What percentage should you invest in each cryptocurrency to become a millionaire? A guaranteed winning strategy (updated 8/16/2017)

Investing in crypto is becoming a safer bet each year as Bitcoin and altcoins get older, improved and better established. We are still in the very early days of crypto and the opportunity to strike it rich is well within reach of most people provided they have access to the internet, modern banking and a little disposable income. However, for most investors deciding which coins to invest in and how much is a very complicated issue.

There’s so many of them, so much information, high tech jargon and amazing promises that sound like lies uttered by politicians. Every new coin is hyped, packaged and sold like the next Amazon... Indeed, there's the remote possibility they could all come crashing down but it’s very unlikely at this point that all coins crash to zero. Some of them will very likely make it big in the future but which one(s)?

The reality is, no one knows, whoever tells you they do, they are flat out lying, fooling you and themselves. This market looks very much like the early car industry in the United States. Thousands of car brands appeared everywhere but most eventually went bankrupt, only a few succeeded in the long run.

So, how do I know which coins will succeed?

The simple answer is you DON’T. Trying to pick winners is very dangerous game that most people lose, those who don’t are demonstrably just plain lucky and end up losing everything the next time they bet big. The strategy that I’m introducing guarantees the winners come to you, rather than you pick them up.

How much money should I put in each?

This is a huge conundrum for most investors. With so many coins available and limited disposable income to invest it’s hard to distribute the funds in a sensible way.

Introducing the Millionth of Supply Passive Indexing strategy:

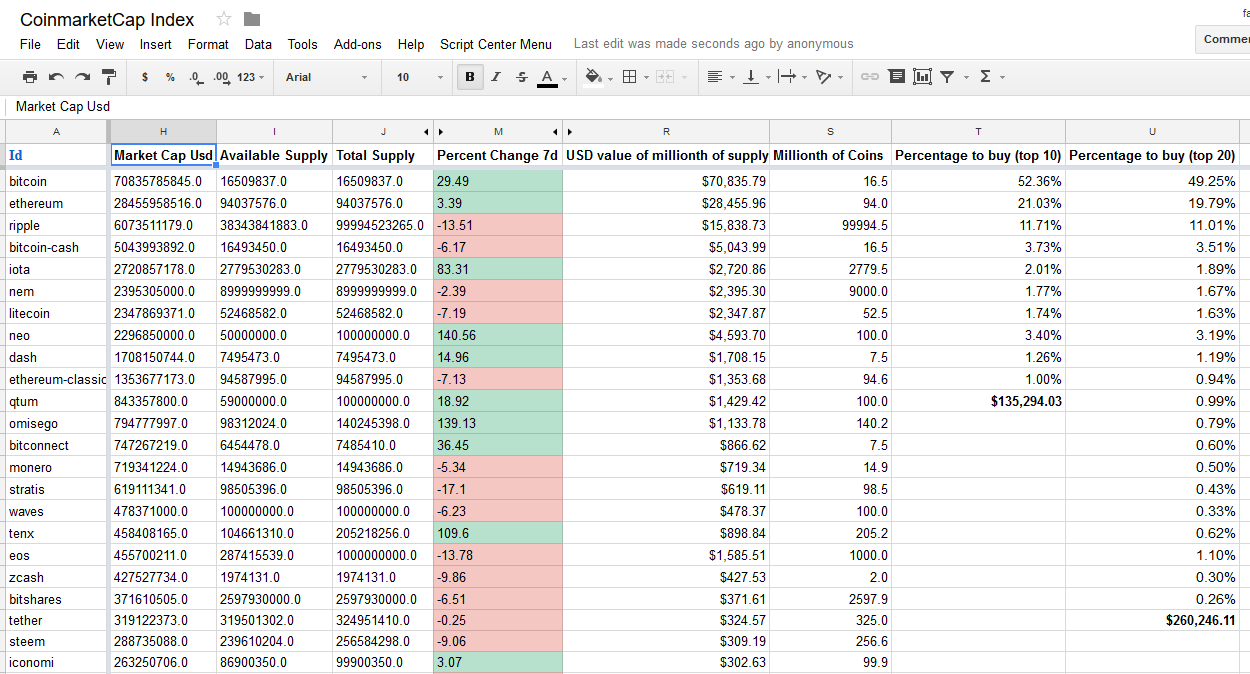

The following spreadsheet feeds from Coinmarketcap’s API and lists (or indexes) the top coins by market cap and daily trading volume. The coins at the top give you a pretty good idea of the current coins being favored by the market as of the day of publication of this post.

