8 extremely bullish arguments for bitcoin

Note: this is a view of the long-term horizon (2-10 years). In the short term under current market conditions we can see much lower prices for bitcoin.

I prepared a list of most important reasons why we'll see new all time highs (ATH) in bitcoin in the next few years. If you are a bitcoin maximalist you already know them, but If you are new to the field and discouraged by the current market situation, just walk through the list and you'll gain some confidence.

1. Flaws of the old system

Stock market is overheated, global debt is $233 trillion and growing, the inflation eats people's savings. Something is wrong here. I'm not going to say that cryptocurrencies will solve all the world's problems, but there is definitely a need for a new financial model.

Given the current situation in the stock market I suppose that institutional investors will use bitcoin (and other crypto assets) as new financial vehicles. This opportunity appeared only a few years ago. The real game hasn't even started yet.

2. Millennials

There is a great video about the macro cycles by Tommy Lee. I place the link here, it's highly recommended to watch:

Thomas Lee Presents The Economics of Cryptocurrencies | Upfront Summit 2018

In a nutshell, he is speaking about the driving forces of the markets. Each generation has a certain period of active investing (prime income years) and millennials are in the beginning of that period. And they don't like gold, instead they will most likely prefer the new internet money.

3. The war agains human rights

Just look around. Almost every month we see a new law which potentially could threaten human rights. Here is a list of only the last few: Undo Net Neutrality , Cloud Act , The Law of Border Searches

Big companies such as Facebook and Google are collecting a huge amount of personal data:

https://twitter.com/iamdylancurran/status/977559925680467968

The recent act of banning crypto advertisement simultaneously on all major social platforms (Facebook, Google, Twitter, Snapchat etc.) tells us that there is a clear cooperation between these companies and the government. This leads to censorship and centralisation of power.

But as the Newton's third law states, for every action, there is an equal and opposite reaction. It's just the nature of the universe.

4. Nano-payments ⚡️

The appearance of Lightning Network is a phenomenon of scale comparable to the appearance of bitcoin itself. It creates completely new ways of interaction between network participants. It can be not only human-to-human, but also human-to-machine and machine-to-machine interactions. New business models are to be discovered.

Now we have only about 1200 mainnet nodes, so it's just the beginning.

5. Early state of technology

You are very lucky to be in 1% of the planet's population who are aware of the implications of this technology.

"We are coming and we are coming in waves!" - Carlos, the first blockchain poet.

6. Bitcoin survived several attacks

It's great to see how bitcoin resists network spam and information attacks (Bitcoin Cash, Segwit2X). Every unsuccessful attack attempt confirms that the system has a set of declared qualities such as censorship resistance, immutability and decentralized governance. Each successfully mined block increases the confidence in the technology.

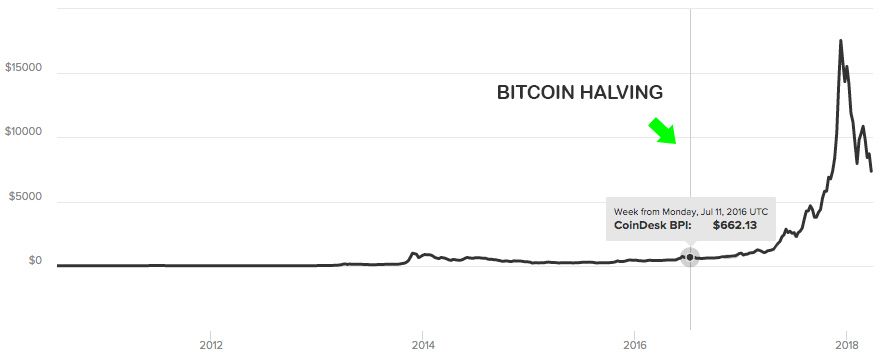

7. Block halving 2020

Bitcoin block halving (block reward decreasing by factor of 2) has a strong impact on the supply-demand ratio. The recent bull run was partially due to the previous halving which happened in 2016.

8. Comparing this bull run to .com run

Let's compare the bitcoin "bubble" to a very similar dot com boom:

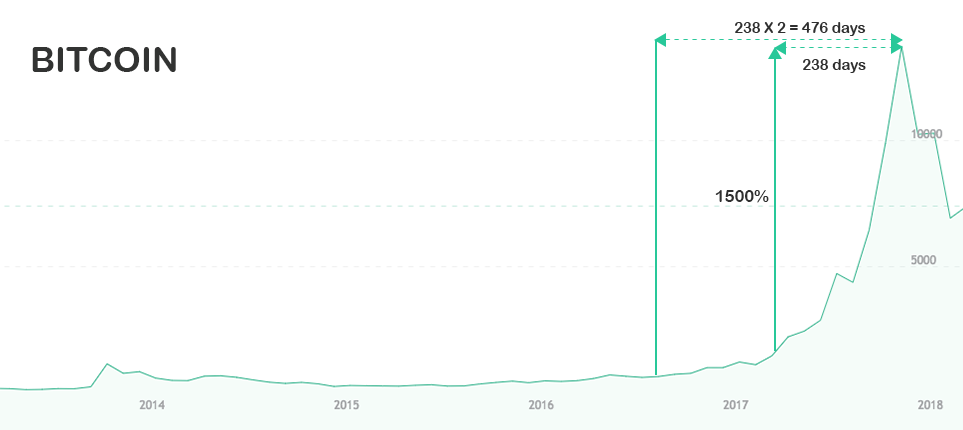

Assuming that the crypto currency bubble has burst in the same way as dot com, we can definitely say that the speed of the process was much higher this time: 238 days against 3472 day to make 1500% run.

We can calculate two ratios:

k1 = 238 / 3472 = 0.0685

k2 = 476 / 3472 = 0.137 (we take the double time of Bitcoin 1500% run, which seems more correct from a charting perspective)

Now we can take the time it took NASDAQ to get back to ATH and make an estimation for bitcoin:

t1 = 5593 * k1 = 383 days

t2 = 5593 * k2 = 766 days

So, approximately after year or two we can see bitcoin at $20K again.

Conclusion

I'm very optimistic about the future of this community and the technology. Yes, the community goes first because it's the most important part. I see thousands of talented people who moving this field forward. Everyday they write code, line by line, adding new features, fixing bugs, discovering new approaches. Guess what happens next? A new generation of technology appears. More scalable, more user-friendly, more error resilient.

And that's all we need.

In line with your reasoning, McAfee gave a talk where he said the Bitcoin price movement was similar to stock market movements only compressed in time. He said if you extend the Bitcoin price charts out (so you are looking at them in slow motion) they look very similar to conventional stock market movements. Interesting idea. Thanks for your hard work.

I didn't know, thanks for the info. But I remember something else about McAfee price predictions :D It'll be fun

good post and content thank you for your contribution