Great time to pick up cheap alts! What percentage should you invest in each coin to become a multi-millionaire? A winning index strategy (updated 9/14/2017)

Hello fellow steemians and crypto investors,

The recent market correction is giving us a great opportunity to buy Bitcoin and altcoins on the cheap! You don't have to fall for the FUD and go with the herd mentality. This is a great time to be a contrarian and pick up some of the top coins for peanuts! In this post I'm sharing with the steemit comunity my strategy, based on passive indexing, to pick up the top coins that are most likely to succeed in the future.

Rest assured, even if China bans Bitcoin altogether, this could only increase prices within the country, the demand is still there, the need to get money out of the country and corrupted officials everywhere are there too, alive and well. Banning crypto, if it actually happens, would only increase demand and prices.

There are other well established, regulated and legal markets in Asia (mainly in South Korea and Japan) that will gladly take their volume. Also, when things are banned, prices tend to go up in the black market and this would create great opportunities for arbitrage from China and, thus, even greater volume. Remember what banning drugs and booze has always done to their prices?

This genie is out of the bottle, no one can put it back, not even the most powerful governments and they won't. My bet is they will actually race to control it. Russia's recent 100 million Bitcoin mining investment confirms this.

A WINNING INDEXING STRATEGY

Investing in crypto is becoming a safer bet each year as Bitcoin and altcoins get older, improved and better established. We are still in the very early days of crypto and the opportunity to strike it rich is well within reach of most people, provided they have access to the internet, modern banking and a little disposable income. However, for most new investors coming into the crypto space deciding which coins to invest in and how much is a very complicated issue.

There’s so many of them, so much information, high tech jargon and amazing promises that sound more like lies uttered by politicians than from the nerdy developers that are pitching them. Every new coin is hyped, packaged and sold like the next Amazon... However, despite all the hype and noise, we can now say with a high degree of certainty that some of them will make it big in the future, but which one(s)?

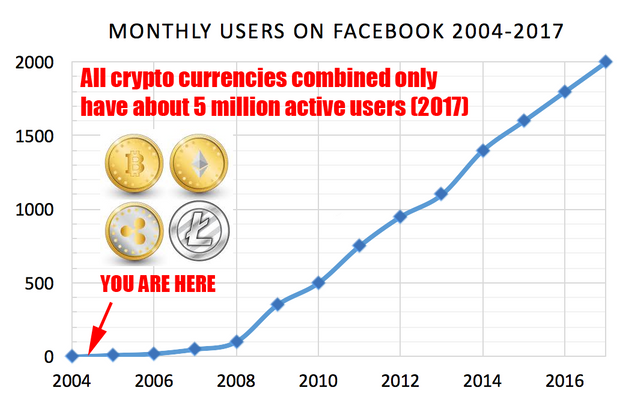

Interesting fact: All users of crypto currencies today represent less than 1% of the number of current Facebook users. More details

The reality is, no one knows, whoever tells you they do, they are flat out lying, fooling you and themselves. This market looks very much like the early car industry in the United States. Thousands of car brands appeared everywhere, a lot of them were very promising (remember the DeLorean?), but most eventually went bankrupt, only a few succeeded in the long run.

So, how do I know which coins will succeed?

The simple answer is you DON’T. Trying to pick winners is very dangerous game that most people lose, those who don’t are demonstrably just plain lucky and end up losing everything the next time they bet big. The strategy that I’m introducing guarantees the winners come to you, rather than you pick them up.

How much money should I put in each?

This is a huge conundrum for most investors. With so many coins available and limited disposable income to invest it’s hard to distribute the funds in a sensible way.

Introducing the Millionth of Supply Passive Indexing strategy:

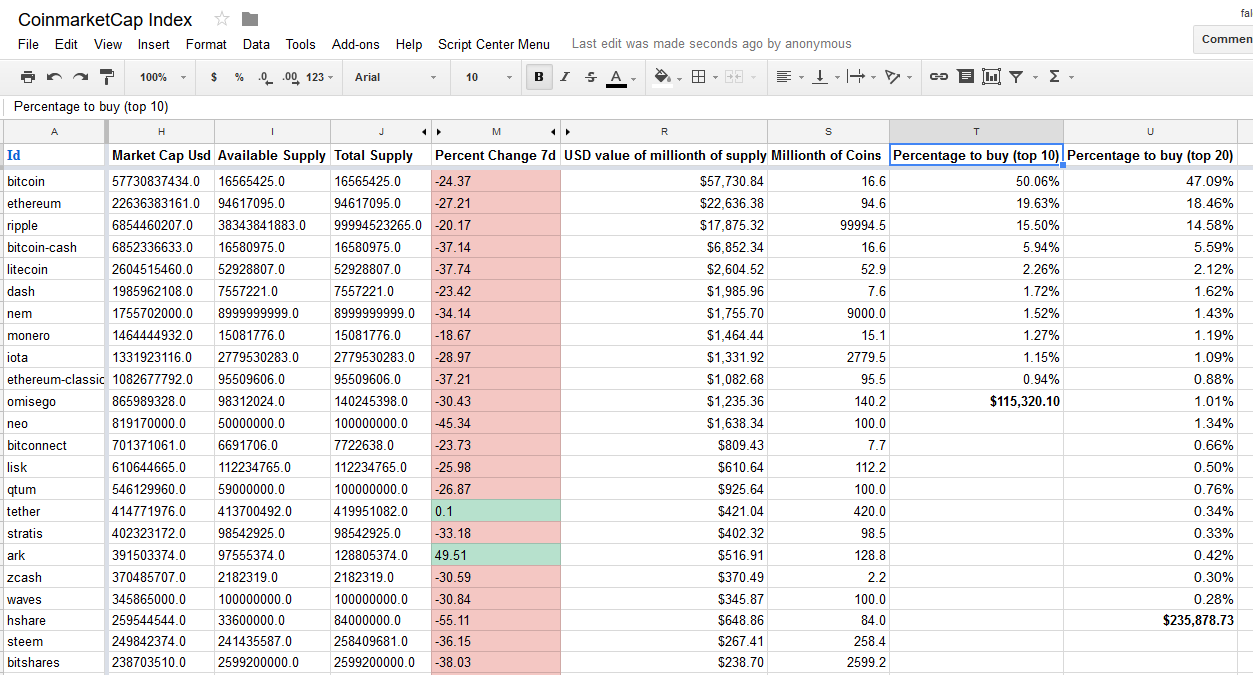

The following spreadsheet feeds from Coinmarketcap’s API and lists (or indexes) the top coins by market cap and daily trading volume. The coins at the top give you a pretty good idea of the current coins being favored by the market as of the day of publication of this post.

Download spreadsheet image showing USD value of millionth of supply and percentages to invest to own the top coins by market cap. Follow me @CryptoEagle for updates.

The goal of this strategy is to own a millionth of the supply of each of the top coins by market cap . This way you guarantee that if any of them succeeds in the future you will be part of the elite, the top 0.1 percenters and millionaires of the future. If any of the coins (or some of them) succeed(s) and become(s) a widely used reserve currency you will be guaranteed to own a millionth of its supply .

In columns T and U of the spreadsheet you'll find the percentage of funds you should invest based on market cap and the USD value of the millionth of supply of the coin. This is calculated by dividing the USD value of the millionth of supply by the total amount you should invest to own the top 10 or 20 coins.

It doesn’t matter if you invest $100 dollars every month or $100,000 at once, your goal will be to own the millionth of the supply of the top coins as soon as possible without spending any income that's not disposable to you . So, if for example, all you had is $100 dollars to invest monthly, you would invest this amount in each top coin according to the percentages shown, no more, no less. At the bottom of the columns is the total amount in USD you would invest to do this for the top 10 and 20 coins.

How rich will you be if you follow this strategy?

There are currently an estimated 10.5 trillion dollars in existence. If you owned a millionth of the supply of US dollars right now you would own about ten million five hundred thousand dollars!

In the United States alone, at end of 2016, there were 10.8 million millionaires, according to a study from Spectrem Group's Market Insights Report 2017.

Credit Suisse estimates there are about 35 million millionaires in the world (including all financial and nonfinancial wealth, such as assets, collectibles, and homes). If we compare this number to 21 million, the total number of Bitcoins that will ever exist, we can see that there won’t ever be enough Bitcoins in the world for every millionaire to even hold just one!

Also, this doesn’t account for the disruption of other industries such as remittances, Gold as a store of value and many other new uses of crypto currencies that we can’t even dream of today. As an example, if Bitcoin overtook just 5% of the market cap of Gold, a single bitcoin would be worth approximately $24,000 USD.

But, “introduce any crazy coin name here” is so great, the technology is amazing, so exciting. It’s the future, my guts tells me!

Yeah right, the market doesn’t care about your hunches, white paper promises, or all those great technologies that people sell as the best thing since Coca Cola. Nope, only market cap, volume and related network effect can tell you what coin will end up being favored by the market.

