Bitcoin’s Timeline – Most Historical Events

Revolution and Drama!

Anyone who has been involved in the crypto space for more than just six months will tell you there is never a dull day. A month in the space is like a year in the traditional stock markets, not just in price movement, but also in news and updates.

Despite the short existence of Bitcoin, history has been made. Bitcoin may be young, but it is not quiet. In this article, we will take a look at some of the most influential moments so far in its short lifespan.

The Bitcoin Whitepaper by Satoshi Nakamoto and the Genesis Block (2008/2009)

2008 was the year it all began to take shape. The domain Bitcoin.org was registered anonymously via anonymousspeech.com in August, and later that same year, the mysterious Satoshi Nakamoto released the whitepaper on a cryptography mailing list, detailing the idea of Bitcoin – a peer-to-peer finance system.

Satoshi Nakamoto is the creator of Bitcoin, however, no one knows who this mysterious character is or if it is a title representing a group of people. Many say Nakamoto originated from Japan, while others say the U.K., but we may never know.

In January 2009, the Genesis Block (block 0) was mined, creating the first bitcoins. At this time, mining Bitcoin was competition-free and didn't require huge amounts of hashing power. The process could be achieved by using your CPU.

Satoshi's original vision for Bitcoin mining was for everyone to be able to mine Bitcoin with a CPU, but as people sought more powerful methods of mining it, smaller miners with less capacity were ultimately pushed out.

First Bitcoin Transaction and the World's Most Expensive Pizza! (2009/2010)

During the same month, the first Bitcoin transaction took place between Satoshi and Hal Finney, a developer and cryptographic artist.

Later in 2010, the first real-world transaction took place to purchase a pizza. A programmer from Florida sent 10,000 BTC to a person in the U.K. in return for two pizzas from Papa John's!

This may sound comical, but is indeed true, and it was a historic day for Bitcoin and an excellent return on investment for the British volunteer, who only paid $25 for the pizzas!

The Birth of the Mt Gox Exchange, Software Bugs, and Pooled Mining (2010)

One of the most well-known exchanges to trade in the cryptocurrency space opened for business in July 2010.

In the following month after Mt Gox's emergence, a vulnerability was discovered in Bitcoin's code, causing 184 billion bitcoins to be generated. Fortunately, the vulnerability was patched, but the exchange value of Bitcoin had crashed as a result.

Later that year, the first mining pool (Slush Pool) mines its first block, enabling a group of users to combine mining power and generate blocks. Bitcoin's market cap also reaches and surpasses $1 million.

The Silk Road Emerges, and Bitcoin Reaches Parity With the Dollar! (2011)

The Silk Road, an online market on the dark web, opens with Bitcoin as its native currency. Users can purchase and sell drugs without being traced.

As more users began using Bitcoin to buy and sell illegal items, the price began to rally, with Bitcoin reaching parity with the U.S. dollar in February 2011.

Bitcoin forks and creates the popular altcoin Litecoin. Litecoin is dubbed "digital silver."

Popular Bitcoin Exchange Coinbase is Founded (2012)

Coinbase, one of the most popular exchanges used to buy bitcoins, is founded and opens for business. Coinbase offers the ability to buy, sell, and store Bitcoin (and now Ethereum and Litecoin).

Bitcoin Reaches $1,000, and Mt Gox Crashes (2013/2014)

Despite the FBI shutdown of The Silk Road in October 2013, Bitcoin's popularity continued to grow. The trading price of Bitcoin rallied above $1,000, and a whole new wave of wealth was created for many early investors.

Early 2014 would prove to be a hard time for the Bitcoin community. The largest Bitcoin exchange at the time (Mt Gox) was hacked, triggering a two-year bear market for Bitcoin.

Mt Gox was handling 70% of the Bitcoin network's transactions. With 850,000 bitcoins stolen, the exchange closed. It was a hard and bitter lesson for many about the importance of storing Bitcoin safely and privately.

Scaling Solutions, New Bull Market, and Bitcoin Cash (2016/Current)

As we entered 2016, the cryptocurrency markets were a different place. Hundreds of altcoins and new blockchain-based projects, such as Ethereum, are now listed on countless new exchanges. Despite exchanges exiting, being hacked, or shutting down, the price of Bitcoin is far more resilient than it was in early 2014.

2016 proved to be an amazing year for Bitcoin, with the mining rewards halving from 25 BTC to 12.5 BTC, limiting the supply and pushing the trade price of Bitcoin to highs not seen since Mt Gox was around.

In 2017, Bitcoin returned to previous highs and surpassed all records, despite a Bitcoin ETF being rejected. The price at the time of writing has reached as high as $5,000. 2017 has been Bitcoin's greatest year so far, pushing away a dark cloud that loomed over Bitcoin for nearly two years… the scaling debate.

Despite the numerous opinions on how Bitcoin should evolve to meet the growing demands and high volume on the network, two major solutions were presented to the community: Segregated Witness (SegWit, or BIP 141) or a block size increase from 1MB to 2MB. As a last resort, it faces a hard fork, and Bitcoin splits into two versions: one with SegWit and the other with larger blocks.

SegWit, also known as BIP 141, works by removing the witness data from the block and adding it into another smaller block. This means the block's efficiency would be enhanced and enable it to store more transactional data and reduce network fees, as congestion would be dramatically reduced. SegWit would also enable the software to implement additional applications to handle micro-transactions (Lightning Network and atomic swaps).

To avoid a hard fork and create unity in the network, BIP 148 was set to activate SegWit with or without the required miner approval in order to solve the scaling deadlock and moves things forward.

