MyTrade - An exciting new early-stage DEX on HPB

Introduction

In this article, I am going to discuss a new and exciting Decentralised Exchange (DEX) “MyTrade”, that is currently hosted on and utilising the advantages of HPB (See my previous articles for details on HPB). MyTrade is at a very early stage of development so in this article I want to show you all why DEXs are more important than ever and introduce this new exciting DEX.

MyTrade presents us with the birth of a potentially huge new DEX, they are focusing their efforts on Ethereum Virtual Machine (EVM) compatible blockchains starting with HPB. They are also currently co-developing an exciting new cross-chain solution with HPB! (More on that in my next article) in a bid to set this DEX apart from its rivals

What are DEXs and why are they important?

Ok so before we start, I consider myself a true blockchain enthusiast, this means I understand fully the ideology behind the blockchain revolution to bring forward a more “Decentralised World”. With decentralisation comes greater risk but more freedom!

Decentralised Exchanges (DEXs) are different from Centralised Exchanges (CEXs) in a couple of different ways, let me explain:

CEXs

Wiesflecker, (2021) states that CEXs have their own order books with data pertaining to the transaction being computed on central servers in a centralised way. Furthermore, they are bound by regulatory frameworks, most have to collect Know Your Customer (KYC) and Anti-Money Laundering (AML) data from users.

Advantages: They tend to have more user-friendly interfaces, higher trading volumes and usually higher trading speeds because trades don’t rely on network nodes to operate. Their use of extensive matchmaking algorithms to plot supply and demand and store orders on an order book is a huge advantage, they can also have automated Market makers (AMM).

Disadvantages: You do not own your private keys as your crypto is held in custodial wallets, if the exchange is hacked your crypto can be stolen! Trading fees also tend to be higher as CEXs are “For Profit” companies.

The most well-known of these being Coinbase and Binance for the average reader. There are hundreds of them listed on Coingecko.

DEXs

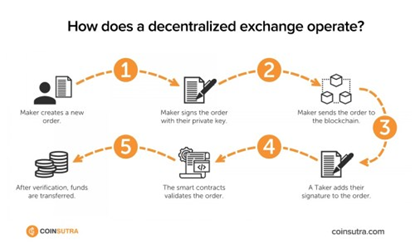

DEXs do not use centralised servers or internal IT infrastructure, they operate as a dApp on a host blockchain with the majority today operating on ETH. Smart contracts are used to regulate the exchange.

Advantages: They bring full anonymity as they are decentralised peer-peer trading platforms, meaning no personal information has to be shared to use them. They are also more secure than their counterparts assuming their smart contracts have been carefully audited and are free of any vulnerabilities. You are in full ownership of your assets as you own the private keys! Some today are developing cross-chain solutions. Trading fees are also much lower and the absence of withdrawal fees is a positive (If not on ETH where the current high gas fees to move tokens from A to B still sting!

Disadvantages: They can be slower if the chain is congested as you rely on them to verify all transactions. They have a steeper learning curve for the average crypto enthusiast and also lack many of the trading features than their CEX counterparts (MyTrade aims to solve this, more below).

The most popular DEXs today include Uniswap, Curve Finance and Sushiswap. Kreuz, (2021) adds that currently the 5 largest DEXs are built on Ethereum and have $13 billion locked up on their platforms, with daily trading volumes matching their CEX rivals.

Trends in the blockchain sphere today certainly suggest a shift from CEXs to DEXs, perhaps due to the popularity of “Yield Farming” and other such incentives for users to lock crypto onto exchanges to act as Liquidity in return for interest. On DEXs Liquidity comes from users rather than a central authority in a CEX. Wiesflecker, (2021) suggests the DeFi craze has led to this change. I agree.

The problems with CEXs

Kreuz, (2021) puts forward that the top CEX “Binance” still leads the charge in the space and is making a killing in exchange trading fees. He also states that Coinbase made $322 million in profit in 2020 and it has just gone public at the time of writing this article with a huge market cap of near $100 Billion! And what do we get for this greed? We get lagging exchanges when there are volatile swings in the markets, I bet most of you have been locked out of your CEX exchanges during these times like me? Technical issues will always plague these exchanges, Kreuz, (2021) attributes this to a reliance on centralised cloud providers like AWS not being prepared for traffic spikes.

Also, who remembers the Mt. Gox scandal in 2014 when a hacker ran off with over 700k in bitcoin? I do! Or what about when the CEO of QuadrigaCX died and $190 million was lost because he was the sole holder of the wallet passphrase with customer funds? Or major 2020 theft from KuCoin! The simple fact is that you do not own your private keys on a CEX. This coupled with the restrictions imposed on you depending on what country you are from is invasive, to say the least and not decentralisation.

