Kraken/Bitfinex/Bittrex Confirm They Will Credit Bitcoin Cash to Users, Poloniex Unsure, Coinbase Will Not

Kraken, Bittrex, Bitfinex Supporting BCH, Statements Below

Bittrex Statement

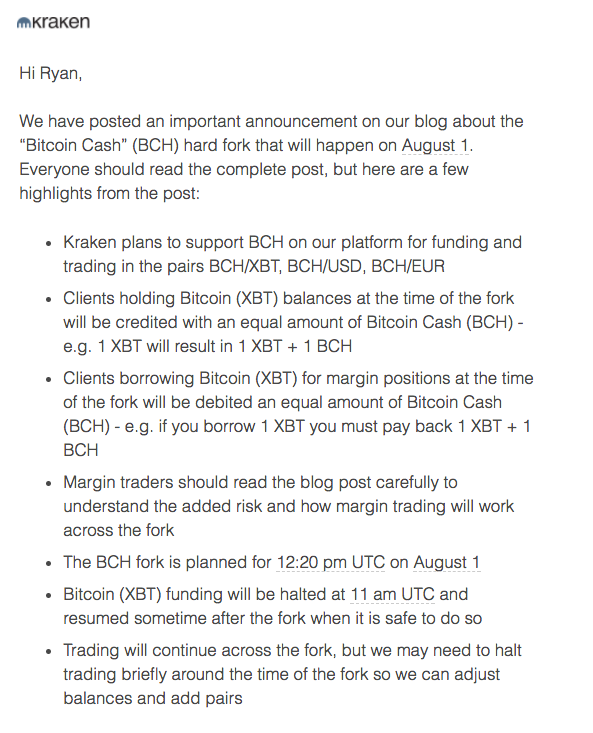

Key part:

If you have a Bitcoin (BTC) balance on Bittrex during the BCC UAHF time on August 1st, 5:20am (12:20pm UTC), you will be credited the equivalent amount of Bitcoin Cash (BCC) on a 1:1 basis. i.e. 1 BTC on Bittrex held during the on-exchange snapshot will get you 1 BCC.

The noteworthy things to me are:

- Kraken and Bitfinex are not giving BCH to margin traders. Bittrex did not specify.

- Kraken is making borrowers pay back their BCH. Bitfinex is not making borrowers pay back.

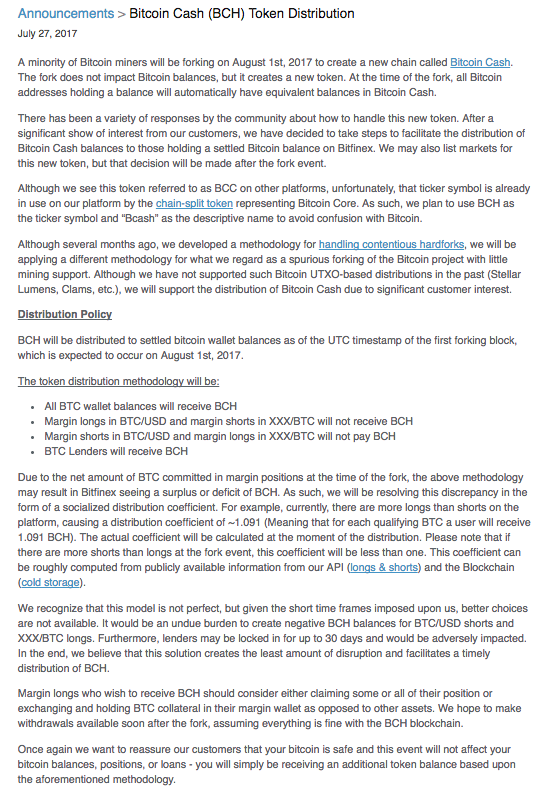

- Bitfinex is issuing BCH based on long/short positions of BTC borrowers, so having 1 BTC doesn't get you exactly 1BCH

- Bitfinex has coin lending, and lenders can still receive their coins even if they are lent

I am thrilled about the lending clause Bitfinex instituted because current lending rates are .3%/day (they are usually around 10-20% that), so I can lend coins for a longer period and still receive BCH for each BTC and dump it quicker than I would be able to by having to transfer it over from a wallet.

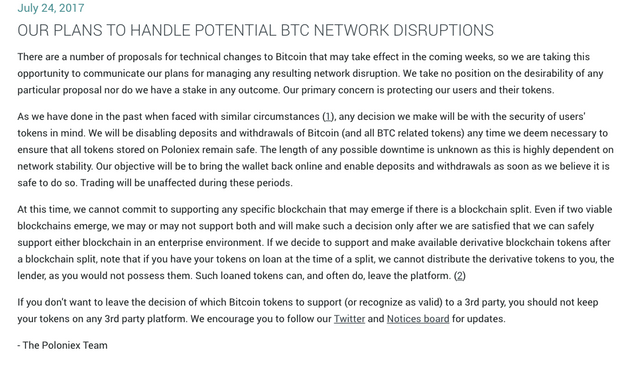

Poloniex issued Non-Statement

Key part:

At this time, we cannot commit to supporting any specific blockchain that may emerge if there is a blockchain split. Even if two viable blockchains emerge, we may or may not support both and will make such a decision only after we are satisfied that we can safely support either blockchain in an enterprise environment. If we decide to support and make available derivative blockchain tokens after a blockchain split, note that if you have your tokens on loan at the time of a split, we cannot distribute the derivative tokens to you, the lender, as you would not possess them. Such loaned tokens can, and often do, leave the platform.

