Insight into Bitcoin downturn — the rise of the others

Bitcoin reached the highest price in the beginning of 2018. Since then, it has been falling all the way down to $6,000 below. Eventhough Bitcoin price has once quick regained to $7,000 over, it soon after fell back to $6,500 around in a steady condition "no gain, no loss".

Bitcoin vs. Altcoins

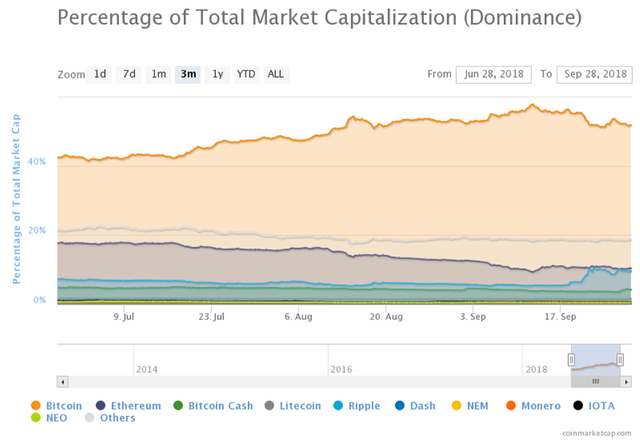

The contribution of Bitcoin to the entire market cap has dropped down from nearly 60% earlier this month to slightly above 50% (Citicoins), other major cryptocurrencies, influenced by the uptrend of Ripple (XRP), Bitcoin cash and Litecoin, has started to recover.

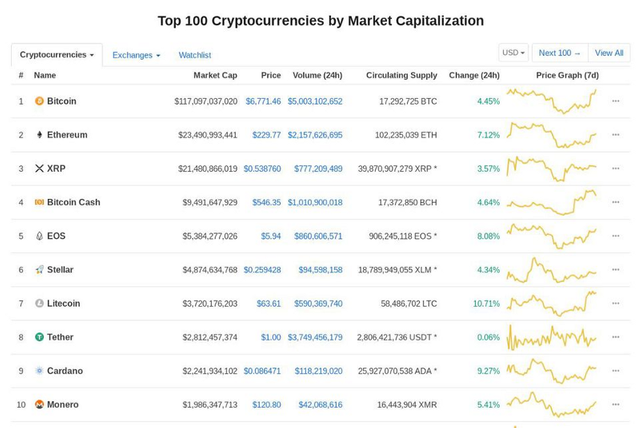

Bitcoin dominance reached 50% for the first time in August (it reached 37% in the beginning of 2018) because many of altcoins fell dramatically as when market trending up. The current Bitcoin market capitalization is $117 billion, $10 billion down from $127 billion at the beginning of this month(September 2018). While, the other major cryptocurrencies have made significant progresses - the market has reactivated the sentiment of traders and investors.

The recent rapid uptrend of bitcoin price was reportedly triggered by a Bloomberg article that hinted an important positive price changes "based on an analysis of the RIG lines"[1] (Bloomberg), an advanced technical standard combined with RSI and market momentum research. However, the positive sentiment of financing companies to Bitcoin and cryptocurrency has gradually faded in September (2018).

Percentage of Total Market Capitalization (Dominance)

The US Securities and Exchange Commission (SEC), which delayed cryptocurrency ETF approvals earlier this month, made decision to thoroughly sight the Bitcoin market [2] (Bloomberg), whereas the banking giant Goldman Sachs seems going to cut out the plan which to provide Bitcoin financing service [3] (Reuters). Many still hope the SEC will approve the Bitcoin ETFs and look forward ICE (NYSE owner) to launch the exchange Bakkt "using Microsoft Corp's (MSFT.O) cloud technology and work with companies including Starbucks Corp (SBUX.O) and Boston Consulting Group (BCG)".[4] (Reuters)

In another perspective, some banks starts to largely adopt XRP for cross-boarder transaction. Under the factors, the Ripple price latterly had doubled. On September (2018), the Ripple's market dominance has gained from 5% to 10%. Earlier this week (September 24 to 30, 2018), Ripple briefly surpassed Ethereum market dominance for a short moment. Ripple and Ethereum respectively has a market capitalization of about $22 billion.

Although Ripple has succeeded in surpassing Ethereum, both Ripple and Ethereum have fallen sharply from their highest peak price. Indeed, the market dominance of Ethereum after reaching 21% (peak), has fallen throughout 2018 and is now around 10%. Moreover, Bitmain's IPO proposed in Hong Kong this week has led Bitcoin cash price to a significant uptrend, so did Litecoin after SFOX announced Litecoin listing on Sep 29, 2018. (Bitcoin Cash accounted for 1% gained in the dominance from 3%).

Top 100 Cryptocurrency by Market Capitalization

However, the decline of Bitcoin market capitalization may be for a short moment. There were several reports in recent months that many influential investors have said that bitcoin prices have reached out bottom and were expected to reach as high as nearly $20,000 in the end of 2018.

Source & Reference:

[1] Vildana Hajric (Bloomberg), Chart Suggests the Next Bitcoin Bull Run On the Horizon, September 27, 2018 https://www.bloomberg.com/news/articles/2018-09-27/momentum-gauge-suggests-next-bitcoin-bull-run-on-the-horizon

[2] Rachel Evans (Bloomberg), Bitcoin ETFs Delayed Again as SEC Seeks Comment on Fund Plan, September 21, 2018 https://www.bloomberg.com/news/articles/2018-09-20/bitcoin-etfs-delayed-again-as-sec-seeks-comment-on-fund-proposal

[3] FINTECH (Reuters), Goldman drops bitcoin trading plans for now: Business Insider, September 5, 2018 https://www.reuters.com/article/us-goldman-sachs-cryptocurrency/goldman-drops-bitcoin-trading-plans-for-now-business-insider-idUSKCN1LL1M0

[4]John McCrank (Reuters), NYSE-owner ICE to form new company for digital assets, August 3, 2018 https://www.reuters.com/article/us-ice-cryptocurrency-bakkt/nyse-owner-ice-to-form-new-company-for-digital-assets-idUSKBN1KO1QN

Data used for price & market analysis collected from Citicoins.com

Note: this is duplicated from my research article (on Medium) and is licensed under CC-BY-SA 3.0. If you're to share this article, please put original source. (https://medium.com/@scryptoxic/insight-into-bitcoin-downturn-the-rise-of-the-others-765ee86591d1)

Indeed. Great write up. I agree wholehearetdly; although I am terrified about bloomberg, reuters, goldman etc. the swamp in general getting involved in #cryptocurrencies as it belonged to US; the community, not THEM.

They own everything else already; let us have this and fuck off! =D

If you check the chart (and I mean ANY chart) you'll see that we are long overdue for some huge parabolic upswing & with the holidays/black friday coming up... I"m utterly convinced that we will see if not a new #BTC #ATH then atleast over #10K before Christmas.

I've been right on literally every analysis I've made since the 2nd half of Q2 to present... no exaggeration

*** hope I"m right about this.***

Congratulations @coingazer! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: