HODLERs can be uninformed Morons. Do you understand you are NOT buying lottery tickets??

Are you one of those people who like to post (or comment):

HODL until the moon.

HODL forever.

Or some other HODL nonsense.

I'm sorry to hear that. You haven't done enough research into reasonable investing strategies. You are probably a millenial and are just beginning to make some of your first investments. And you assume HODL is a great strategy that is guaranteed to win.

Step back and think about your actions. You are treating crytpo EXACTLY like a lottery ticket. HODL until the value of what you are holding is zero, and then toss the scraps away.

Isn't that what you do with the lottery tickets you buy? Why are you confused about the difference between cryptos and lottery tickets?

Sorry dude. Or dudette. If BTC was your first rodeo, you are getting a trial by fire.

Let's look at data and facts.

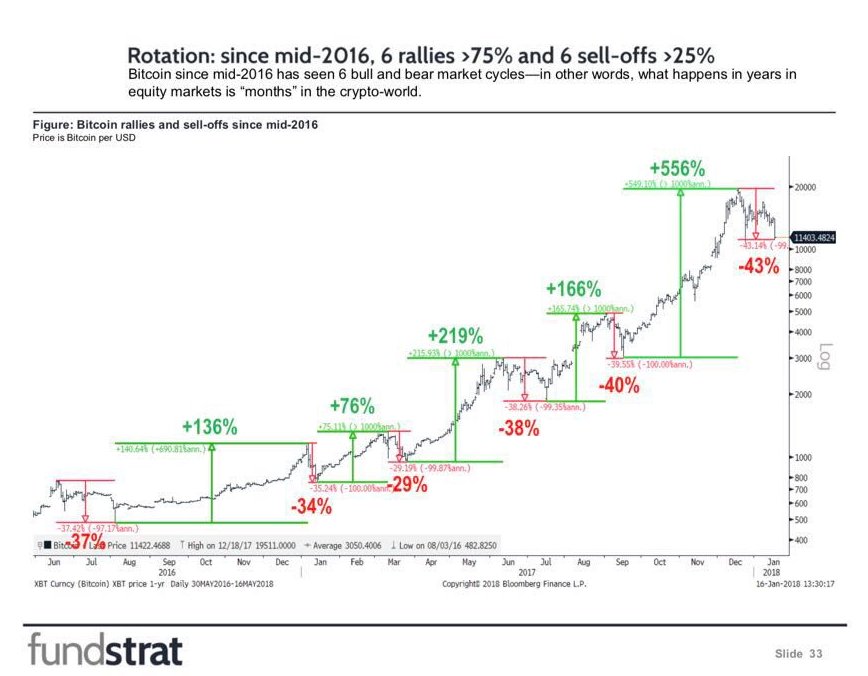

The last upleg for BTC was 566%. The corresponding down leg could easily be 90%. Based on 40% downlegs being common for uplegs of 200%.

BTC at its peak was approx. $20K. It is possible BTC won't find support until $2,000 per BTC range.

A 90% drop. Am I guaranteeing a 90% drop? Nope. Just saying it is definitely in play as a possible outcome.

And now you are asking - what should I have been watching to determine when to TEMPORARILY back out of the market and let the extreme volatility settle down?

You should have been watching 50, 100 and 200 day SMA lines. Simple Moving Average.

You probably should have sold when BTC dropped below the 100 day SMA. You would have sold at $12,000.

And when BTC dropped below the 200 day SMA at around $9,000; you should have been running for the exits at high speed if you tried to hold through the plunge below 100 day SMA.

A steep price drop that plunges below the 200 day SMA is as bearish a signal as you can get.

When do you get back in?

Watch for upwards piercing crosses, above 50, 100 or 200 day SMA, depending on how confident you want to be for about the bullish trend, before you put money at risk again.

A few thoughts for your trading mind to consider.

I am hoping for an upvote from an everyone who can see that the haejin TA and triangles are a bunch of BS compared to trading signals for volatile markets using SMAs.

When all you see if a rising market, then you can draw triangles and post 10 articles a day predicting upwards price movement. In a rapidly rising market, continuously predicting a continuing price rise can look like genius. To the uninformed. But that doesn't change the old saying.

With a strong enough tailwind, even the fattest turkey is able to fly (to the moon).

STEEM ON !!

DaveB

Most of my long-term hold are my strong platform tokens. These I will be HODLing for a very long time. I bought many of these below $1 (NEO, STEEM etc...) You are correct but only about spec coins and shitcoins. If you are still hodling those then you are correct. ;) Many of these will correct below ICO and can be bought again @ or below your previous cost.

I'd argue that so little is known and understood about crytpos, even by the so-called experts, that it is impossible to predict long-term winners. NEO, STEEM, etc. are good. But is good going to be good enough?

I agree. Anyone that proclaims to be an "expert" at this stage probably is a software dev. and is speaking on his familiarity w/the software itself. Not the price action! ;). Also, it is only my opinion about NEO, STEEM etc....will be good hodls. They certainly could turn down quickly, I'm just putting my money on them rather than many others. I feel platform tokens are the "safest" simply because many other tokens will depend on their adoption to use successful utility coins. Just because the specific utility coin doesn't work out doesn't mean NEO for example will also fail.

