Technical Analysis of Bitcoin & Ethereum

Bitcoin (BTC) has rallied ~80% from its low on February 6th and now finds itself moving into the thick of some fairly significant price memory between $10,700 and $12,000:

Bitcoin (Daily)

80%-100% rallies are normal even in bear market environments. If Bitcoin is able to move back above $12,000 within the next couple of months it will be a bullish sign that the long term bull market is potentially still intact. Meanwhile, bears will be looking for the current rally to end fairly soon as supply comes back into the market near previous areas of support (~$11,000).

Turning to Ethereum (ETH) we see a very similar situation with a 70%+ rally from the low a couple weeks ago now running into major levels of previous support:

Ethereum (Daily)

The odds favor ETH pulling back before rising above $1,000, the less likely scenario involves an immediate breakout above support/resistance ($940-$980) before an eventual pullback to retest the support/resistance area. Support at $900 followed by $850.

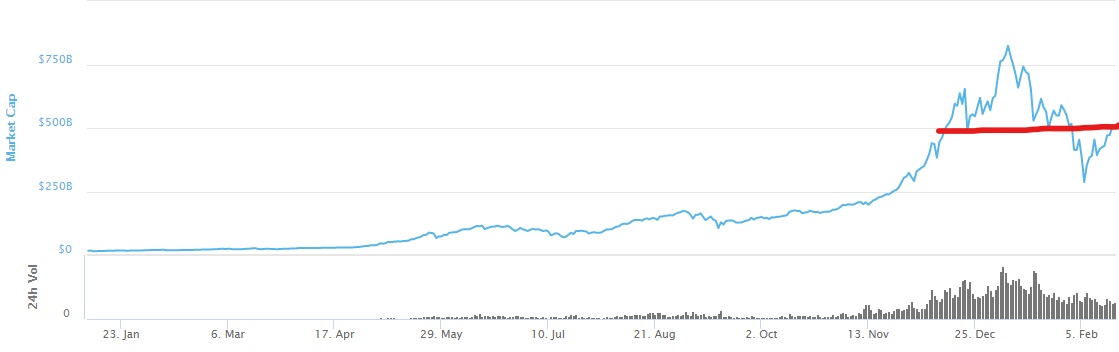

Turning to total cryptocurrency market capitalization we have moved above US$500 billion in the last 24 hours and it is difficult to overstate the importance of the US$500 billion market cap level from a technical standpoint:

Let’s see if the rally can hold above US$500 billion throughout the President’s Day holiday weekend in the US.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the 321Ethereum website do not necessarily reflect the views of 321Ethereum LLC, publisher of 321Ethereum.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Cryptocurrencies can easily lose 100% of their value. It’s your money and your responsibility.