Download spreadsheet image showing USD value of millionth of supply and percentages to invest to own the top coins by market cap. Follow @CryptoEagle for updates.

The goal of this strategy is to own a millionth of the supply of each of the top coins by market cap. This way you guarantee that if any of them succeeds in the future you will be part of the elite, the top 0.1 percenters and millionaires of the future. If any of the coins (or some of them) succeed(s) and become(s) a widely used reserve currency you will be guaranteed to own a millionth of its supply.

In columns T and U of the spreadsheet you'll find the percentage of funds you should invest based on market cap and the USD value of the millionth of supply of the coin. This is calculated by dividing the USD value of the millionth of supply by the total amount you should invest to own the top 10 or 20 coins.

It doesn’t matter if you invest $100 dollars every month or $100,000 at once, your goal will be to own the millionth of the supply of the top coins as soon as possible without spending any income that's not disposable to you. So, if for example, all you had is $100 dollars to invest monthly, you would invest this amount in each top coin according to the percentages shown, no more, no less. At the bottom of the columns is the total amount in USD you would invest to do this for the top 10 and 20 coins.

How rich will you be if you follow this strategy?

There are currently an estimated 10.5 trillion dollars in existence. If you owned a millionth of the supply of US dollars right now you would own about ten million five hundred thousand dollars. Just to give you an idea, in the United States alone, at end of 2016, there were 10.8 million millionaires, according to a study from Spectrem Group's Market Insights Report 2017.

There are approximately 18 million millionaires in the world according to the 6th annual Credit Suisse Global Wealth Index. This doesn’t even account for the disruption of other industries such as remittances, Gold as a store of value and many other new uses of crypto currencies that we can’t even dream of today. As an example, if Bitcoin overtook just 5% of the market cap of Gold, a single bitcoin would be worth approximately $24,000 USD.

But, “introduce any crazy coin name here” is so great, the technology is amazing, so exciting. It’s the future, my guts tells me!

Yeah right, the market doesn’t care about your hunches, white paper promises, or all those great technologies that people sell as the best thing since Coca Cola. Nope, only market cap, volume and related network effect can tell you what coin will end up being favored by the market.

You must re-balance every once in a while

About every 3-6 months you should take a look at this index and re-balance it. Follow me for updates to this post. If any coins dropped in market cap sell them and re-invest the money on the top coins until you own the millionth of their supply. If there are new coins in the list you should invest in them until you reach the goal as well, no more (over invest), no less (under invest). If you don’t do this you are risking missing the upcoming coins and keep investing in the long term losers.

Don’t invest on coins that only briefly come to the top

(Especial thanks to @famunger for contributing to this point)

Advantages of this strategy:

- You will be almost 99% guaranteed to become a multimillionaire by owning the top coins the market finally ends up favoring. You will certainly sleep like a baby!

- You can start investing with very limited funds and continue investing periodically. Even if you don't get to own the millionth supply of every top coin you'll be certain you did as best as you could with your limited resources.

- You won't over or under-invest in any particular coin and thus keep risks at a minimum.

- You’ll skip all the typical drama of investing in cryto. The Fear of Missing Out (FOMO), the Fear, Uncertainty and Doubt (FUD), the daily crashes, the pumps and dumps etc. will not rattle your nerves and send shivers down your spine every time they happen.

Disadvantages:

- This is a boring, long term, no feelings involved, passive strategy, you will not have the adrenaline rushes and enjoy or suffer all the crypto drama. Picking winners is reduced to a simple to follow probabilities game.

- There may be coins that gain 1000 percent in a few weeks that won’t show up in the index until their market cap grows to the top and which you will miss but, on the bright side, you’ll also miss the big losers, the suicide inducing and family wrecking crashes.

- There’s still the slight possibility (the 1% chance) that the entire crypto world is a huge bubble that will never work, the Internet could come crashing down after an EMP attack or a meteorite could strike earth... In which case we are all screwed anyways and should worry more about food and bullets to fight the zombies...

