Cryptocurrency ICOs Must Stop Flying Blind On Money-Laundering Risks

Companies have raised as much as $4 billion this year through token crowd sales, or Initial Coin Offerings, a new mechanism that many startups using blockchain technology in some way have used to bypass traditional venture capital funding routes. That is a lot of money flowing to entities to fund their ideas and develop their products. It is also a lot of money originating from unknown sources, some of them also high risk or illegal.

While many of these startups will inevitably fail, hopefully many more will succeed. We may soon see new Amazon- or Facebook-like successes in this space. But will the next market winner end up regretting where their funding came from? Will they ever even know who was really behind the money that launched their business? How will it impact their valuation? Would competitors point this out in the future to weaken the challenger?

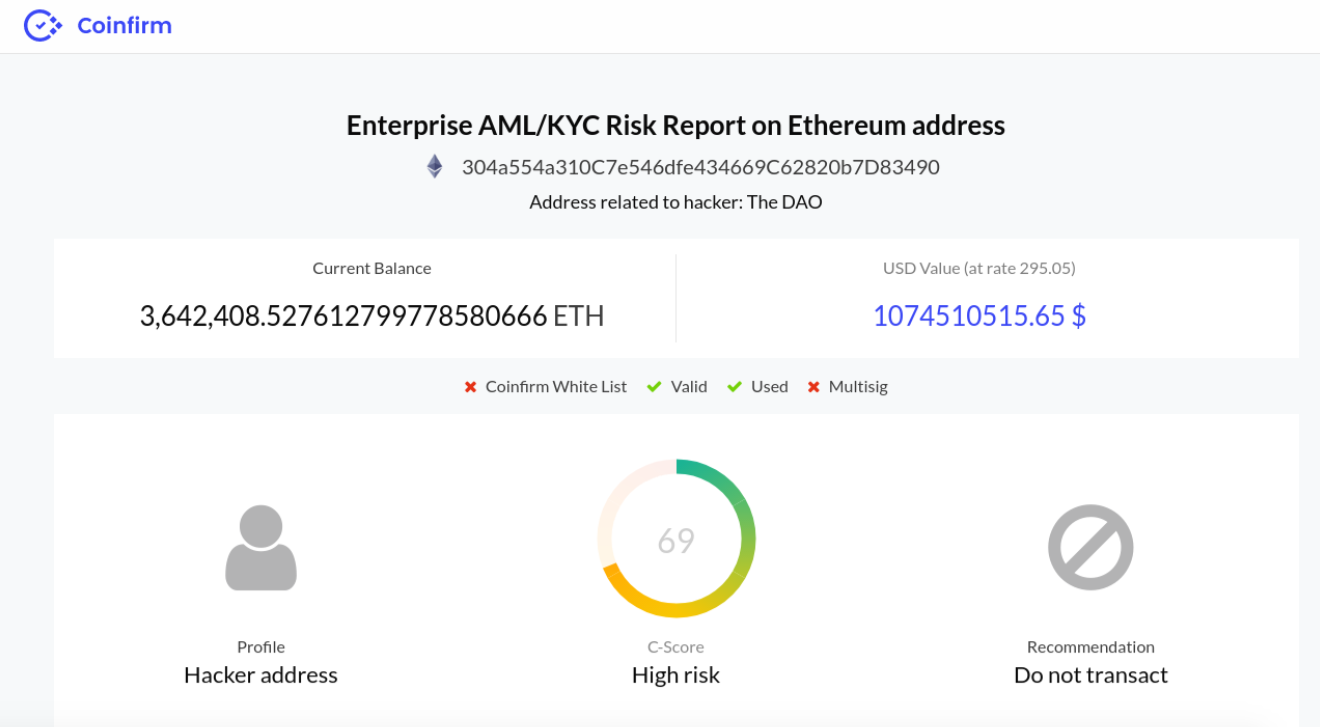

Typically, the startups use the Ethereum blockchain platform to issue tokens to hundreds if not thousands of buyers dispersed across the globe in the ICO phenomenon. But they have had little or no way of answering with confidence the following: Is their backers’ money flowing from savings, inheritance and asset sales — or from ransomware, drug-trafficking or other nefarious sources? Does the profile of the entity providing the funds match the profiles of their transaction?

Unfortunately, the companies raising the funds have generally lacked the tools to analyze and structure data based on Ethereum for anti-money laundering and counter-terrorism financing compliance purposes. This has also blocked countless entities who have raised funds through the ICO process from being able to use those funds or functionally interact with the traditional economy and its regulatory structure. Why? Precisely, because they cannot prove the anti-money laundering (AML) and counter-terrorist financing (CFT) risk related to the source of funds.

To read the rest of the article please follow the link: http://www.ibtimes.com/cryptocurrency-icos-must-stop-flying-blind-money-laundering-risks-2631057