Crypto Arbitrage Analysis: BTC / GAS **0.75BTC worth of profit in 2 days**

Hey Steemit - it's been awhile!

Today I'm going to discuss the 2 day arbitrage opportunity we saw between the 14-16 March in BTC / GAS on the Binance & Poloniex exchanges. We have seen plenty of these opportunities and its a great way to make decent profit in a very short space of time (5-20 minutes).

If you need a quick refresh in Arbitrage and how it works click here.

Lets Crack On

Arbitrage Information

Duration of Arbitrage: 2 days

Pair Traded: BTC / GAS

Buy Exchange: Binance

Sell Exchange: Poloniex

Max Spread: 12.6%

Average Spread: 5.6%

Volume Traded on Binance: 300BTC (across the 2 days)

Volume Traded on Poloniex: 15 BTC (across the 2 days)

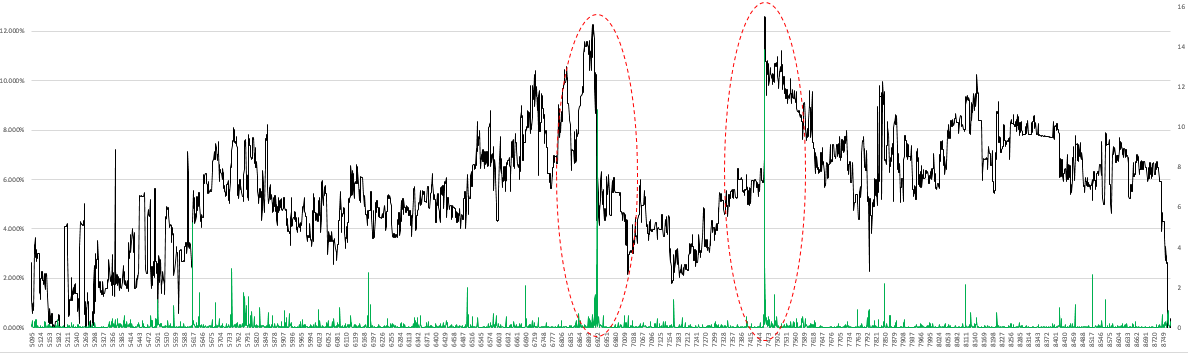

Arbitrage in a Graph

Black line is % spread (representing the arbitrage opportunity)

Green columns are the GAS volumes (in BTC terms) on Poloniex

Graph 1: % Spread + Poloniex GAS Volumes (in BTC)

Deeper Dive

From Graph 1 you can see our constraining factor is the low volumes on Poloniex (vs. Binance which was 20x more) and that towards the end of the 2 days there is a major ramp in volume on Poloniex.

As of writing we haven't seen this opportunity resurface which means that you could have played this arbitrage for 2 days and made next to "risk free" profit.

However you can see that the arbitrage opportunity reduced and then increased massively in Graph 1 (both circled in red). Why?

Looking at Graph 2 below you can see that when you plot the Binance volumes (instead of Poloniex) there is a huge drop (and later on spike) in the arbitrage opportunity as a result of the dramatic increase in volume on Binance.

Graph 2: % Spread + Binance GAS Volumes (in BTC)

What is even more interesting is that the final coup de grace of the arbitrage opportunity came purely from the increase in volumes on Poloniex (Graph 1) as the volumes on Binance remained relatively normal (Graph 2).

Profitability Analysis

Lets talk $$... so the best thing about Arbitrage is that there is no PRICE RISK - you buy and sell within a short time frame and so have very little exposure to the market. (If you short instead of withdrawing your coin to physically sell on another exchange then your risk is the time it takes you to click buy and sell...seconds!).

HOWEVER the con is that liquidity is often a constraint so you can't just make a few $1m trades and then retire. The aim of the game with Arbitrage is picking up pennies constantly...you're interested in finding lots of arbitrage opportunities which then accumulates to a nice Lambo, Patek Phillipe watch or some $100,000 Crypto Kitty (I'm not judging).

Anyway doing some back of the envelope math can show that the total profitability of this one specific arbitrage trade is 0.8 BTC which is c. $7-8k (5.5% average spread with 15 BTC over 2 days).

Whilst it would be difficult to capture 100% of the 0.8 BTC of profit yourself you could easily have earned a portion of the profit had you been aware of this opportunity.

How did I find out about this opportunity?

We built a a bot that currently scans 9 major exchanges and 20 coins and posts to a private Telegram group every 2 minute all the arbitrage opportunities currently on the market.

If you have any questions or are interested in joining the Telegram group to discover all the arbitrage opportunities available just drop me a telegram message @Crypto_Dino.