Crypto Investment Firm’s Revenue Reaches Record $330 Mln in 2018, Despite Bear Market

bitseven.com - Cryptocurrency asset management firm Grayscale Investments Inc. has reported revenue of nearly $330 million in 2018, according to its third quarter (Q3) investment report released Nov. 1. The company managed to reach this figure despite a prevailing bear market.

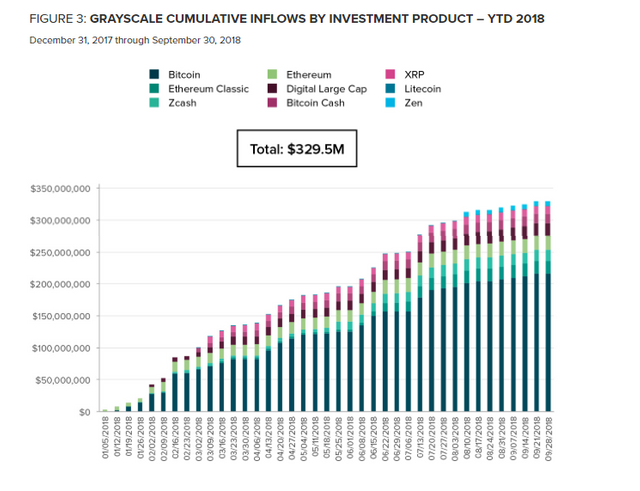

In the report, Grayscale highlights that it raised $81.1 million over the last three months, which brought the firm’s year-to-date inflows to almost $330 million, representing an increase of almost 1,200 percent from the same period in 2017, when the company raised $25.4 million. The current year is the strongest Grayscale has experienced during any calendar year since the beginning of its activity.

In Q3, institutional investment contribution reportedly increased to 70 percent, however, in comparison with the two previous quarters, the dollar-value invested remained lower. The Bitcoin Investment Trust saw 73 percent of inflows, while 27 percent were into Grayscale products pegged to other digital assets. The first positive quarterly returns for Grayscale in 2018 were generated by Bitcoin Investment Trust and XRP Investment Trust.

In terms of average weekly investment, Q3 saw $6.2 million, which is lower than the company’s average weekly investment across all products during 2018. “The average weekly inflow into Bitcoin Investment Trust was $4.5 million, down from the year-to-date average of $5.5 million. The average weekly inflow into “Non-Bitcoin” investment products was $1.7 million, down from the year-to-date average of $2.9 million,” Grayscale specifies.

Grayscale further notes that, despite the majority of new investment in Q3 going into Bitcoin Investment Trust, investors are diversifying their portfolios into other digital assets, with 66 percent and 34 percent respectively. 64 percent of all new investments originate from U.S. investors, who are followed by offshore investors, and investors from other parts of the world.

In the beginning of October, Bitcoin Investment Trust saw its net asset value hit the lowest point since the BTC price surge of 2017. Shares of Bitcoin Investment Trust reportedly dropped by around 80 percent since BTC hit almost $20,000 last December. The drop purportedly follows the fall of the BTC price, which is down nearly 66 percent during the same timeframe.

bitseven.comBitcoin leveraged trade at 100x leverage maximum, 100% profit at 1% price raise

Make a profit whether the bitcoin price rises or falls

BITCOIN LEVERAGE TRADING YOU CAN TRUST