BITCOINCASH ON BITTREX

#BCC #bitcoin #India

BitcoinCash(BCC) Volume biggest on BITTREX:

The great Bitcoin fork has just happened and things are going smoothly so far, there have been no blockchain reorganizations and no further sub forks. Currently Bitcoin Cash’s blockchain is 50 blocks behind the main chain, putting it roughly 8 hours behind. The reason for this lag is because it took miners quite a while to find the first block, some people panicked when a block couldn’t be found, but eventually one was found by ViaBTC.

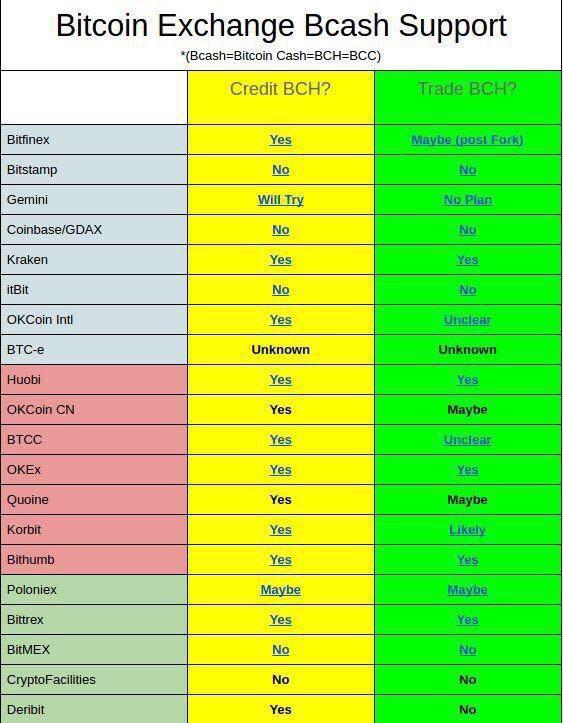

Before The fork There is only three exchanges Trade the BITCOINCASH(BCC).

ViaBTC, HitBTC, and Kraken were only the exchanges that support the coin.

But As Fork Announced, Many of exchanges Added bitcoin cash Trading pairs.

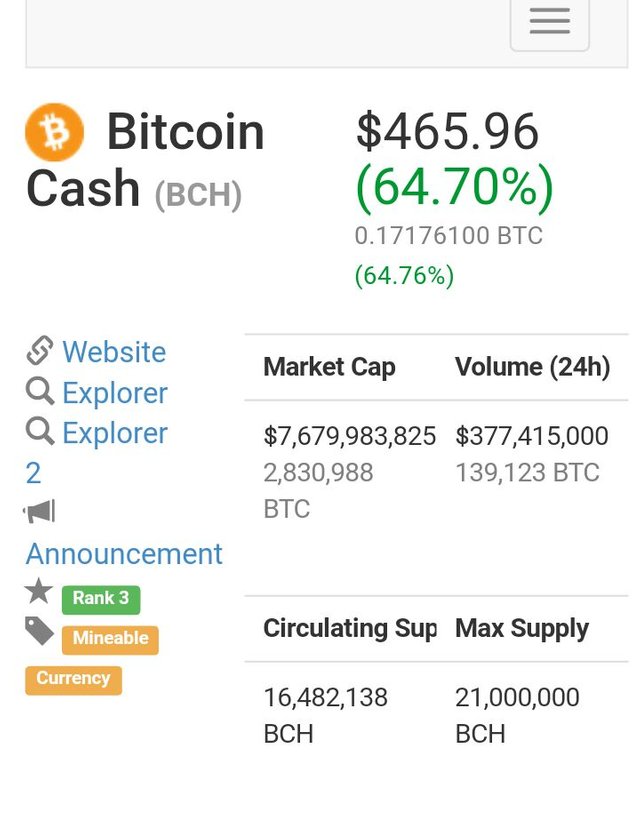

(Coin Market Cap)

Market Cap

$7,554,378,479

2,798,531 BTC

Volume (24h)

$360,428,000

133,521 BTC

Circulating Supply

16,482,113 BCH

Max Supply

21,000,000 BCH

Bittrex :

PAIR(BCC/BTC)

Volume 24hr($163,232,000)

Price($728.50)

Volume in %(45.29%)

RecentlyAs per According to Coinmarketcap.com, There is 20 % to 30% increase in trading volume on BITTREX.

What is interesting is how exchanges are at a disagreement when it comes to the naming convention of the token. It seems there is a 50:50 split between using BCC or

BCH. While the exact name of the coin is up for debate, some argue that using the name BCC creates ambiguity. There is already a cryptocurrency called BitConnectCoin

using the acronym BCC. Thus, exchanges supporting both cryptocurrencies would have to differentiate between the two if Bitcoin Cash is traded as BCC.

Furthermore, BitConnectCoin is not just another altcoin that can be buried in the ground. It boasts a market cap of over $300 million and trades at $54 per coin. Using

BCC for both Bitcoin Cash and Bitconnect creates unnecessary compatibility issues if an exchange chooses to support both trading pairs.

Speaking of unnecessary issues, if Bitcoin Cash keeps trading at the current $200-300 range, Coinbase might find itself in quite a predicament.

Their controversial decision to not support BCC tokens, and complications and delays with withdrawals might hold them liable for the losses each of their users

incurred by not being able to either move their coins off of the exchange, or not being able to receive their share of BCC.