Simply put, BIP 91, which was an adaptation of BIP 148 and the proposed 2MB block size increase, was released onto the network. Anyone not signalling for BIP 91 by August 1st would be rejected from the network, as BIP 148 would activate SegWit regardless.

BIP 91 successfully activated in mid-July 2017 before BIP 148 enforced SegWit, creating huge relief in the community.

All three of these solutions eventually ended up happening. Bitcoin hard forked, and to the disbelief of many, it triggered a price rally to $5,000. Bitcoin lives to fight another day!

However, on August 1st, Bitcoin Cash began mining blocks, making it an official fork of Bitcoin. The only differences between the two cryptocurrencies are that Bitcoin Cash does not have SegWit and it has a larger block size capacity of up to 8MB.

SegWit activated without any problems on August 24th, 2017, another huge day for the Bitcoin and blockchain industry.

Everyone who held Bitcoin up until August 1st was given Bitcoin Cash at a ratio of 1:1, with many labelling it as "free money." July and August 2017 proved to be the most crucial months in the history of Bitcoin so far.

Chinese Regulation, Fake News, and SegWit2x!

In September 2017, the Chinese government declared a stricter stance on cryptocurrencies, mainly focused on the ICO (initial coin offering) mania sweeping the globe. This triggered a mass selloff, as many users simply panicked.

To fan the flames of fear, another announcement was made, declaring a shutdown of all Chinese-based Bitcoin exchanges and mining, with some exchanges announcing they will cease trading.

To add insult to injury, Jamie Dimon, CEO of JP Morgan, labelled Bitcoin a fraud! The markets crashed after this and combined. With the possibility of another hard fork (SegWit2x) with no replay protection, Bitcoin's price crashed from $5,000 a low of around $3,000 (currently back to around $4,200)!

SegWit2x is a scaling solution that was agreed upon at a conference in New York. It includes SegWit, but also a block size increase to 2MB. This is not due to happen until late October or November.

What Happens Next…

In conclusion, we can't truly predict what will happen. This industry is moving at an accelerated rate, and it is still pioneering in the unknown!

Could Bitcoin reach $10,000? Will we see a true diplomatic resolution to the scaling debate? History will be the judge…

thanks for share

No one really knows what's in Bitcoins future could be ten thousand could be a hundred thousand but know this is that Bitcoin is still very much in its infancy and it's only going to get more popular it's only going to get more widespread so I think we're in a really good spot we just need to continue this push

Nice post friend

Wow, crazy

Muito maneiro!

Very cool ! Tanks !

very nice share

Great history lesson on Bitcoin! I firmly believe that by studying history, it gives us a glimpse of the future. What we see happening today, will soon become part of Bitcoin history :)

Great enjoy a lot want to see more of this in future. @crushthestreet

It has been a crazy ride so far! And it will only get crazier! I think the announcement of SMT's will change the game again. Businesses will have more options for raising capital to fund startups or expansion, so I think when they get on board, crypto will start to become mainstream as more people will start to understand it and there will be more opportunities to use it in everyday life! It is an awesome time that we are living in right now, and it will go down in history!

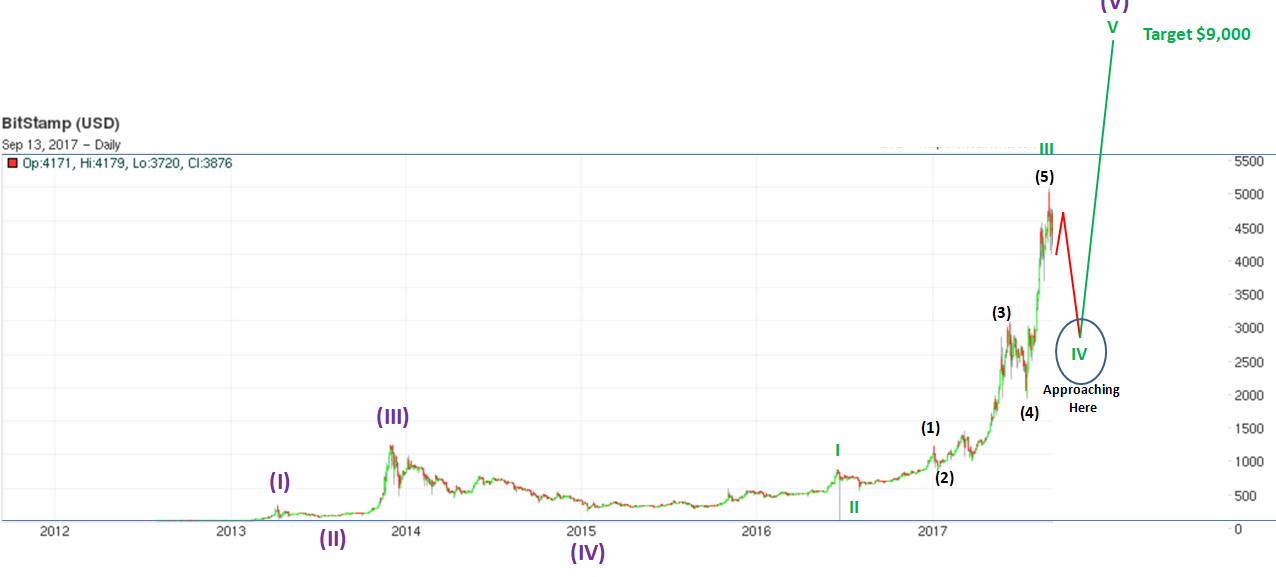

My Technical Analysis projects Bitcoin $9,000: