Mainstreet Investment LP - The First Securitized Blockchain Asset by Intellisys Capital and Charlie Shrem

Hey All! I wanted to talk about my newest project. Feel free to ask any questions.

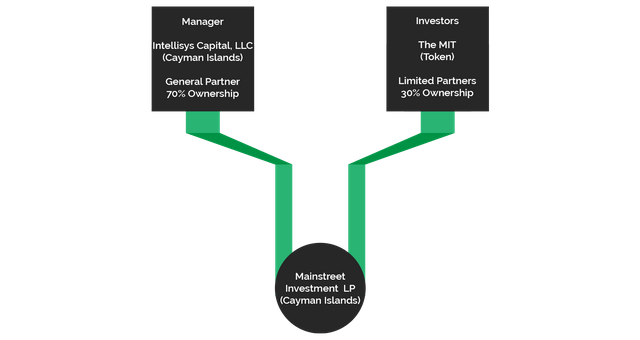

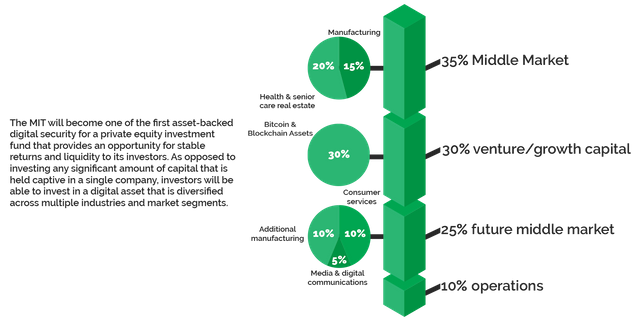

Mainstreet Investment LP (“The Fund”), is a Cayman Islands limited partnership established for the purpose of issuing one of the first digital token security in the world that is backed by real assets and provides real investment returns to holders. The fund will invest private equity funds for the purchase of US-based middle market operating companies, fund-of-funds, real estate, and blockchain technology.

Tonight, there will be a live AMA with Coinfund.io: https://twitter.com/coinfund_io/status/809986165319180290 (http://slack.coinfund.io )

The ITO will be run by an exchange that will also list the token, that will be announced soon.

Download the Initial Token Offering Memorandum (ITOM) from http://mainstreet.ky/

Add your email address to http://mainstreet.ky to stay updated!

We want to modernize private equity and provide investors with the opportunity to reap the returns of strong operating businesses in the US they currently don’t have access to, amid low-yielding bonds, high risk equity picks, and profit-erasing fees of mutual funds. Furthermore, through securing an excellent portfolio of assets we will focus on developing powerful synergies with our blockchain and bitcoin opportunities to create even greater value and returns to our investors and the respective industries we’re involved in.

The fund will be issuing tokens, MITs (Mainstreet Investment Tokens), in order to raise capital and to represent equity ownership and distribution rights for the assets within the portfolio. They will be distributed and tracked through the Ethereum Virtual Machine (EVM) using two smart contracts. The first contract to create and launch the token, the second for locating the current holder and sending of quarterly distributions.

Intellisys Capital, LLC

Managing Entity & Co-owner of The Fund

Intellisys Capital, LLC is the managing member and co-owner of the fund. Intellisys is responsible for all management duties, financing and debt obligations as the fiduciary on behalf of MIT investors. This includes discovering new acquisition targets, negotiating terms of the deals, and executing on the current pipeline of portfolio assets. Co-founded by Granger and Shrem, the two, along with an experienced team of managers and advisors, aim to change the landscape of private equity.

Jason Granger

Founder & CEO

Since 2004, Mr. Granger has successfully built large teams in banking, real estate, construction, and private equity. Recently he led a four-year joint venture partnership with AIG equating to a $405 Million equity commitment in a $2 Billion real estate development platform for First & Main™ senior living as SVP of The Granger Group.

Charlie Shrem

Founder & CTO

Shrem is a Bitcoin Pioneer, founder of the Bitcoin Foundation (Vice-Chairman 2012- 2014) and former CEO of BitInstant, one of the earliest and largest Bitcoin companies processing 30% of all Bitcoin/USD volume. Recently, Shrem has developed joint ventures between traditional finance companies and Bitcoin companies like Payza.com.

Jeremy Lehman

Mr. Lehman is a fintech investor and operating advisor, who has sourced investments and guided execution in numerous ventures and growth equity companies. Previously Mr. Lehman was EVP, Global Product Development and Operations (CIO) at Experian and held officer positions at Barclays, Citigroup, Thomson Reuters, and Microsoft.

Paul Puey

Mr. Puey is CEO and Co-Founder of Airbitz, the leading single-sign-on security platform for blockchain technology and decentralized applications. Airbitz has won accolades including being one of the top 3 mobile apps for bitcoin in the 2014 Blockchain Awards and being voted in the 'Top 50 FinTech Companies to Watch' by AlwaysOn Inc.

Jered Kenna

Mr. Kenna is the Founder and CEO of Tradehill, the first US Bitcoin Exchange, an investor specializing in start-ups, and an entrepreneur at heart. In addition to Tradehill, Jered also owns 20Mission, a “Hacker Hotel” and startup accelerator in the Mission District of San Francisco as well as 20mission Brewing in Medellin, Colombia.

Thomas Holzinger

Mr. Holzinger is the Asset Manager at JetLevel and General Manager for NEFT Vodka. Mr. Holzinger has 10 years’ unique experience in aviation in general and with special focus on management. He has developed a new business concept of aircraft acquisition, financing and managing $250M in assets.

Lisa Cheng

Ms. Cheng is the founder of The Vanbex Group, one of the largest full service Blockchain consultancy groups and Etherparty. Previously, Ms. Cheng led Communications for Ethereum and Business Development for Mastercoin and currently serves on the Blockchain Committee with the Standards Council of Canada.

Daniel Winters

International and Bitcoin Tax Compliance - Global Tax Accountants, LLC.

L. Mazzola

Mr. Mazzola has extensive qualifications in financial sales, project planning, and documentation. He is experienced in evaluating business and purchasing opportunities with 20 years experience in financial analysis, sales and customer service.

The Fund’s initial token offering, or “ITO”, of the Fund’s MIT will be capped at $25,000,000, plus an amount equal to 10% thereof as a holdback for future investment opportunities in the portfolio, for a total offering amount of $27,500,000. The ITO will extend for 60 days. Eligibility to invest in the Fund and acquire MIT is open globally; however, no residents of the United States or European Union may participate. The $27,500,000 goal of the ITO raise is based on the Intellisys acquisition pipeline, which includes a number of assets currently in different stages of analysis and negotiations. At the ITO’s termination, Intellisys will burn any MIT that have not been purchased (e.g., send the un-sold MIT to a public but un-spendable address.

Download the Initial Token Offering Memorandum (ITOM) from http://mainstreet.ky/

Token Name: MIT

Public Symbol: MIT

Token cap: 50,000,000

Decimal Places: 8

Holdback Allocation: Created at the beginning of the sale and will be used for additional investment and working capital needs for existing investments.

Raise cap: $27.5M US

Distributions: To be issued via Smart Contract to registered token holders in compliance with anti-money laundering, risk management and know your customer procedures.

Accepted Coins: BTC, ETH. The fund will be issuing a security on the Ethereum network as part of its commitment to their investors for transparency and liquidity.

Start Date: January 15, 2017

End Date: March 15, 2017

Initial Token Offering (“ITO”)

Mainstreet Investment Token (“MIT”)

Location: Cayman Islands

Ownership: 100% owned by MIT holders

The Fund

Mainstreet Investment, LP

Location: Cayman Islands

Ownership: MIT holders: 30% and Intellisys: 70%

General Partner

Intellisys Capital, LLC (“Intellisys”)

Location: Cayman Islands

Ownership: 75% owned by Jason Granger 25% owned by Charlie Shrem

The Investors, as MIT holders, are entitled to receive the first distributions from each class of Fund investments. The Fund Agreement provides that the Investors are given preferred treatment for a 10% annual cash-on-cash return (the “Preferred Return”). Next, Intellisys is entitled to a catch-up on that Preferred Return equal to 10% of the amount distributed to the Investors. All additional amounts are split 30% to the Investors and 70% to Intellisys (the “Carried Interest”).

Acquisition targets for the Fund will be purchased using a leveraged buyout structure. This structure helps to achieve better returns and also shifts a majority of the risk on to Intellisys, the general partner. Funds raised through the ITO, will be used to purchase a portion of the target asset, but the majority will be financed through outside debt secured personally by Jason Granger.

