Attention traders: The bitcoin misery index is here

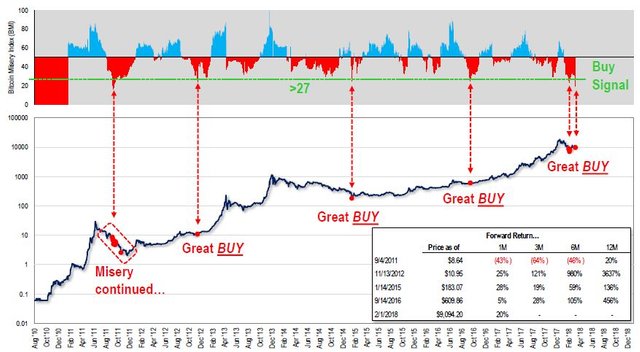

Thomas Lee is co-founder of Fundstrat Global Advisors and Wall Street strategist. He has developed the Bitcoin Misery Index (BMI). BMI is a contrarian index that informs people the misery bitcoin holders are facing.

The Bitcoin Misery Index is a trading tool for investors. It derives benefit from the volatility of BTC in various exchanges. The Bitcoin Misery Index varies from 0 to 100. The index also considers volatility and number of winning trades out of the total. Thus, a low index indicates best buy and vice-versa.

In a CNBC interview on Friday, 9th March 2018, Lee explains,

“When the bitcoin misery index is at a misery (below 27), bitcoin sees the best 12-month performance. A signal is generated about every year. Thus, when the BMI level is at a “misery” level, future returns are very good.”

Currently, the BMI is at 18.8, which is the least it has gone since 6th Sept. 2011, says the report.

Bitcoin’s value fell by over 27 percent from its weekly high of $11,675 on 5th March, 2018. Additionally, the fall is attributed to negative publicity amid heightened concerns regarding regulating cryptocurrency markets.

Negative Publicity

The US SEC issued a statement on March 5, 2018 regarding the status of crypto platforms. Thus, the statement said that all security trading platforms must register with the agency as an exchange. Furthermore, on March 8, 2018 in Japan, authorities have clamped down on two cryptocurrency exchanges. Additionally, the authorities have also issued punishment notices to seven exchanges.

Countries across the world are contemplating regulatory frameworks for cryptocurrencies. Wyoming Senate passed a bill exempting tokens from security regulations.

Russia is proposing lighter ICO regulations. Italy has proposed a cryptocurrency regulation. Austria has proposed pan-EU regulations based on rules for gold.

South Korea is mulling self-regulation. Furthermore, Thailand requests all banks to avoid cryptocurrencies till regulations are in place.

In Dec 2017, the Reserve Bank of India issued a third notice warning against the use of virtual currencies. Meanwhile, the Indian Government is yet to decide on regulations.

Amid all these developments, Gibraltar will be the first to introduce ICO regulations in 2018.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptonewsmagnet.com/bitcoin-misery-index/