You must re-balance every once in a while

About every 3-6 months you should take a look at this index and re-balance it. Follow me for updates to this post. If any coins dropped in market cap sell them and re-invest the money on the top coins until you own the millionth of their supply. If there are new coins in the list you should invest in them until you reach the goal as well, no more (over invest), no less (under invest). If you don’t do this you are risking missing the upcoming coins and keep investing in the long term losers.

Don’t invest on coins that only briefly come to the top

(Especial thanks to @famunger for contributing to this point)

Even though the spreadsheet gives a pretty good idea of the top 4-5 coins, as you go down the list you will see, every once in a while, some temporarily overhyped coins that come up but can’t sustain their ranking and eventually crash. Only invest in coins that manage to maintain their ranking on the list for at least 3 months or more. Don’t fall victim to the Fear of Missing Out (FOMO) so typical in this world. Think of these coins as if they were the hot chick from high school that got away but later you find out she became an ugly fat blob...

Advantages of this strategy:

You will be almost 99% guaranteed to become a multimillionaire by owning the top coins the market finally ends up favoring. You will certainly sleep like a baby!

You can start investing with very limited funds and continue investing periodically. Even if you don't get to own the millionth supply of every top coin you'll be certain you did as best as you could with your limited resources.

You won't over or under-invest in any particular coin and thus keep risks at a minimum.

You’ll skip all the typical drama of investing in cryto. The Fear of Missing Out (FOMO), the Fear, Uncertainty and Doubt (FUD), the daily crashes, the pumps and dumps etc. will not rattle your nerves and send shivers down your spine every time they happen.

Disadvantages:

This is a boring, long term, no feelings involved, passive strategy, you will not have the adrenaline rushes and enjoy or suffer all the crypto drama. Picking winners is reduced to a simple to follow probabilities game.

There may be coins that gain 1000 percent in a few weeks that won’t show up in the index until their market cap grows to the top and which you will miss but, on the bright side, you’ll also miss the big losers, the suicide inducing and family wrecking crashes.

There’s still the slight possibility (the 1% chance) that the entire crypto world is a huge bubble that will never work, the Internet could come crashing down after an EMP attack or a meteorite could strike earth... In which case we are all screwed anyways and should worry more about food and bullets to fight the zombies...

CHECK OUT MY PREVIOUS POSTS:

ETHEREUM’S RAIDEN VS BITCOIN’S LIGHTENING – What’s happening?

SEE THE CHARTS! Segwit progressing slow but already helping ease congestion in the Bitcoin network

Tell me what you think of this strategy in the comments below. This is not professional investment advise. I'm not your financial advisor. Only invest money you can afford to lose!

Follow me for updates to the spreadsheet.

Happy crypto investing!

good post..

hot post of the day

Thanks for the post, i'll be following you from now on!

Great post, thank you, up-voted and now following , looking forward to more posts like this.

nice post, all vote

Nice post, thank you for the tips!!!

Hi! I am a robot. I just upvoted you! Readers might be interested in similar content by the same author:

https://steemit.com/bitcoin/@cryptoeagle/what-percentage-should-you-invest-in-each-cryptocurrency-to-become-a-millionaire-a-guaranteed-winning-strategy-updated-8-16-2017

@cryptoeagle got you a $1.73 @minnowbooster upgoat, nice! (Image: pixabay.com)

Want a boost? Click here to read more!

Thank you @cryptoeagle for sharing this again.

As I look at it closer, what you are proposing is just a model to follow. I dont see where this is passive in the sense of someone puts up, say, $100 a month and it is invested for them. Am I correct in concluding this is still an path that is actively managed by the individual...one where he /she makes the purchases.

As for the idea makes total sense. I am glad to see I own more than a millionth of LTC and Steem....I am a bit shy on the others though...might need to take out a loan.

Thanks again and I welcome your insight.

Hello taskmaster,

Yes, this kind of strategy is called passive because it doesn't require the investor to be glued to the trading terminal all the time, about to have a heart attack with every move the market does :) There are other passive alternatives such as Iconomi, but I'd rather do the index (and control the private keys myself). I personally bought yesterday the millionth of supply of IOTA, NEO and Qtum, I didn't have those yet so I took advantage of the drop. Best regards

Thanks for the 411....

Just to clarify some more...are you stopping at the millionth and not exceeding it? Also, I understand about buying every coin out there but are you sticking to the top 20 or 30?

What is your strategy over the next year let's say?

I'm stopping at the millionth of supply. I'm not buying any coins under the top 20, too much risk with those. They'll likely go to zero

Not even Steem at #21?

I got some steem from Steemit

What should be the maximum investment of coin investment The post is very good. Thank you for the posting

Aim to own the millionth of supply of the top coins by market cap. regards

There is a lot more amount. thanks for telling me