I acknowledge that CEXs like Coinbase, Binance, et al… have provided an easy on-ramp for new investors into the space, something critical for growth. However, I would advise you all to start off-ramping to some DEXs. It is DEXs who can match this user experience in terms of ease of use and platform interface who will excel. We are already seeing this with huge DEXs such as Uniswap, Sushiswap, and Compound, etc… As mentioned above, the popularity of these DEXs is now arguably on par with some of their larger CEX counterparts.

The DEX problem today

As mentioned above the top 5 DEXs are hosted on ETH. As we all know from my previous articles, ETH has huge problems with Gas fees and transaction speeds when the network is clogged. The other problem is the problem of cross-chain interoperability on DEXs, a critical pinch point for DEXs to fully compete with CEXs.I believe those who manage to do this properly will grab a huge market share.

The Solution- MyTrade

I believe MyTrade may offer this solution. As I mentioned previously, this new DEX is in early-stage development and currently utilising High Performance Blockchain (HPB) as their host chain in V1. They will also be launching on other EVM-compatible chains. Furthermore, there is some exciting cross-chain development going on behind the scenes between the developers of MyTrade and HPB, I will be releasing an article very soon on this and I urge you to keep an eye out for it!

Features of MyTrade

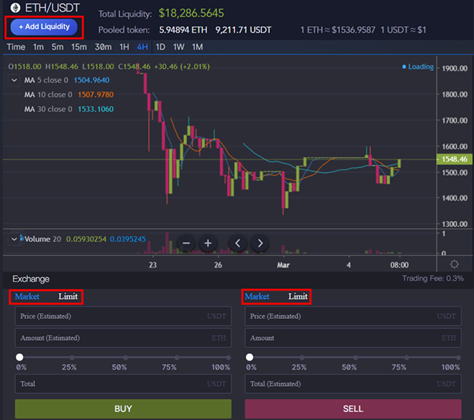

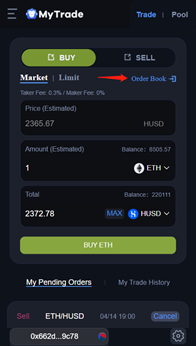

MyTrade, (2021) states they are a DEX that most resembles the user experience of a CEX. They integrate an Order Book and Automated Market Maker (AMM) to bring the best DEX user experience possible. To explain, Dexe.Network, (2021) defines these as:

Order Book: Essential for seeing the volume of orders for both sellers and buyers at every price point. TA factors this data in so it is a huge requirement for traders, i.e., they try to identify where the buy and sell walls are for entries and exits. You can choose your entry/exit and ensure there will be liquidity to fill it. You need Order Books for Limit orders also. We are used to this on CEXs. DEXs struggle with this as it can create high spreads and low liquidity which is not great for traders.

Automated Market Maker (AMM). Most DEXs favour this to solve the order book problem above. Essentially pools are created for each trading pair e.g., HPB/ETH. So, if I sell 100 HPB the pool now has another 100HPB and there will be less ETH on the other side and vice versa. The AMM will adjust the price based on order volume and some other parameters. No human order books are therefore required. With AMM you get more liquidity and less slippage on smaller orders but more slippage on larger orders which creates a problem. Liquidity needs to be high enough to support a large volume.

MyTrade are committed to offering both these options, resembling what we see on most CEXs. To draw in Liquidity, MyTrade, (2021) states they will offer 0.3% of the trading fees to Liquidity Providers (LPs), an essential offering of a DEX according to Dexe.Network, (2021). So, in theory, MyTrade can draw in Liquidity Providers and also offer traders features similar to a CEX with an order book, meaning market and limit orders are possible due to the combination of the two. MyTrade, (2021) states that the order book will allow users to set their buys/sells and the AMM will give the trading depth. I believe there will be community votes on preferred pairs before negotiations start with LPs. In practice, the first LPs are usually project developers so they can put their money where their mouth is so to speak! Also, I believe there are plans to add APIs for traders to automate trades in V2 of the DEX.

MyTrade, (2021) also claims their Total Value Locked (TVL), a core metric showing how much crypto is locked in DEXs/DeFi marketplaces will be boosted due to their addition of sufficient trading depth to swap assets, thanks to the addition of an Order Book.

You get the best of both worlds with MyTrade. Traders will get the best price from either liquidity pools or the Order Book (MyTrade, 2021). They also state trade makers will enjoy 0% trading fees and state that DeFi mining will be more beneficial on MyTrade because you can set higher sells via Limit Orders. What is not to like? Compare this to Uniswap where you have to buy or sell at the price on offer currently! At a ridiculous fee! More on that below.

How to use MyTrade

As mentioned before it’s still early stages but anybody can connect and give it a try. I won’t get into too much detail here. Very simply you can connect via MetaMask. There is a great tutorial of how to use it via the below links.

- Set up guide: https://mytrade.org/#/tutorial

- Transferring between chains guide: https://docs.google.com/document/d/e/2PACX-1vSJCpSrO-3rqd1iWGk_N5dkQeS20v4htV6lej6D1n7xCtGS4tfmaFgQ2i1JvX7gwnMuZzZb1CX3aZAM/pub

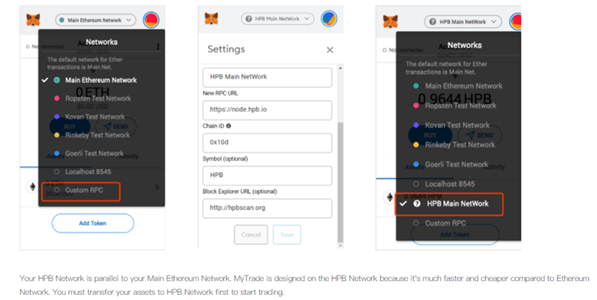

The image above reiterates the need to first add the HPB network to your MetaMask wallet before trading.

From reading comments in the MyTrade TG channel (linked below) it seems the setup is as follows:

- HPB is to MyTrade what ETH is to Uniswap.

- As HPB is EVM compatible Metamask sets the same public addresses on both chains-so you can switch between them.

- At the moment you must first swap from ERC-20 to HRC-20 standard, do your trade on MyTrade, then swap back out to ERC-20. And eventually, this will be branched out to any EVM standard chain.

So why launch MyTrade on HPB over ETH?

Currently, MyTrade is deployed on the HPB Main Network in its Alpha form (V1) and uses the HPB Token as gas for fees on the exchange. I stumbled across a great interview between Jason from HPB and Kris from MyTrade (both co-founders).

MyTrade, (2021) state they chose HPB over ETH due to the problem with congestion on ETH and the insane Gas fees. HPB offers the solution of lower fees and much faster speeds! I believe that the deal breaker was that HPB is EVM compatible, which means the “account system” is the same as ETH so you can connect to Metamask to open MyTrade (As noted above). This means you don’t have to download new wallets; you can use what you have. Convenience goes a long way in the sector!

According to MyTrade, (2021) The reason DEXs on ETH do not combine Order Books with AMMs is partially because of the insane gas fees it would cost to increase smart contract logic of integrating the two. HPB does not have this same limiting factor because its fees are a fraction of the cost of ETH, so provides MyTrade with the optimum solution. Indeed, this seems true, I came across a conversation on TG with the founder of MyTrade stating they offer a “one time free 0.2HPB for Gas” if you connect a new MetaMask account to MyTrade, suggesting it will last you a very long time on the exchange. That sure sounds like a challenge to the competition.

In summary, the advantages I can see from my research are:

- ETH has a huge transaction fee cost coupled with huge congestion problems that can hinder a DEX. HPB solves this with its 5000TPS and negligible costs.

- MyTrade, (2021) states their algorithms are far more complicated than other DEXs so to launch on ETH would cause their fees to shoot up.

- They are focused on EVM chain compatibility first, so utilising HPB as the core chain is a great starting point as they are working on their cross-chain solution with the HPB team, to span further networks. In the future even non-EVM chains.

- It may suit traders more at the beginning, i.e., day trade in HRC-20 standard then convert back to your regular assets. “One swap transfer” may be cheaper on MyTrade also but you still need to pay ETH fees to send and retrieve your ERC-20 Assets. Still though! You will not have to suffer the ridiculous trading fees on top of ETH Gas fees seen on ETH DEXs like on Uniswap.

MyTrade strategic Plan

MyTrade is currently in early development stage at V1 on HPB as explained above. MyTrade, (2021) has just announced the launch of their V1 DEX on Huobi Heco Chain this week (another EVM chain). Both versions will operate under the same domain prefix “mytrade.org”. My understanding is that the Huobi Heco launch is designed to draw in a huge amount of volume as it is far larger than HPB. V1 is where all early-stage development is still taking place.

MyTrade will then launch a V2 exchange back on HPB once the development of their cross-chain solution is finalised. I believe they plan to roll out to as many EVM compatible chains as possible (fully open source) allowing users to access all from within their MetaMask wallets under the same MyTrade domain. So, you can choose the chain you prefer with HPB being the default option, hopefully attracting more attention to HPB. They also plan to launch some form of exchange token after V2, which will attract more attention.

