Bitcoin halving may not influence a Bitcoin price hike. Let's stay skeptic

"As it is written in the book Sapiens by Yuval Noah Harari, humankind possesses the power of imagination and can create stories that can become common knowledge for many people. Bitcoins is such a story."

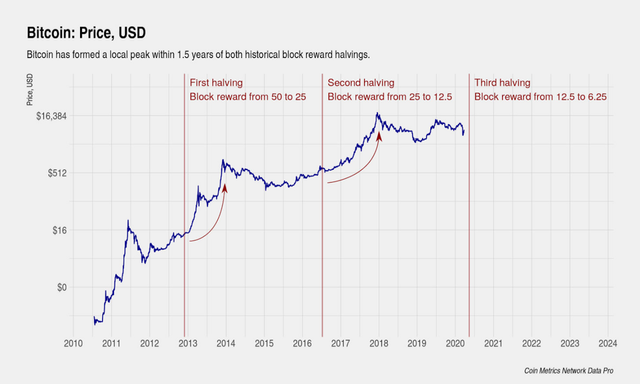

This article talks about how the halving of the supply of Bitcoin may not impact the price because about 85% bitcoin has already been generated and possibly inaccurate assumption in stock to flow ratio model typically used to predict future price of bitcoin. It's very simple to me, value or price of something will only go up, if the demand or perception of utility go up. By demand, I believe it needs to correlate with the usage of money and desirability. That means, Bitcoin price will go up if it attracts more Bitcoin owners and investors. If Bitcoin can not attract new people and investors with its various valuable decentralized money properties, it will not gain in price. Because I believe that Bitcoin, being a 24/7, fixed supply, authoritiless global money, is a better money system, I think more people will want to own it and therefore it will gain its value. The only issue I have with any kind of money including Bitcoin is that, if the majority of the ownership is held in few hands, then the market can always be manipulated and controlled by those few. Bitcoin also has fallen into this category, as the early investors and few exchanges hold and control most of the Bitcoins. However, that is the world we live in, even though I wish the world is more egalitarian and wealth are redistributed. May be, it's possible to create even better money just like many other crypto currencies tried.

Predicting future price action is always hard. So, let's wait and see. Just remember there's only three realities:

You stay the same

You gain

You lose

But these three outcomes have different likelihood of occurrence based on various variables that you need to be constantly analyzing, adapting and redirecting.

"according to Carter’s analysis, the flow of Bitcoin is effectively zero. This consideration is based on the assumption that all Bitcoin miners and users understand that Bitcoin has a fixed supply of 21 million BTC.

As such, no one will see an increasing ‘supply’ of Bitcoin. Instead, Bitcoin is released, much like stock vesting, but not created in the same sense of other commodities.

If Carter’s analysis is correct, the supply of Bitcoin is a fixed number, and the halving will have little effect on price. Instead, investors should focus on changes in demand to determine price movement, such as shifts away from fiat currencies during the COVID-19 crisis."

https://beincrypto.com/stock-to-flow-model-faulty-for-price-prediction-says-bitcoin-analyst/

https://medium.com/braiins/the-bitcoin-halving-part-1-market-edition-bb1b0b7a27e8