For example, Portfolio Asset #1’s total purchase price might be $5mm. Investors will put up $1mm (20% of the purchase price), and Intellisys secures the debt $4mm (80%). With this structure token holders are effectively gaining an additional 10% interest (or a 50% increase from original investment value) as they own 30% of the asset but will have invested 20% ($1mm of the $5mm needed). Further, If Portfolio Asset #1 were sold for $5mm after a few years of operations and debt service payments, the investment would be worth a minimum of $1.5mm. The incentive for Intellisys is to provide operational excellence and grow the value of the company to earn profits for itself.

Intellisys will, in conjunction with its Board of Advisors, approve annual operating budgets for each asset held in the Fund, which will outline annual financial goals, including projected income and expenses, debt obligations, capital expenditures and estimated investor returns. Available cash will be distributed on a quarterly basis after payment of all expenses (i.e., capital expenditures, debt obligations) and setting aside reasonable reserves.

As the Fund’s general partner, Intellisys is responsible for all Fund decisions, including relating to the Fund’s portfolio holdings and working with the Board of Advisors to ensure that decisions work for the good of the Investors. From a nancial perspective, an Investor might look at the structure detailed above and think, “If the a portfolio company performs exceptionally well, the general partner stands to make a lot more money in this transaction than investors.”

However, considering that the general partner does all of the heavy lifting in a deal, while Investors are paid a Preferred Return, it is logical for the general partner to expect to earn a greater share of profits. Investors rely on the general partner to do the following, among other things:

- Source and identify portfolio companies

- Underwrite and discover hidden value

- Pursue, negotiate and win deals

- Develop company business plans

- Negotiate purchase and sale agreements

- Conduct thorough due diligence

- Secure financing

- Provide personal debt guarantees

- Close deals

- Manage assets

- Perform and manage capital expenditure projects

- Execute asset business plans

https://twitter.com/Intellisys_LLC

https://www.reddit.com/r/IntellisysCapital

https://www.facebook.com/Intellisys-Capital-LLC-2013973512162650/

http://slack.intellisys.ai/

http://intellisys.ai/

DISCLAIMER:THE INTERESTS DESCRIBED HEREIN ARE NOT BEING OFFERED TO RESIDENTS OF THE EUROPEAN UNION OR THE UNITED STATES, AND HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY EUROPEAN UNION OR UNITED STATES STATE SECURITIES LAWS OR THE LAWS OF ANY OTHER JURISDICTION. THE INTERESTS WILL BE OFFERED AND SOLD UNDER EXEMPTIONS UNDER THE LAWS OF THE JURISDICTIONS WHERE THE OFFERING WILL BE MADE. THE FUND WILL NOT BE REGISTERED AS AN INVESTMENT COMPANY UNDER THE UNITED STATES INVESTMENT COMPANY ACT OF 1940, AS AMENDED (THE “INVESTMENT COMPANY ACT”) OR SIMILAR LAWS. CONSEQUENTLY, INVESTORS WILL NOT BE AFFORDED THE PROTECTIONS OF THESE ACTS.

THE FUND’S INVESTMENTS WILL BE CHARACTERIZED BY A HIGH DEGREE OF RISK, VOLATILITY AND ILLIQUIDITY. A PROSPECTIVE INVESTOR SHOULD THOROUGHLY REVIEW THE CONFIDENTIAL INFORMATION CONTAINED HEREIN AND THE TERMS OF THE FUND AGREEMENT AND SUBSCRIPTION AGREEMENT, AND CAREFULLY CONSIDER WHETHER AN INVESTMENT IN THE FUND IS SUITABLE TO THE INVESTOR’S FINANCIAL SITUATION AND GOALS.

CERTAIN ECONOMIC AND MARKET INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM PUBLISHED SOURCES PREPARED BY OTHER PARTIES. WHILE SUCH SOURCES ARE BELIEVED TO BE RELIABLE, NEITHER THE FUND, INTELLISYS, NOR THEIR RESPECTIVE AFFILIATES ASSUME ANY RESPONSIBILITY FOR THE ACCURACY OR COMPLETENESS OF SUCH INFORMATION.

Too bad not being built as a side chain on Graphene.

We are still discussing that and talking to BitShares people. This can be token agnostic, however the exchanges we are talking to want Ethereum to list it. We need liquidity.