Tell me what you think of this strategy in the comments below. This is not professional investment advise. I'm not your financial advisor. Only invest money you can afford to lose!

Contact me for updates to the spreadsheet and for instructions on how to own it and update it yourself.

Happy crypto investing!

great post like it

Aiming to be a millionaire is a great idea. I say only buy Bitcoin, never buy STeem when you can earn it for free.

:) lol u r bold .. :D

All eggs in one nest, could work but could also leave you featherless ;)

My upgraded strategy on top of this will be that the currencies i do not want to support in any way i will not buy them at all. For example in top 10 i will not buy Ripple, BCash so i will buy from list as well 11 and 12. In top 20 this is the same and i will not buy Tether. Since on 21st place is Steem and i remove 3 coins i will remove Steem as well and go till 24th. Who is longer in the space of crypto know what i am saying and perhaps there is some more coin i should not buy anyway but i need to make more research.

Since i cannot resteemit i just put link of this post in comments under my post: https://steemit.com/bitcoin/@fire-fly/slog-i-trip-on-homeland-with-living-in-the-nature-xii-i-since-2013

Solid blog. I was about to start a similair discussion. Be prepared for a fluctuating crypto market. We really need more insights in the market and previous investment results. This is quite an interesting website I found: https://www.coincheckup.com Since I use this site I make so much less basic investment mistakes.

Seems reasonable to me. The one I am most concerned about is steemit. Thanks for the info. 🐓🐓

Thank you mother! Happy and safe crypto investing for you and your chicks!

Thank you for keeping an eye on things for us. Glad you stopped by.🐓🐓

This seems to be a bit high and hold and hope approach. If you are only buying when a coin has reached the top, I think you are asking to lose money.

True, some people prefer to pick coins at the bottom and hope they go up, spend countless hours reading white papers and listening to the hype. It's like trying to pick Google and Facebook from the DOTCOM bubble, very unlikely. I've done it, but realized it was costing me a lot of stress and money so I decided to go with a passive strategy to sleep like a baby and secure my wealth.

This strategy is a combination of dollar cost averaging, and momentum investing. Having invested in the stock market using both these strategies, I can attest that it is very unlikely to become a millionaire using these strategies. I dollar cost averaged in about 20 DRIPS (dividend reinvestment plans) and momentum invested in several mutual funds. The funds were much more fun to watch, but the DRIPS had the better returns. The problem becomes, being in the ones that actually have the great moves.

Not that I am agreeing or disagreeing with the strategy here but comparing it to stocks really isn't fair. The top ten or twenty stocks by market cap are typically already fairly valued unless there has just been some sort of crash that took out the good with the bad. This would be more like buying into the top 20 tech companies is 1998. The bigger problem is that even if you bought a millionth of the supply of Amazon in 1998 your 5k would have become 500k but it would have taken you 20 years and inflation would have crushed your gains. I think for this strategy to work you need to truly believe that blockchain and cryptocurrency will displace major stores of value AND that one of the current top 20 will be the ones to do it and that is still a huge gamble.

Voorash, I think you got this right. This is predominantly why most stock investors are down the last 20 years or so, because their gains, if any, get goobled up by inflation, and loss of purchasing power in the dollar. This is why crypto are so appealing to me, because no one is inflating them away, like the Fed does with the dollar.

Agreed Voorash, another possible comparison could made about the top brands in the beginnings of the car industry

Very interesting view :P At one point a couple of months ago I was a DOGEcoin millionaire! Traded it out when it hit 70 sats though- was sad to see it spiked to over 180 later!

Take a look at my price forecasts and let me know what you think https://steemit.com/bitcoin/@hotsauceislethal/bitcoin-price-forecast-8-16-2017

I like this part very much: "Most of the wealth from the millionaires and billionaires of today will be transferred to crypto investors like you and me if/when cryptocurrencies become mainstream reserve currencies. "

Very good insight... Resteeming!!!

Nice post! I like that it is clearly thought through and has taken some time to put together. Up voted and will be following

So approx. you need to invest percentage of 135K respectively for the top 10 and 260K for the top 20 ? if I understood so to go secure you willl have to invest about a quarter of a million and hodl right? :D

You can do that, or just invest $100 monthly and aim to reach the millionth of supply. If you don't that's fine, you'll sleep well knowing you did the best you could with the resources you had