Poloniex issued this statement 4 days ago, but still cannot commit to supporting both chains. Further, unlike Bitfinex, in the case that Poloniex decides to support BCH, forked copies of loaned coins will not be granted.

Coinbase Not Supporting BCH, GET YOUR COINS OFF ASAP

In the event of two separate blockchains after August 1, 2017 we will only support one version. We have no plans to support the Bitcoin Cash fork. We have made this decision because it is hard to predict how long the alternative version of bitcoin will survive and if Bitcoin Cash will have future market value.

This means if there are two separate digital currencies — bitcoin (BTC) and bitcoin cash (BCC) — customers with Bitcoin stored on Coinbase will only have access to the current version of bitcoin we support (BTC). Customers will not have access to, or be able to withdraw, bitcoin cash (BCC).

Customers who wish to access both bitcoin (BTC) and bitcoin cash (BCC) need to withdraw bitcoin stored on Coinbase before 11.59 pm PT July 31, 2017. If you do not wish to access bitcoin cash (BCC) then no action is required.

Coinbase committed early to not granting coins to users. This is typical of them: they charge ridiculously high trading fees compared to other exchanges, and will keep users BCH for themselves.

Coinbase is my least favorite exchange, and the only time I would recommend using them is if:

- You want to sell BTC for USD and cash it out.

- BTC is trading at a premium there.

BTC is no longer trading at a premium there, so don't even bother using them.

Whether you support the idea of Bitcoin Cash or not, claim your free coins.

I think Bitcoin Cash is a shitcoin being pumped by Roger Ver and Jihan Wu and I hope it quickly disappears. They had futures trading as high as $500 per BCH, but I think this was a heavily manipulated number, and it is already down 50% (to .088 BCH/BTC). Regardless of how much each coin is, I'm not turning down free money. I advise everyone else to do the same and claim your BCH, just in case. Whether you keep the coins afterwards or dump them immediately is up to you.

Remember: the safest place to keep your bitcoins is in a wallet where you own the private keys.

I try to keep most of mine on a trezor. Some people use a nano. There are other similar devices. But if you prefer to trade, or want an easier way to get rid of BCH post split, then knowing which exchanges will grant BCH is important.

My name is Ryan Daut and I'd love to have you as a follower. Click here to go to my page, then click  in the upper right corner if you would like to see my blogs and articles regularly.

in the upper right corner if you would like to see my blogs and articles regularly.

I am a professional gambler, and my interests include poker, fantasy sports, football, basketball, MMA, health and fitness, rock climbing, mathematics, astrophysics, cryptocurrency, and computer gaming.

Amendment

I misread something in the Finex statement (I updated my blog) but want to clarify it now because it's a little tricky.

Unlike Kraken, Finex is not requiring those borrowing BTC on the platform to pay back the BCH owed. Bitfinex is instead weighting the longs and shorts of BTC and distributing the according number of BCH.

So as of yesterday when the announcement was posted, there were more BTC longs than shorts, so Finex would have issued ~1.091 BCH for each BTC someone had on the exchange. But if instead there are more shorts than longs, Finex will issue less BCH per BTC.

Consider the following example to illustrate why:

Imagine if person A loans out 100 coins to person B.

person B then sells them to person C cause person B is shorting the coin.

Person C then withdraws those coins to a personal wallet where he owns the private keys.

Now Bitfinex doesn't even have the 100 BCH to match the borrowed 100 BTC! Thus, if there are more shorts than longs, they will pay out less BCH. So it's possible we could only receive something like .8 BCH for each BTC in our Finex account.

BUT

By having BCH on Bitfinex immediately after the fork, it's possible we could get a better price for selling those BCH by selling before the price drops when others deposit coins to sell them.

Also, by having BCH on finex, we could possibly loan those out to people trying to borrow them on margin to short them at outrageous rates. Give me 5% interest/day on something that is crashing and I don't really care if it's crashing.

Making the right decision is a really tough balancing act.

I have to consider:

This is complete chaos and I FUCKING LOVE IT.

Bitmex have also confirmed they will not credit bcc

Good content. i already lost 100 euro on coinbase. Waithing for it over 3 weeks. Also betting on NFL?

Thanks for the information!

If I put BTC on Bittrex to collect Btc Cash....How long should it take to recieve BCC cash? Any ideas?