The correlation between cryptocurrencies market and policies

There is a view that cryptocurrencies are outside the scope of state regulation. However, according to the latest research report of the Bank for International Settlements (BIS), regulatory still have a huge impact on the cryptocurrency market (Members of BIS grouped 60 central banks or financial management authorities, account for 95% of the global GDP).

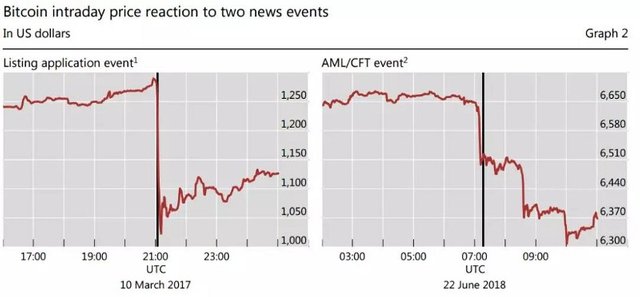

The BIS report said that for the central banks to create their own cryptocurrency or issue non-specific warnings about cryptocurrency, the marketplace usually did not have a significant reaction; however, it would be significantly affected by some regulatory policies, such as cryptocurrency legal status such as regulatory announcements, ICO legal status, AML (anti-money laundering), KYC and CFT (counter terrorism financing) regulations expansion and enforcement.

(Figure 1) There is a certain relationship between Bitcoin price fluctuation and regulatory policies

There are 3 major aspects to the relationship between cryptocurrency market and regulatory actions and announcements:

The Bitcoin market has the most significant response to related events such as cryptocurrency, ICO restrictions and prohibition. If the news directly involves regulatory decisions or the legal status of cryptographic assets, the market’s response is usually strong. Specifically, the price of Bitcoin always affects the entire marketplace, including the other major coins: Ethereum, Ripple, NEO, etc. : This also includes matters of securities regulators, such as the SEC’s pending ambiguity about the Bitcoin ETF. For example, to establish positive news for Bitcoin and cryptocurrency and ICO new legal framework, the market will respond actively. Despite on stablecoins Tether USDT which react accordingly to the market trend, nor the price.

Regulations on anti-money laundering or counter terrorism financing measures, and regulatory news restricting the integration of cryptocurrency and traditional financial systems have also had a significant impact on the market: Cryptocurrency exchanges are often denied access to banking services in the formal financial system — such messages have a significant negative impact on local market. However, news about cryptocurrency startups in corroboration with regulated financial institutions, such as an exchange or company successfully licensed under New York BitLicense, will have a positive impact.

The impact of non-specific warnings about cryptocurrency investment and trading risks on the market is almost negligible. Financial regulators and central bank’s issuance plans of cryptocurrency that have little impact on the market: Markets generally ignore such news either is good or bad. For example, the European Union earlier cracked down Estonia’s plan to issue national cryptocurrencies — the market apparently had no negative response. Meanwhile, Venezuela introduced Petro coin backed by oil reserve that was recognized by the country — the market did not react actively, either.

(Figure 2)The impact of Bitcoin news messages among bitcoin price history

Conclusion

The BIS analysis report shows that despite the intangible and borderless feature, regulatory actions and related news will have a strong impact on the market, at least in terms of price and volume. Presently, governments still have the ability to effectively monitor the cryptocurrency market.

Forwardly, governments will confront 3 key challenges:

To effectively address regulatory issues and achieve technical neutral regulation, the government ought to officially clarify activities related to cryptocurrencies, based on cryptocurrency economical purpose, rather than the use of blockchain technology. The responsibility boundaries of national regulators correspondingly has to be redefined.

In present, there are various segments of the cryptocurrency market in the world. If when a regulatory event occurs in a certain region, it may result cross-border transaction overpriced. As the market continuously develops, more banks and funds participating in cross-border arbitrage, regulation and enforcement rules under a jurisdiction will spread this phenomenon to the other regulatory extents where the regulations are weaker. For example, governments often seek ways to treat similar products and services based on their functions and risk profiles (such as the 2015 Financial Action Task Force), and coordination between regions can help the efficiency of anti-money laundering standards. In order to maximize impact and avoid defunctions, the cryptocurrency industry should also form an internationally consistent approach.

Although the illegal use of cryptocurrencies transcends national borders, it seems difficult to adopt cryptocurrencies to bypass regulation on a large scale. The new crypto products, such as cryptocurrency funds and derivatives, are bridging additional relevance with the financial system.

Cryptocurrencies and other assets can be applied on traditional financial systems. If the public loses trust in the cryptocurrency market, it moreover, will lead the entire financial system and regulators become distrusted. Although the current cryptocurrency does not provoke a risk to global financial stability, governments should remain cautions and closely monitor the development of the market.

Source:

Raphael Auer, Regulating cryptocurrencies: assessing market reactions, 23 September 2018

Data used for price & market analysis are collected from Citicoins.com