BTC TA (Technical Analysis) - ANALYSTS DAILY SUMMARY - JUNE, 12th

NOTE ABOUT BLOG

The blog is still in it's infancy and I ask that you guys give me feedback on analysts being reviewed, layout etc. I've removed "The Moon" and "Coin Mastery" as analysts. In my experience (following both of them for quite a while now), they're more geared towards macro trends in the BTC Market, which is not the main focus of the blog. We try and do the heavy lifting for you guys, to give you a concise systematic DAILY TA ANLAYSIS of the BTC market. You can find "The Moon" and "Coin Mastery" on Youtube, for those still interested in following them.

JD Marshall

Type of Trader: Medium/Long Term Trader

[Macro argument is that BTC is consolodating at these levels and building steam for higher highs in the FUTURE is still his macro perspective. In his opinion we're not seeing BTC reaching all time high any time soon. BTC next big resistance is the top of $9990. Since Feb. BTC's seen 3 major bottoms around the 6k-7k level. Which is an indication of forming higher lows and confirms a macro bullish trend (Green Line on Chart). Patience will be the key word for medium/long term investors in the BTC Market]

BTC broke uptrend line and downtrend line. Prices are heading toward $6.4k and even lower. Volume is declining, and the downward momentum will continue and BTC will probably see $6k taken out and find support around the mid 5000 range. The overall trend is down and Marshall is bearish. As always do not expect an immediate drop to below $6k, but BTC will eventually fall lower.

@chartguys

Type of Trader: Short Term Trader

Advice on market cycles: Trading markets is to trade a series of boom and bust cycles. BTC is pulling back from it's 2017 highs, which is normal. Even-though sentiment in the market is very low, it's not the end of the market, and Bitcoin will eventually recover and reach new highs. This is the macro context one needs to keep in mind, if you're a long term investor. Brilliant example used was the Canadian MG boom en bust cycle, which can be good case study for what's happening in BTC.

BTC TA: If the bulls are to regain any ground they need to break the $6969 ( bounce after sell-off) resistance. Also, on the 4-hour chart the RSI have cooled off from 14 to 27, this is allowing for another leg down. No bullish trend change is site, although we might see a small bounce, but no trend change.

This market can be very favorable is you are able to trade the bearish trend playing out in BTC.

@tradedevil

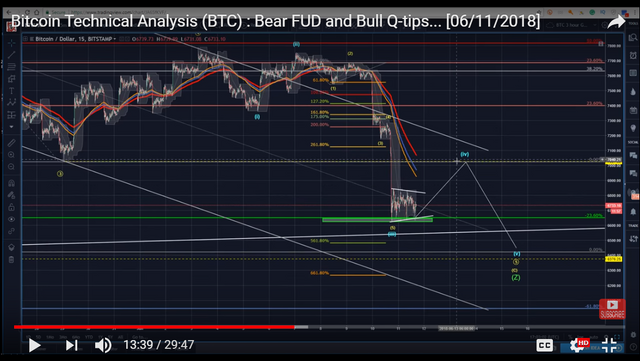

Type of Trader: Short Term Trader/ Day Trader / E.W. Analyst

New Primary (Bullish) Count: BTC just finished the 5th wave of an ABC and the 5th wave also converged with an important algo target. Also, April's low is still not breached and technically the recent low can be counted as 'unusually deep' 2nd wave (which is a characteristic of BTC - 2nd waves seem to a-typical), with a third wave going up from here. If April's low does not hold, the 'bullish' count will be invalidated.

Going forward from here: We might see a forth wave going up from recent lows and then going further down from there. If the count is valid and we're going to see a low 5th wave, going long on BTC might be an option. As of now @tradedevil is not buying.

chris L $ChartVampire$

Type of Trader: Short Term Trader/ Day Trader

BTC charts update.

1- look what happened the last time BTC touched the 7MA ⚠️⚠️⚠️ 📉

2- my target is still valid in the bubble now moving lower 7000-7200

3- I never said LONG I am loading more shorts laddering

4- SL is over the 30MA 7420

5- we are on a red 9

Peter Brandt ** (UPDATES MIGRATING TO BITCOIN.LIVE)

Type of Trader: Short/Medium Term Trader

NO NEW UPDATE: TA WILL MOVE TO BITCOIN.LIVE. I'LL KEEP HIM ON THE LIST FOR A FEW DAYS AND SEE IF HE'LL POST ANYTHING USEFUL OUTSIDE OF BITCOIN. LIVE.

