Bitcoin Cash (Futures)(BCC), the product of debates and the vision of maintaining Satoshi Nakamoto original plan

What if I told you that a coin was recently release in the market that is a direct fork of the Bitcoin blockchain, on a 1:1 code level with a protocol upgrade to fix on-chain capacity. This coin is special, there is no premining, no ICO or ICCO and everyone who owns Bitcoin(BTC), that is in control of their private keys automatically owns this coin.

Let me explain

At approximately 2017-08-01 12:20 p.m. UTC, this coin would be fork. You have an opportunity of owning the exact # of Bitcoin Cash (BCC) that you currently own in the above date. However, if your Bitcoins are stored on third party exchange like Coinbase, then that third party automatically owns that sum of BCC which they can choose withheld from you if they do not support the project.

Here is quote from the developers, not my own word craft

Quotation "If Bitcoin Cash gets majority of PoW then it becomes de facto Bitcoin.

It will be a Bitcoin without segwit as soft fork, where upgrades of the protocol are done mainly through hard forks, without changing the economic rules of the Bitcoin"

Let's get down into Bitcoin Cash and why it exist today

Here I want to take a snapshot of the given definition as I try my best not to add my flavor of it while paraphrasing.

.png)

The developers are very assertive of theme they want to associate with Bitcoin Cash "Peer-to-Peer Electronic Cash" as they try to make this coin people oriented as originally intended by Satashi Nakamoto. Now there is a lot more twist to this story but today I am focus on giving you the basics that you should know. You can get much more to the twist of this story by checking out this piece by Jimmy Song at https://medium.com/@jimmysong/bitcoin-cash-what-you-need-to-know-c25df28995cf

Here are some new features of Bitcoin Cash

- Block size limit increase: block size limit to 8 MB

- Replay and Wipeout Protection: minimizes user disruption, and permits safe and peaceful coexistence of two chains

- New transaction type: input value signing for hardware wallet and elimination of quadratic hashing problem

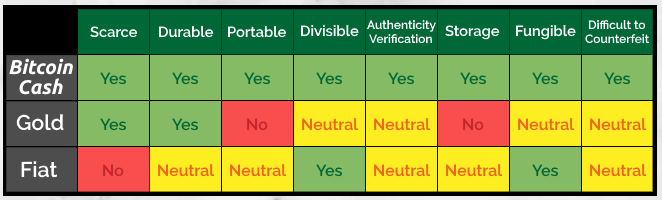

What gives Bitcoin Cash the edge

- Fast: transect in seconds, confirm in minutes

- Reliable

- Low fee: almost negligible

- Simple

- Stable

- Secure

.png)

Useful information with question you may ask?

.png)

Technical side of debate

.png)

Currently Bitcoin Cash Futures are trading at ViaBTC and here on the data base from coinmarketcap

Market Cap: USD ?/ ?BTC

Volume (24h): USD$ 215,079/ 78.80 BTC

Circulating Supply: ? BCC

Current Price: $496.49 (-6.91%)/ 0.18190000 BTC (-5.28%)

Rank: 788

Bottom line and my thoughts

The Bitcoin community made some progress with regard to the scaling debate by BIP91 lock in last Thursday. BIP141 isn't far behind with 64.8% progress made thus far. SegWit2X is on track but not all developers are on board. While Segregated Witness increases the transaction capacity some developers aren't happy and have gone on an created Bitcoin Cash. The likelihood of Bitcoin Cash becoming successful would depend heavily on users and miners willing to adopt this protocol. Probably the discussion would continue after August 1st as the Pro's and Con's of Segregated witness manifest itself but I like one thing about this project, it has the economic model that can take some market-cap away from Bitcoin. The reason I say this, it addresses transaction fees and promises transaction time within seconds to minutes. It also gives you the opportunities to increase your cryptocurrency collection by automatically getting your Bitcoin Cash if you control the private keys of your wallet. The way I see it, if you own 1 or 2 BTC, who knows how high this Bitcoin Cash can go after August 1st, that's just extra money in the portfolio you can play it.

====Sources=====

https://bitcointalk.org/index.php?topic=2040221

https://www.bitcoincash.org/

https://coin.dance/blocks

https://medium.com/@jimmysong/bitcoin-cash-what-you-need-to-know-c25df28995cf

https://coinmarketcap.com/currencies/bitcoin-cash/