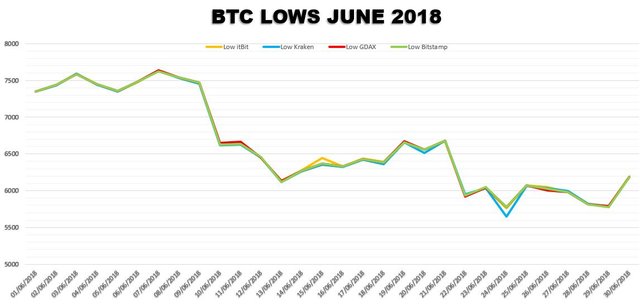

A very similar situation occurs with June 2018 BTC daily lows:

Once again, daily lows gap proved wider than daily highs one. That said, it averaged a very narrow 22.66 USD, i.e. 0.36% difference (more less one third with respect to November 2017).

These data show us an incontrovertible fact: futures introduction had indeed influenced BTC prices, at least with respect to the price gap previously existing between the 4 exchanges taken into account.

It would be interesting to further extend the “arbitrage research” to other exchanges as well, so to assess the extent to which futures introduction influenced price gap among the overall market.

However, one more question remains unanswered:

What role did BTC futures play in the recent months bearish market?

If, on one hand, finding an answer to such question is no easy task, on the other we have to bear in mind few significant facts. For example, it’d be wise to remember that futures’ introduction made short selling on Bitcoin much easier than it used to be, especially because the settlement of the contracts is on a cash basis.

Moreover, the narrower price gaps between exchanges may have made life easier to everyone who intended manipulate BTC’s price (especially downwards), but of course we can’t put forward any proof, yet.

Did you like the article? What are your thoughts? Leave a comment and let us know what you think!

Best,

Black Swan Team