How is the Bitcoin price affected, when the US dollar and Euro inflates ?

Bitcoin prices are mainly measured with fiat currencies such as USD, EUR, JPY, KRW, (formerly CNY before China banned RMB trading with Bitcoin in September 2017). In English-speaking countries, the US dollar and the euro (EUR) are the two major currencies. Both are experiencing continuous inflation due to increased money supply from the central bank's money printing. This article will help you understand the impact of inflation on the price of Bitcoin.

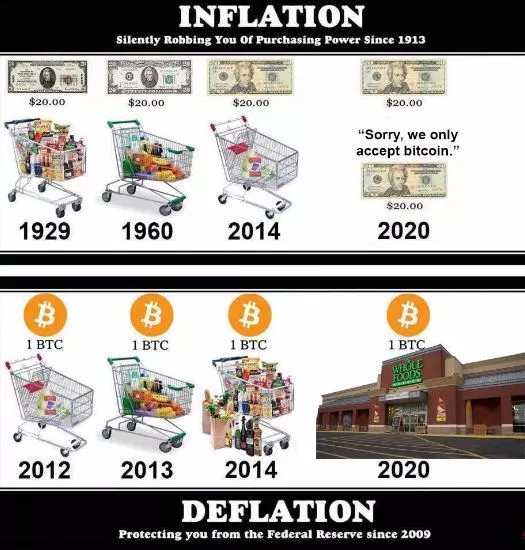

Assuming Bitcoin's value does not change - a bad assumption because it's extremely volatile - to illustrate a concept, if the USD and EUR devalue inflation, the price of Bitcoin will increase. Therefore, fiat inflation will increase the price of Bitcoin in the long run.

CPI data for the United States began to be recorded in 1913, when a basket of goods on the market was $ 9.80. As of June 2018, the same basket of markets is priced at $ 252, corresponding to a 2.470% CPI increase since 1913. This shows that inflation averaged 23.5% per year over the value of USD in 1913 and most of this inflation came after 1970.

In general, inflation is measured by the consumer price index (CPI), which measures the cost of a basket of consumer goods, such as food and gas, and shows the change in fiat quantity needed to purchase. by the time. Here, there is a correlation between increasing money supply from money printing and increasing CPI in the United States.

Since the launch of Bitcoin, the USD CPI has risen from 211 to 252, corresponding to an inflation rate of approximately 20%. As a result, US $ inflation will cause Bitcoin prices to rise by 2-3% per annum. This is in fact impossible to detect because Bitcoin prices are extremely volatile, but perhaps once the Bitcoin market has matured it will become a more important factor.

The CPI of the euro has risen from 90.8 in 2009 to 103.8 in May 2018, showing a 1.5% annual inflation rate since the launch of Bitcoin. As a result, EUR inflation will cause Bitcoin prices to rise by 1-2% per annum against the euro.

One should be cautious when calculating CPI inflation, as there are many controversies surrounding CPI since the calculations have been revised several times by the government. Some people believe that the government is underestimating the CPI to make inflation less real, so that the public does not criticize government money printing.

US M0 money including cash, coin and easy-to-convert assets, increased sharply during the global financial crisis that began in 2008, from less than $ 1 trillion to $ 4 trillion. USD in 2015, showing that the printing of trillions of dollars and inflation is much higher than the official CPI figure.

The huge amount of fiat money printing explains why Bitcoin has a big advantage over fiat currencies. The total number of bitcoins is fixed at 21 million, so in the long term, Bitcoin will not have inflation when mining is completed. This means that in the future people can save money with Bitcoin and not have to worry about losing money from printing money.

By 2018, the extraction will generate 657,000 Bitcoins, equivalent to an increase of about 4% in the Bitcoin supply, which can be considered as Bitcoin inflation. Dollar inflation and Bitcoin inflation are almost canceling each other, if the CPI figures are correct. However, if Bitcoin has a CPI, it will fall sharply because Bitcoin prices will increase rapidly over the long term, so Bitcoin is indeed a strong deflation.

You have a minor misspelling in the following sentence:

It should be in the long run, instead of in the long term,.Congratulations @cybrus343hector! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!