Two Big Factors Are Driving Up Bitcoin Prices

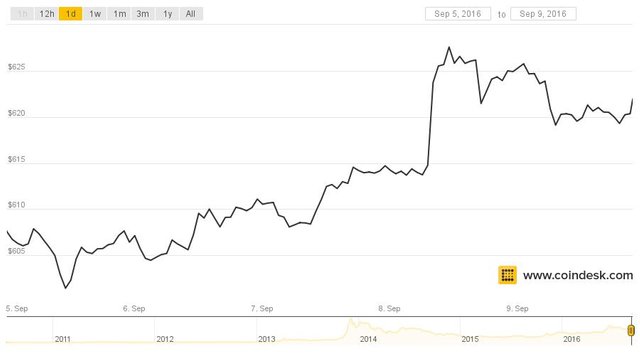

The price of bitcoin rose close to 10% this week, pushing higher as bullish market sentiment and low liquidity created an ideal environment for gains.

The digital currency enjoyed notable increases during the week, surpassing $600 on Sunday, 4th September, while largely avoiding any significant pullbacks or corrections.

Sentiment is so strong "players are not willing to bet against the rise of BTC/USD," according to Petar Zivkovkski, director of operations for Whaleclub.

He told CoinDesk:

"New short position openings are almost at all-time lows, [which] indicates that the market expects a continued rise."

Tim Enneking, chairman of cryptocurrency investment manager EAM, sees similar forces propelling the current market.

"Sentiment is generally bullish," he added.

Fast start, bullish sentiment

Bitcoin prices had a fast start during the week, opening at $571.68 on 2nd September before surging 4.9% to $599.60 the following day, according to CoinDesk USD Bitcoin Price Index (BPI) data.

While the digital currency tested $600 and failed to break through that resistance, it surpassed that key psychological barrier on Sunday, 4th September, before rising to an intra-day high of $612.39, additional BPI figures reveal.

The digital currency's price surged more than 6% over the weekend of 3rd and 4th September. Market sentiment was strongly bullish during these two days, data provided by leveraged bitcoin trading platform Whaleclub reveals.

Long exposure – as measured by the size of open positions – was 88% on Saturday and 87% on Sunday.

Confidence, which measures the percentage by which a particular day’s position sizes were larger than average, registered 86% on 3rd September and 87% on 4th September, according to additional Whaleclub figures.

Additional figures from BFXData reveal that during the period, the value of long bets, as measured by USD margin funding, significantly exceeded the value of short wagers as measured by BTC and LTC margin funding.

Priming the pump

Bitcoin enjoyed these sharp gains and bullish sentiment after the digital currency ranged sideways for several weeks following the hack of exchange Bitfinex, Zivkovkski told CoinDesk.

During this time, trading volume was limited as many market participants took a pause in the aftermath of the Bitfinex hack. Bitcoin transactions totalled 7.82m in the seven days through 8th September, Bitcoinity data revealed.

This period of range-bound trading "lasted for several weeks, during which the market was 'powering up' – behind the scenes, traders were opening positions, betting almost equivalently on a price rise vs a price decline, often on margin," he said.

These substantial speculative bets, coupled with low trading volume, left the market highly susceptible to short and long squeezes. In this environment, a purchase of less than 600 BTC, executed by one or more market participants, was all that was needed to trigger a short squeeze, Zivkovski stated.

Jacob Eliosoff, a cryptocurrency investment fund manager, emphasized that the sharp rally that took place over the weekend required both a notable purchase and short squeeze which forced speculators to close out short positions.

"This weekend's rise was much too sharp to represent just gradual recovery," he told CoinDesk. "A short squeeze can turn a small rise into a big jump, but it can't turn a flatline into a jump."

After bitcoin’s sharp gains over the weekend, the digital currency traded between $600 and $615 on 5th, 6th and 7th September, BPI figures reveal.

During this three-day period, the market was 86.3% long on average. Confidence was also high, averaging 84.3% over the three days.

Bitcoin breakout

The digital currency broke out of this malaise on Thursday, 8th September, when it surged more than 2% to a weekly high of $628.75, BPI data show.

Once again, a short squeeze was the likely culprit, stated Zivkovski, emphasizing the price movement took place during a time of low trading volume and did not coincide with any notable news catalysts.

In the near-term, the market could experience further short squeezes, as Zivkovski told CoinDesk on 9th September that "the current market is quite illiquid."

"Existing short positions are being cleared out as price continues to rise. Shorters are closing their positions at a loss and re-opening longs or simply staying out of the market for a while," he said.

Because the market is so illiquid, the situation "places price at the mercy of players with larger firepower"

Nice .. where price will go you think of bitcoin n coming week ?

will go to the top

If you had included a link to your source, I would have upvoted this some.