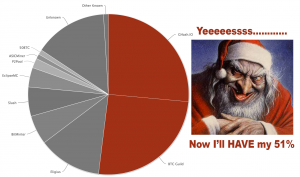

51% attack

51% attack is a term which signifies that an attacker has accumulated more computing power in his hands than all the other members of the network combined: a sort of controlling interest of generating power.

Consequences of 51% attack

51% attack vulnerability is a kind of cryptocurrency’s sickness and a terminal one at that. When a new cryptocurrency isn’t trusted it’s network’s power is poor so enough power for an attack can be accumulated easily. Of course, there’s no economic gain to be yielded at this stage but an attacker could, for example, “kill off” a rising competitor.

Another possible way of application is an attack on already commercially successful currency for profit. However, this case implies that the coin is commercially mined by network members who use their computing power for the generation of cherished coins. In the case of a successful currency, this means that the total network power is enormous as there’s a massive number of people who are engaged in the mining process. Thus a 51% attack becomes hard to conduct.

Therefore 51% attack is a tool of a natural selection of sorts that separates the coins with high potential from all others at early stages of their existence. At the same time, it may present a problem in the future when commercial mining will come to an end. Once in every four years, the reward for a block is halved. Now, this reward equals 25 BTC per block and at the end of 2016 will drop to 12.5. Sooner or later this number will become lower than efforts spent on block generation. Lower people engaged in mining means lower combined network power means higher applicability of 51% attack.

Vulnerability to attack 51% is a kind of children’s disease of cryptocurrency, and the disease is deadly. When confidence in the new currency is small, generating capacity is still negligible, you can easily collect the necessary forces for the attack. Of course, no commercial benefits at this stage can not be obtained, but you can, for example, “kill a competitor.” Another scenario is an attack on a commercially successful currency for profit. However, in this case, the currency provides for commercial mining — its users use their power to generate the coveted coins. In a successful currency, this phenomenon is massive, the total generation capacity is huge. And, therefore, attack 51% becomes intractable. Thus, 51% attack carries out a kind of natural selection of cryptocurrencies in the early stages of development — only the strong survive.

However, it can also be a problem in the future when commercial mining will come to an end. Every 4 years in the network is halving the rewards for the block. So, closer to the end of 2012, the award will be 25 PTS, and approximately by the end of 2016 already 12.5 PTS. Sooner or later, this figure will be less than the effort spent on block generation. Less people are involved in the generation, the less the capacity of the network, the more likely the attack 51%. It turns out that everyone is interested in the continuation of the network, but no one wants to generate blocks for free. The classic scenario of “tragedy of the Commons”.

51% attack and Bitcoin

So, put yourself in the place of an attacker who intended to gain control of the blockchain. Let him manage to split the chain in the above way. One of the formed branches he controls, how to make it so that the network discarded the other? This requires that the aggregate complexity of the blocks in that branch be greater than the true complexity. In practice, this means that the attacker must have more power than the rest of the network, a kind of “controlling packet” of generating capacity. Hence the name “attack of 51%”. What does a burglar get in case of luck? Control of the entire network, no more or less. The ability to carry out any transaction at its discretion. It is clear that it means the death of the currency.

This type of attack can also take place in the Bitcoin network if for example someone will buy an entire batch of BFL ASICs and commit them all to an attack. Although there will be no profit in it. Entire Bitcoin capitalization is around $5.5 billion at the moment. If someone starts withdrawing them at once their price will drop in an order of magnitude or two. Now one just has to compare this to the price of buying the equipment needed for such an attack. Most probably the attacker will be a manufacturer of mining equipment and not a buyer. What is more profitable in the end: to blow up a goldmine and get 10% of all gold in the process or continuously sell shovels to the prospectors for several years? Almost certainly it’s the second.

There’s also a dreamlike possibility of the appearance of fundamentally new kinds of computing equipment, for example, quantum computers. Although in this case the Bitcoin price drop will be the least of our problems. In this scenario, cryptographic resistance will be lost by most of the current encryption systems including those used by governments and banks.

All this doesn’t mean however that a 51% attack on Bitcoin or even Litecoin is theoretically impossible.

Solutions

The vulnerability is fundamental, stemming from the architecture of bitcoin-like cryptocurrencies. This means that by making some changes to the process of generating blocks and confirming transactions, it can be eliminated. One example of how this can be done demonstrates the recently introduced currency of PPCoin. It implements the Proof-of-Stake principle instead of the standard Proof-of-Work principle. Its meaning is that the probability of generating a block is not affected by the generation power, but by the number of coins that the miner already has. That is, to generate 51% or more of the units must have 51% of coins, which makes the attacker the most injured member of the network. Thus, commercial hacking is excluded completely, and destructive becomes difficult and expensive, Nevertheless, the technology is very controversial and carries other dangers, such as the possibility of monopolization of the transaction process by one major holder of funds. In other words, it turns out the same Issuer-the Central Bank, voluntarily distributing the currency in the economy. Strictly speaking, ppcoin uses hybrid technology — and Proof-of-Work and Proof-of-Stake at the same time. Such a system needs to be time-tested, since removing one problem can give rise to a dozen others.

This vulnerability is part of the lives of all involved in various cryptocurrencies. Also, this is a very likely cause of death of the young currency “standard design”, which does not have additional protection mechanisms. Moreover, this problem is fundamental and will not disappear. The night is a nightmare or a Ghost threat — everyone decides for himself.

Thanks for explaining that in details