"You are correct but only about spec coins and shitcoins" well said. Ignorant people and gambler have made this market delicate and vulnerable. they are busy with fruits ignoring the root of the tree. thanks.

Oh well.... easy come easy go.....

hodl and sell the peak

Sounds like a great fantasy. How do you plan to make your fantasy come true?

he has no idea ;)

lmao okay guys.... sure

lol, just messin' w/u. U make it sound so easy. Hodling is, but timing the peak....very difficult! Best of luck 2 ya!!

Some people will be HOTZing (Holding on to zero!)

Yep !!!! Many of the "HODL UNTIL THE MOON" crowd, are going to be holding to zero

“Our favorite holding period is forever.” - Warren Buffett, richest investor in the world.

Not to disagree with you but if you are going to quote Buffett on that, then it appears you are in the wrong arena;

https://www.cnbc.com/2018/01/10/buffett-says-cyrptocurrencies-will-almost-certainly-end-badly.html

In that article he says he isn't shorting anything and admits: "Why in the world should I take a long or short position in something I don't know anything about." That's his other advice, to only invest in what you understand. It is his guy feeling that it will go bad but he doesn't trade on gut feelings. That's why he is the richest investor.

You do get my upvote for this, however.

He has been straying off what he knows in recent years. And is paying a price. Look at what has happened with Warren's jump into tech stocks with IBM. Very ugly. Sure, he recovered with Apple, but I think it was a lieutenant of BRK that got BRK into Apple.

Well then, by his own logic he should fail. I also have no idea why he is making any crypto predictions when he admits he knows nothing.

Anyway, S&P500 beats over 90% of managed funds so I just go with them. Index funds don't get emotional and make bad decisions.

Makes sense. I agree. Lets take Nasdaq as another example.

Do you think QQQ is a decent index ETF to invest in?

If QQQ is good, is TQQQ better?

TQQQ is a leveraged ETF and those make me uncomfortable. I like simple equity plays. QQQ gives you a nice stable-ish basket of stocks while TQQQ is more of a short term play, in my amateur opinion.

I'm not saying I like trading on SMA's but the SMA is a fact. You can argue how to interpret it but you can't argue that a moving average isn't real. I'm done with all of this talk of waves and triangles and cups. That's no more real than the constellations in the stars.

Look at Warren's behavior. He doesn't hold everything forever.

You obviously have to reevaluate your portfolio. However, top investors do that on the scale of decades, not days or weeks. I no longer believe Bitcoin can be on top in 10 years so I do not own any.

Agreed again. Innovation in BTC is too slow, and governance is so ffff'ed up that it will never be able to keep up. On top of that SHA2 will be cracked within 10 years, and that is the end of BTC as we currently know it.

Seems like close to a certainty that BTC either won't exist in 10 years, or it if still does it will be a minor novelty. Kinda like AOL.COM has been over the last few years.

Agreed. Not sure if it will be cracked but at the very least PoS and more energy efficient algorithms will start to take over. Also, I believe a zero-fee protocol will win.

He's saying that as a rich old man looking back at life, one who counts Elliott Waves on a yearly chart..

He's a romantic who won't live forever.

Though it's forever nice to be grandiose - but most folks, especially the young, feel they don't have the time ;)

Resteemed your article because this is just 110% true @davebrewer!

All those experts out there with three days' experience through hearsay are getting on my nerves. HODL is just one of many strategies and not always the right one. If everyone could think rationally instead of shouting Moon or Lambo, the world would be a beautiful place. But at least this way, the clever and experienced people can continue to enrich themselves.

I am also a friend of Hodl's, but I should have sold everything on the 4th of January and not just a part. Learned for the future

I couldn't agree more. You are totally right. No one can predict the how price and future of coins. I bought steem when it was $2, with 300% increasement it was $6. I tought in that time, this is super easy, seems like easy money right? But look it now. I am at very begining, maybe will lose money if this madness continue.

Cryptos, being "the wild frontier" of investing also seems to attract a lot of first time investors and "lottery players" who are attracted by the possibility of 900% returns. It's not that different from what used to be called trading in "pink sheet" stocks and even penny stocks.

I expect Bitcoin could keep going all the way to about the actual current cost of mining.

Personally, I am more of a "fundamentals" type of investor. Which is why I like assets like Steem ad Bitshares that are based on something more than promises and thin air.

Excellent point. Smooth path for price to go all the way down to cost of mining. And for a short period of time, price could even go below the cost of mining. But price couldn't live below cost of mining for too long, before the miners would start to question why they are still mining.

This article is a perfect bric for the building block of crypto knowledge. thanks for it. Lets set back another two days to invest in crypto.

@echowhale team swimming by with your upvotes

@echowhale

@echosupport

@babyechowhale

@journeyoflife

@carterx7 and @angrydolphin : will shortly do the same