Liquidity will come if projects like yours pioneer the use of STEEM or SBD and help us increase demand. You'd have a whole community behind you to push it, also, which would increase demand and help create liquidity. We probably need to bring Steem-powered UIAs (User Issued Assets) over here from BitShares to enable more efficient crowdfunding. I don't think they wouldn't take that long to implement with Steem, since BitShares has had them for some time and both are Graphene.

So much to learn. It never ends lol

Isn't STEEM essentially Graphene 2.0? I was thinking Steem Side Chain so that it becomes yet one more thing to increase the attractiveness of the Steem ecosystem. I know Graphene is used for Bitshares, but @dantheman did make that too before Steem. :) So my question was purely in the interest of seeing Steem expand and grow and do well. From the writings of @dantheman I would expect it to be fashioned to do anything that Ethereum can do, but I could be wrong.

@dwinblood:

Well, we'd all like to pioneer the use of STEEM or SBD. It'd be much better if we could pioneer the use of STEEM or SBD. And stable, clear interfaces would certainly help us to do that. But those are anathema to talk about around here, treasonous, in fact.

Oh, well.

@charlieshrem

This sounds absolutely amazing. Congratulations. Good luck with your launch: I can see projects like yours creating a completely new dynamic in personal finance, and if successful, begin to morph the idea of what a business really is. Blockchains will win out anywhere people collaborate on things of value.

#everybody

This is the real message about blockchains, and this is why they have such power. The machines successfully mediate a collaborative human process, and in doing so actually help us to overcome some of our flaws (like casual dishonesty.) Blockchains augment people. They can make value move in entirely new ways that we'd never attempt as just ourselves because they create a flawless shared narrative, which is impossible among a group of 100's or 1000's of humans.

If we even compare this to distributed databases, we find that those mutable systems are vulnerable again from the human angle. And that's the insane thing about blockchains people: So far, they've worked.

Hi! I am a content-detection robot. I found similar content that readers might be interested in:

https://bitcointalk.org/index.php?topic=1718724.msg17209704

This sounds like an exciting project, and I have some questions about it.

I'm not an expert in the jargon, so I may have overlooked some things. Please let me know if I'm missing something.

You're trying to raise $27.5 million for a 30% stake, that puts the valuation at $91.67 million. There have been no previous rounds of funding and the company owns no assets, correct?

I'm certainly not an expert in valuation, but that seems extraordinarily expensive - an investor would be taking a 70% haircut the moment they invested. Can you provide any additional insight into the valuation/ownership structure?

The "why" section was very weak imo. What are the benefits of this structure compared to a traditional fund structure for both the GPs and LPs in the fund?

It seems like a cool concept in theory, but most funds with international investors set up a Cayman Islands structure that makes the fund accessible to LPs globally anyways. Aside from the novelty of using a blockchain to raise a fund, I'm struggling to see benefits for either the GP or LPs.

@ntomanio

OK I'll keep it quick: programmable business. Business that works by algorithm, not by human. In the end, because of reduced friction, all humans win in an epic fashion. Friction = poverty.

In my own work I've been calling it computed value flows. What it works out to is being able to offer an incredible level of granularity by having programmed specifications for financial transactions that don't require any human interaction. This means that they will operate under certain known parameters with clear if-thens or other algorithmic judgements.

But by and large, people won't make these judgments except in a very macro sense. I imagine that @charlieshrem is working to create a set of algorithms for essentially routing flows of value. Oh, and yeah, I think it's pretty great.

People are an essential component of private equity. A blockchain token-based fund is not going to change the human element of PE.

I agree with you entirely. In the end even the crypto economy is about the desires of human actors.

Looks good charlie... stop by my blog and look at my analysis of reddit. Interested in your opinion. :) You're pretty keen on things...

Thanks Obama.

Joking aside, this sounds pretty awesome, @charlieshrem. Congrats on all the work on this! I hope it goes very well for you and your investors.

Happy new year brother, I will be in touch with that size soon. Very cool stuff here...Hope all is well with you. Cheers.

Disclaimer: I am just a bot trying to be helpful.

So, this is mostly for the Asian market and a few Latin Americans? This should probably be translated appropriately.

It seems like a nice idea, though.

There's always a way... ;)

This post has been linked to from another place on Steem.

Learn more about and upvote to support linkback bot v0.5. Flag this comment if you don't want the bot to continue posting linkbacks for your posts.

Built by @ontofractal