Bitcoin Drops Nearly 20% as Exchange Hack Amplifies Price Decline *ALL NEWS*

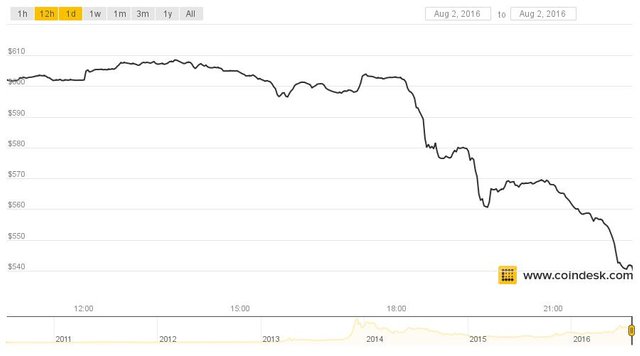

The price of bitcoin fell sharply today exacerbating an already existing decline as global market participants reacted to news that one of the largest digital currency exchanges had been hacked.

Earlier this afternoon, Hong Kong-based exchange Bitfinex halted trading after discovering a security breach, which included taking its website offline and pausing all withdrawals and deposits. Representatives from the exchange told CoinDesk engineers were seeking to uncover issues at press time, though the company had confirmed roughly 120,000 BTC (more than $60m) has been stolen via social media.

In response, bitcoin prices fell to $560.16 by 19:30 UTC, $530 by 23:30 and $480 at press time, CoinDesk USD Bitcoin Price Index (BPI) data reveals.

This price was roughly 20% lower than the day’s opening of $607.37 and 27% below the high of $658.28 reached on Saturday, 30th July, when the digital currency began pushing lower.

Arthur Hayes, CEO of bitcoin leverage trading firm BitMEX, emphasized that this event had a clear and measurable effect on bitcoin prices.

"A high profile hack is not good for sentiment and curtails the ability for market makers to keep an orderly market."

Market observer and trader Jacob Eliosoff provided similar input, telling CoinDesk that the event had sparked a new wave of uncertainty.

"The big question will be how much was stolen and whether Bitfinex will make customers whole," he said. Market participants traded more than 600,000 BTC via Bitfinex during the 30 days through 2nd August, Bitcoinity">Bitcoinity data reveals. This figure represented represented 1.6% of the more than 39m BTC transacted through various exchanges during the 30-day period.

The halving's impact

However, the price decline does not appear to be the sole result of the issues at Bitfinex.

Bitcoin prices experienced a gradual, downward movement over the course of several days, with market observers pointing to the halving of rewards on the bitcoin network as the cause. This event – which coincided with a 50% reduction in the mining subsidy – generated significant visibility and took place 9th July.

At the time, there was no major change in bitcoin prices, despite expectations that such a move may have been probable.

"It looks like traders got a bit ahead of themselves thinking that the price would go in a straight line after the halving," said analyst Tuur Demeester. "The halving is real and will have real effects."

One such effect is profit taking. Petar Zivkovksi, director of operations for full-service bitcoin trading platform Whaleclub, spoke to this development, noting his belief this trend was "in full effect" after the halving.

Still, he suggested the impact could be limited due to existing market support.

"There are still plenty of ‘stubborn’ longs open," he added.

Search for meaning

The drop below $600 may also indicate a change from the bullish sentiment that has so far characterized 2016.

For example, Joe Lee, founder of leveraged derivatives trading platform Magnr, stated that bitcoin's drop below $600 could indicate that the currency's long-term fundamentals are weak.

He emphasized that market observers would be watching bitcoin prices “to see how much of bitcoin’s steady growth has come from long-term holders."

Going forward, market observers also offered predictions on where bitcoin prices will go next. Now that the digital currency has breached $600, it will test $550, its low before the Brexit vote, said Hayes.

Tim Enneking, chairmain of cryptocurrency investment manager EAM, interpreted the recent price decline as evidence of a post-halving fallback, further stating that bitcoin will find support above $500.

Zivkovksi told CoinDesk that the digital currency’s decline below $600 “could signal the start of a medium term bearish trend powered by a strong long squeeze and a lull in bitcoin interest by the general public.”

While these analysts pointed to future weakness in the digital currency and potential declines, Demeester emphasized that not only did he not “see any sign why this bull market is over,” but he expected the price would “go a lot higher over the next 12 months.”

Hi! This post has a Flesch-Kincaid grade level of 11.4 and reading ease of 59%. This puts the writing level on par with Michael Crichton and Mitt Romney.