EOS re-allocates $1bn of capital. Binance vulnerability. Aus government spend $740m on intranet of blockchains. - Weekly Recap 8 July

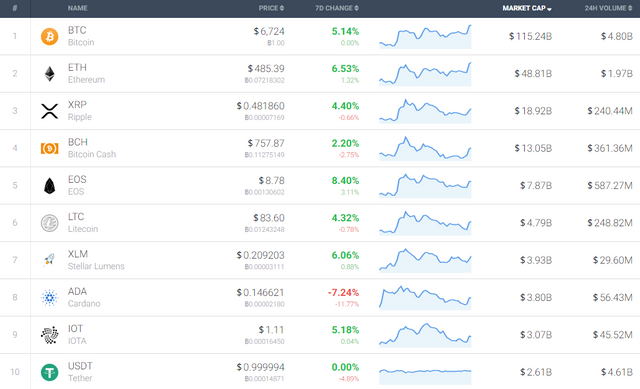

Coinbase custody. Swiss exchange. EOS $1bn VC. BIS rant. IBM 740m Aus gov deal. Binance vulnerability.

Coinbase has launched an institutional custody business through it’s partnership with an SEC regulated broker dealer. The custody service will expand the asset offering beyond the big 4 cryptos listed on coinbase. It will also allow for flexibility (shifting funds between cold and hot storage) and will allow for users to stake their coins in the future.

The Swiss stock exchange is launching it’s own fully regulated cryptocurrency exchange.

The head of the Bank of International Settlements (BIS) believes cryptocurrencies are a bubble and a ponzi scheme and instructed people to stop trying to create money. “Young people should use their many talents and skills for innovation, not reinventing money.”

EOS, the ICO which raised $4bn in funding to build it’s protocol has hired former Jeffries Asia CEO to lead a $1bn venture capital arm. In my opinion this reflects the poor allocation of capital that is currently happening across the cryptocurrency industry. Projects are raising more money than they require and are going outside their circle of competence to generate a return on investment on the surplus capital.

IBM has signed a $740 Million Deal with the Australian Government to build a private blockchain for data security.

Here’s a relevant video from Andreas on why open blockchains matter (and hence why private/closed blockchains are missing the point).

Europe’s largest trader of exchange-traded funds is now making markets in the first exchange-traded notes based on Bitcoin and Ether.

BTCC, one of the oldest and largest exchanges out of China is re-opening its doors. This comes after it was forced to close by Chinese authorities last year. The company was bought out and relocated by a Hong Kong blockchain investment fund earlier this year.

Binance, the world’s largest crypto to crypto exchange by trading volume had to pause trading unexpectedly after an exploit of their APIs saw irregular trading in altcoin “SYS”. As customer funds were put at risk they have taken measures to re-build trust in the community. They have created a “Secure Asset Fund for Users (SAFU)” which will be allocated 10% of all trading fees and used to bail out users in future hacks. Binance also released earnings guidance, with a wide target of $500m-$1bn for 2018 after making $300m in the first half.

Eos really taken so much money that they do not know what to do with it. That can not be the right way for the crypto community

It is a bit worrying. Investors in EOS didn't support them because of their venture capital skillset.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Cryptsheets from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.