Decentralized Currency Competition Forcing Better Economic Policy In Developing Nations

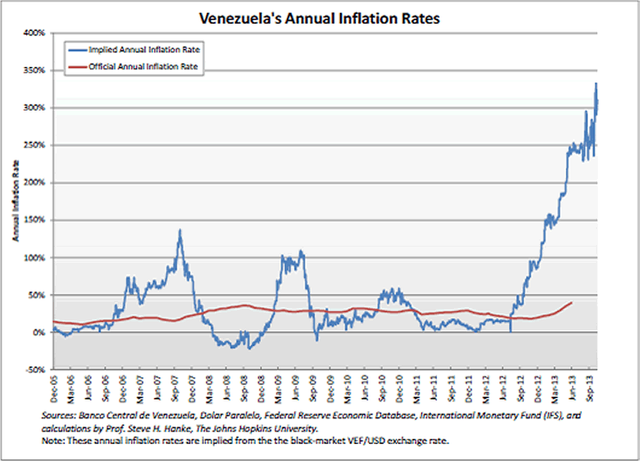

One of the biggest problems that have plagued many developing countries, early in to their cycle of modernization, is poor government economic policy, especially in regards to their currency. Countries like Venezuela, deep in debt and boasting 10 year inflation rates of around 475%, kill potential growth and savings within the county. With hyper inflation at that level, banks can’t lend, businesses won’t be created and economic prosperity is impossible to reach. Sound economic policy and minimum inflation may be best for the country, but inability to pay back debts and an over extended balance sheet make it impossible towards a more sound option.

![]()

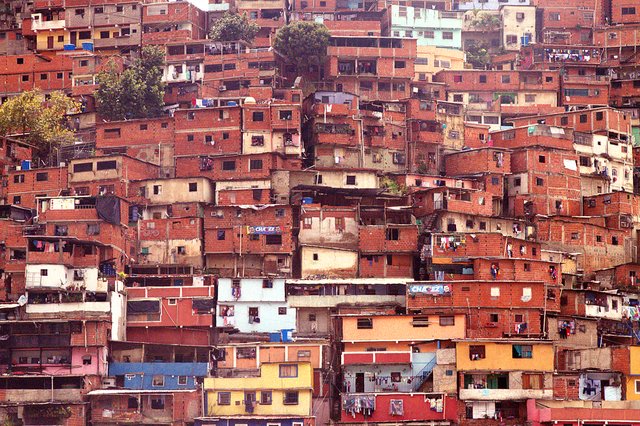

The reality is that governments in these developing countries can mostly get away with ridiculous inflation policies because for the average person, there is no competition. Sure maybe the wealthy are able to hold United States Dollars, Euros, or CNY, but the vast majority have no access to any sort of hedge against inflation. Citizens won’t be able to save and the cycle of poverty continues generation after generation.

However, as technology becomes more advanced through networks like the internet, government censorship becomes less and less feasible in the long term. Even in countries like North Korea where the government will execute you for talking out against the ruling regime, connections to the internet are still possible by some of the adventurous few.

With the recent introduction of decentralized currencies like bitcoin, that can be used to thwart capital controls and exist solely online, saving in developing countries is becoming a reality. Countries like Venezuela are now doing over 2 million USD a day in bitcoin volume and exposing themselves to far less currency volatility than ever before. Even a currency like bitcoin which can be very volatile still is less so than their national currency.

Blocking person to person transactions of these digital currencies, or even banning them, overall has little effect because there are ways around capital controls and there is a strong necessity for these currencies. I foresee that in the long term the addition of digital currencies will push countries like Venezuela to completely reevaluate their economic policy, not for the good of the people, but as a necessity to stay in power. The idea of currency competition of national fiat currencies versus digital ones is not a new idea, but it is one that I more than likely see coming to fruition in the next few decades. Deflationary currencies like bitcoin might not be ideal for loans, but for saving and wealth control for the poor in countries that have no outlet to hedge against inflation, digital currencies are better than nothing.

-Calaber24p

"Countries like Venezuela are now doing over 2 million USD a day in bitcoin volume and exposing themselves to far less currency volatility than ever before. " - great and insightful post here @calaber24p... it will be very interesting to see how countries with terrible checkbooks engage with cryptocurrencies and perhaps adopt them as a way to re-stabilize their economies.

I can only hope that crypto will spread mainstream so it has the possibility to do this. If people have access to better ways to store their hard work and savings, they are going to take them.

nice

Great post, inspiring and insightful. Thanks for sharing; upvoted, resteemed and followed

I found this work to be very enlightening. Thanks for posting it.