KEEP YOU POSTED

Nick Cawley (NO NEW UPDATE)

Type of Trader: Long Term Trader/Investor

CRYPTOCURRENCY MARKET CRUMBLES – SUPPORT LEVELS TESTED

South Korean cryptocurrency exchange Coinrail revealed that it had been hacked on June 10 and that some of the exchanges cryptocurrency holdings had been stolen. Coinrail said in a statement that 70% of the cryptos it holds are safe, while two-thirds of the stolen tokens – NXPS, NPER and ATX – have been frozen or recovered. The news from this small exchange – Coinrail just makes it into the top 100 crypto-exchanges by volume traded – sent the marketplace spiraling lower with double-digit losses commonplace.

The move over the weekend may have been exacerbated by thin trading volumes but the fact that a small crypto-exchange hack produced such a large move shows how fragile the marketplace is.

The weekend falls tested many important technical support levels with mixed results. Bitcoin (BTC) rebounded just ahead of a support cluster made in late April and looks likely to re-test the $7052 double-low made on May 28/29. A re-test of the $6,438 cluster would open the way to further losses with the February 6 low at $5,932 the first target.

Trading Room

Type of Trader: Short Term Trader

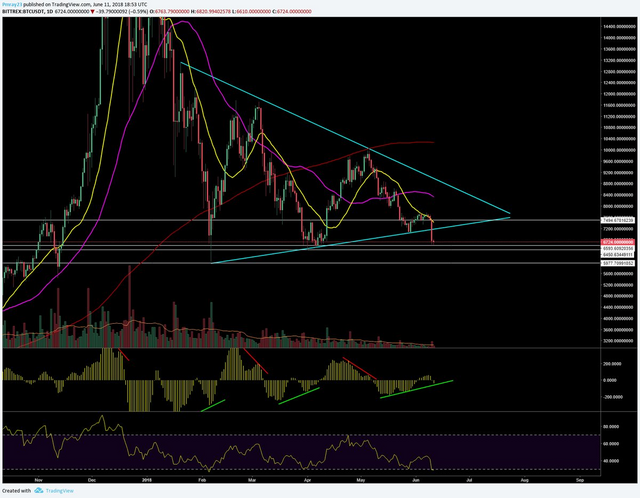

NEW BTC Chart - MUST READ COMMENTS ON CHART

In Nutshell plenty of long term support Levels broken. Expecting Bitcoin to spend better part of 2018 below 10,000

However not all is lost, selective ALTs will outperform BTC

Crypto Guru ** (NO NEW UPDATE)

Type of Trader: Short Term Trader

The lower support/trend line of the massive wedge broke as an immediate dump subsequently followed. He's surprised that BTC is back in the 6k range; He suggests adding possitions to the ALT COIN space, as many coins are very cheap with the recent down move in BTC. See chart for the next levels of support in BTC.

Coindesk Markets **

Type of Trader: Short Term Trader

OUTLOOK: Remains bearish, but cannot ruled out corrective rally

BTC likely to test $6K in a week or two as suggested by downside break of pennant pattern.

However, a move abv $6873 (session high) could yield rally to $7,040 (May 29 low + pennant resistance).

Mr. Swing Trade

Type of Trader: Short Term Trader

Bitcoin has found some near term support. Any bullish moves from these levels should be shorted, as price will go even lower in the coming weeks.

Crypto Wolf

Type of Trader: Short/Medium Term Trader

BTC broke consolidation triangle, we failed to break above weekly MA50. But if bulls manage to defend the higher low we could see a reversal as weekly RSI screaming bullish divergence.

Inverted #hs on the 4 h RSI. Likely a retest of the previous triangle support for BTC

Lord Ray

Type of Trader: Short/Medium Term Trader

BTC/USD (1day chart). We are now seeing triple MACD bullish divergence at critical areas of support. This signifies price action reversal to the upside. Also, we are in oversold territory on the RSI.

Also, a shout out to @famunger for his daily Analyst Summaries.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://forexsignals7.com/2018/06/11/bitcoin-ether-ripple-prices-slump-after-korean-exchange-hack/