MyTrade, (2021) positions themselves as a cross-chain decentralised exchange, their vision is to not just be limited to deployment on HPB and Huobi ECO Chain (HECO) but to expand onto all EVM compatible blockchains. This is very exciting guys, MyTrade plans on becoming the largest Cross-Chain DEX in the space. This means you will not be restricted to the original chain on which your tokens were minted. I will explain a lot of this in my next article on their Cross-Chain solution being co-developed with HPB (“Asset link”) - you really do not want to miss that one!

ESR Launch on MyTrade

I also have been informed ESR will be listing as one of the first native HRC-20 tokens on MyTrade, providing liquidity for HPB-ESR trading. As many of my readers may be aware, ESR is currently conducting a private sale with their whitepaper about to land 19th April 2021-I plan to do a review of this whitepaper! This dApp has all the hallmarks of being a huge hit in the industry.

Conclusion

I consider myself a true blockchain enthusiast. However, I do not claim to be that tech-savvy, so I hope you found this easy to follow. Decentralisation is what blockchain is all about and we need to train ourselves away from the easy option of CEXs. The DeFi craze is shifting attention to DEXs, we are already seeing comparable trading volumes on some ETH DEXs compared to their CEX counterparts. I am looking to get in early on some new DEXs, I believe MyTrade looks like a serious competitor in this space. They are thinking outside the box, utilising a far superior blockchain in HPB, spreading to other EVM compatible chains, and spearheading Cross-Chain development with their host chain.

With MyTrade we get the user features of a CEX coupled with the decentralisation and security features of a DEX. The combination of negligible trading fees and integration of an Order Book and AMM gives it a clear competitive advantage. The vision to span across multiple EVM chains to be an all-encompassing DEX really excites me and should cause quite a stir in the crypto sphere. There is much development yet to come to realise this vision, so I will be keeping an eye on it. Hopefully, I can release an updated article down the line showcasing its potential in the space.

Further Reading

- MyTrade Twitter: https://twitter.com/mytradeglobal

- MyTrade Medium: https://mytradeglobal.medium.com/

- MyTrade Website: https://mytrade.org

- MyTrade Telegram: https://t.me/MyTradeGlobal

- HPB Website: http://www.hpb.io/

- HPB Twitter: https://twitter.com/HPB_Global

- HPB Telegram: https://t.me/hpbglobal

References

- Agrawal, H., 2021. Decentralized Exchanges Vs. Centralized Exchanges: Know The Difference. [online] Coonsutra. Available at: <https: coinsutra.com="" decentralized-vs-centralized-crypto-exchange=""> [Accessed 15 April 2021].

- Dexe.network, 2021. Order Book vs. Automatic Market Maker (AMM). [online] Medium. Available at: <https: medium.com="" dexe-network="" order-book-vs-automatic-market-maker-amm-3e3bd8e2bb22=""> [Accessed 14 April 2021].

- Gupta, A., 2021. 32 Best Decentralized Exchanges (DEX) In 2021 » CoinFunda. [online] CoinFunda. Available at: <https: coinfunda.com="" best-decentralized-exchanges=""> [Accessed 13 April 2021].

- Kreuz, F., 2021. Why decentralized exchanges like AAVE and Uniswap are catching up with their centralized counterparts | Saidler & Co. [online] Saidler & Co. Available at: <https: saidler.com="" why-decentralized-exchanges-like-aave-and-uniswap-are-catching-up-with-their-centralized-counterparts=""> [Accessed 14 April 2021].

- MyTrade, 2021. Medium. [online] Medium. Available at: <https: mytradeglobal.medium.com="" mytrade-2021-roadmap-released-33f2830d583=""> [Accessed 10 April 2021].

- MyTrade, 2021. Medium. [online] Medium. Available at: <https: mytradeglobal.medium.com="" hpb-mytrade-interview-series-1-9b38c631f707=""> [Accessed 10 April 2021].

- MyTrade, 2021. MyTrade is about to launch on Huobi Eco Chain (HECO)!. [online] Medium. Available at: <https: mytradeglobal.medium.com="" mytrade-is-about-to-launch-on-huobi-eco-chain-heco-3f613bf33fe6=""> [Accessed 15 April 2021].

- Wiesflecker, L., 2021. CEX vs. DEX — here are the differences. [online] Medium. Available at: <https: medium.com="" coinmonks="" cex-vs-dex-here-are-the-differences-143fae4c33d4#:~:text="DEX%20are%20anonymous%20because%20almost,trade%20on%20a%20decentralized%20exchange.&text=While%20CEX%20users%20have%20no,in%20possession%20of%20the%20users."> [Accessed 10 April 2021].

</https:></https:></https:></https:></https:></https:></https:></https:>