Bitcoin: Capital-gains vs Digital Currency

Bitcoin: Capital Gains vs Digital Currency

Hello again fellow Steemians! I was reading forums on https://www.reddit.com/r/btc/ and stumbled on a discussion on how Uber drivers were soon going to accept Bitcoin as payment. What surprised me was someone's reaction when he asked "Why would you spend Bitcoins to pay a ride?" I didn't understand his question right away because I had a paradigm belief where everyone knew that Bitcoin could be used for payment, until I realized that he saw Bitcoin as something not to be spent but something to be saved since it would increase in value! Which brings me to my topic:

Bitcoin: Is it a store-of-value, like Gold? Or is it to be used as a form of currency for buying and selling products and services?

Because of the massive rally in price of Bitcoin and how people are comparing it to stocks or precious metals some, if not most, buyers of Bitcoin are seeing it as an investment, which I believe it is, to be saved and held on to for long-term capital-gains profit rather than as a replacement for the fiat currency we use in purchasing products and services, which I believe it can too.

Let's examine the 2 cases:

1) Capital Gains Bitcoin

What is Capital Gains? To illustrate it just imagine if you had $100 of CAPITAL and bought Bitcoin when 2017 started and today you sold it and GAINED $800! Using your CAPITAL you GAINED profit -- CAPITAL GAINS!

And so Bitcoin buyers today, speculators and investors, want to invest in Bitcoin despite the network congestion and high transaction fees because they see Bitcoin as a STORE-OF-VALUE that would protect their money from losing value through the inflation of Fiat Currencies and are hoping for higher returns in their investment in the future.

These people don't really mind the rising transaction fees and long confirmation times especially if they are long-term investors/speculators.

2) Digital Currency Bitcoin

Satoshi Nakamoto's original intention and vision for Bitcoin was actually for it to be used as a digital currency for everyone around the world to use as can be read in his original whitepaper.

Bitcoin: A Peer-to-Peer Electronic Cash System

Source: https://www.bitcoin.com/bitcoin.pdf

Bitcoin when it started in 2009 was literally worth $0. People laughed, ridiculed and even called it a scam back then, well, even today actually but that view is quickly disappearing.

So what caused it to gain popularity and rise so quickly? Here are the 2 main reasons I believe caused it in my personal opinion:

- Transaction fees are almost zero (in the past)

People would send Bitcoin to each other for fun and eventually used it the same way we use online banking -- Online banking is only computer code too but it is used to track the balances we have between each other the same way Bitcoin does it too.

When Bitcoin started some transactions could be processed without any fees. Eventually as it got popular small transaction fees became necessary to discourage DDOS attacks. People and businesses then used it instead of banks and remittance centers because of its low fees.

- Relatively Fast Transaction times

Bitcoin's other advantage over the banks and remittance centers was its ability to perform transactions between people without the need for a 3rd party that would just cost money and time (24 to 72 hours). With a Bitcoin transaction you would only need to wait around 10 minutes or less.

These people are affected immediately with any rise in transaction fees and confirmation delays.

Verdict

Bitcoin can be used for CAPITAL-GAINS as long as it is used MORE as a DIGITAL CURRENCY.

The only reason Bitcoin has reached the price it is today is because ordinary people throughout the years were legitimately using it for their everyday needs and wants without really minding the volatility of the price. And it was attractive to use as well because of its speed and cheap transaction fees.

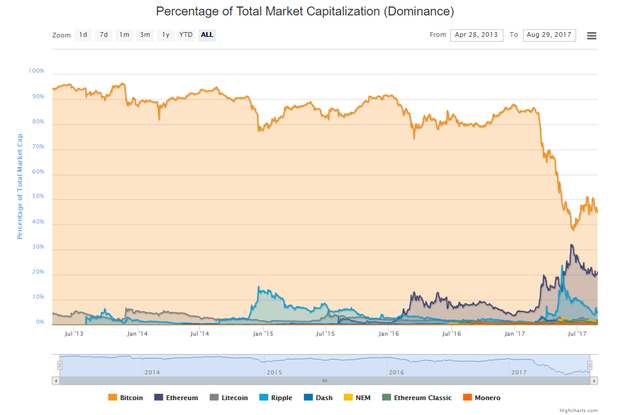

But despite its apparent rapid growth this is actually STUNTED growth. Why? Because it had the potential to grow even BIGGER than it is now. But because of the 1 MB Blocksize limit literally THOUSANDS of transactions a day are delayed for hours and sometimes DAYS!

Segwit was introduced to solve this problem but unfortunately it did not live up to its hype with the same problem still in place. Unless something improves quickly to let people have faster and cheaper transactions again it is only logical that what is coming next is people leaving Bitcoin for something faster and cheaper than bitcoin -- and there are literally hundreds of cryptocurrencies waiting to take its place.

My personal favorite: Bitcoin Cash (Satoshi Nakamoto's original vision continued)

Don't let the crashing price fool you! Could this be a great failure as the Segwit supporters would have you believe? Or will the rise of Bitcoin Cash be the greatest underdog story of cryptocurrency history?

I will make my argument for why it will eventually be dominating the market in the future in another blog.

In the meantime, to learn more about the untold debates between Bitcoin and Bitcoin Cash visit here: https://www.reddit.com/r/btc/

upvoted and followed you if you like fitnessallione please follow me....