CGCX is an Exchange for Emerging Markets

Website | Whitepaper | ANN | Telegram | Bounty | Twitter | Facebook

By https://bitcointalk.org/index.php?action=profile;u=2230830

There are currently many cryptocurrency exchanges out there and a lot of people feel that there is no point in making more of them. The reality is that the vast portion of the world's population is regionally under-served by quality exchanges. Contrary to popular belief, we need more exchanges so the security and quality of services given to the crypto market continues to grow.

At present, the largest exchanges in the world based on volume are primarily in either the US or East Asia. While the major exchanges are primarily focusing on a small number of countries, particularly in terms of fiat trading, crypto interest is swelling at a global level.

ICOs have made it possible for entrepreneurs all over the world to raise funds and build innovative projects. Because ICOs have come from virtually everywhere, a lot of attention has been aimed at this market from almost every country. However, the locations of major exchanges do not reflect this. A growth in the number of exchanges that provide active services in emerging nations is important and makes the crypto market more inclusive.

Recognizing New Markets

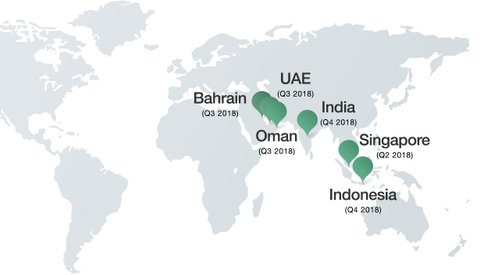

CGCX is the first exchange that aims to offer features that match those of leading exchanges like Binance, but plans to extend its depth to under represented markets like South Asia and Middle East.

CGCX is being founded in Singapore but its immediate plans are to extend its reach into major Indian and Middle Eastern cities; these are target markets with a combined population of over 2 billion people. There is an incredible opportunity to validate the interest of such a huge market. This exchange makes it possible for more people to actually own a cryptocurrency.

Competitige Edge

CGCX is offering features that make it very attractive to the populations of South Asia and Middle East. These are regions where people have primarily been risk averse and tend to value things based on utility experience. Such a market will find solace in the conveniences and security offered by CGCX.

CGCX, like any other exchange, aims to utilize cutting-edge security. However, media's heavy focus on the exchange hacks makes exchanges untrustworthy. A risk averse population, in particular, does not trust crypto exchanges. To resolute this issue, CGCX is partering with third party insurers to make sure people who use its services can rest assured that their money is guaranteed to be safe and available for withdrawal no matter the circumstance.

As mentioned earlier, the populations of Middle East and South Asia also tend to appreciate value when they can witness utility in real life. Such a perceived utility will be possible with CGCX as it includes the creation of a payment gateway that will allow users to excute purchases with cryptocurrencies (the payments will be converted to fiat at the instant if spending).

In conclusion, even though CGCX is based in Singapore, it recognizes the lucrative opportunity to provide a localized fiat-crypto exchange to the massive populations of Middle East and South Asia. It has built features like insurance of assets and transaction facilitation to make itself appealing to the target market.

By https://bitcointalk.org/index.php?action=profile;u=2230830

This post has received a 7.54 % upvote from @booster thanks to: @cobone.