Massive Bitfinex Hack: thoughts on hard fork, fungibility, ETH versus ETC and Monero

So guys, this is a crazy night...

It seems that ~ 120000 BTC are stolen from the Bitfinex wallets! This is almost 8% of the current BTC in circulation! So what are the consequences?

Well, when we look at Ethereum where a similar hack (around 10%?) happened just a few weeks ago, the DAO hack, we can see that there was a big push for forking the blockchain. Vitalik Buterin, Stephan Tual, Griff Green, Andreas Antonopoulos & co wanted a hard fork which would return the ether to the "rightful" owners. It is, in theory at least, possible that people will try to lobby for this to happen on the BTC blockchain as well.

But... Looking at the result this had on the Ethereum-chain, I doubt it will happen. When Vitalik pushed his Hard Fork decision on the ETH "community", he thought immutability wasn't such a big deal. Well, now it seems that the market seems to care:

The immutable Ethereum Classic seems to gain momentum and maybe we'll see it even overtake Ethereum HF.

In any case, I think the result will be that those 120k hacked BTC will be very hard to spend. It is VERY likely that exchanges and payment processors will block those coins. This will clearly show that Bitcoin has fungibility issues!

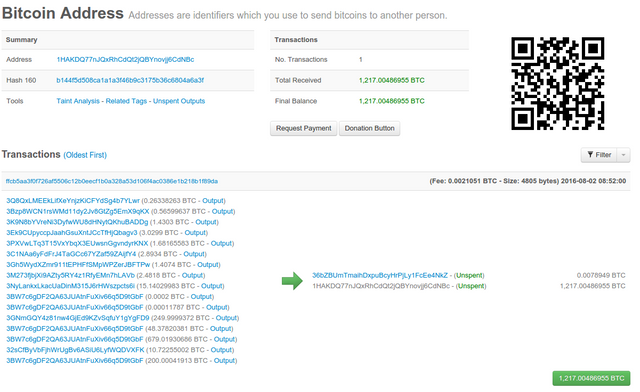

It's pretty easy to identify the hacked coins. All coins originating from the address 1HAKDQ77nJQxRhCdQt2jQBYnovjj6CdNBc are involved in the hack:

Fungibility is a property of cash. It doesn't matter what the transaction history of a paper note was. Even though a paper note has serial numbers, nobody cares. Every paper note is accepted by everyone. In the real world, fungibility is enforced by law.

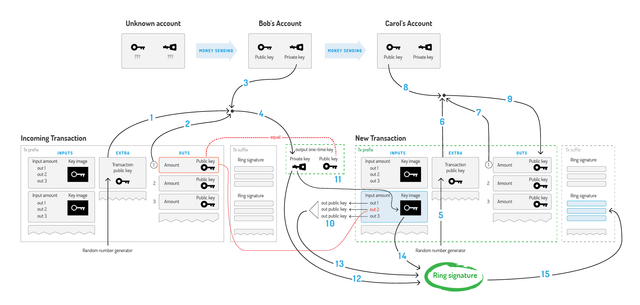

But... Most cryptocurrencies log every transaction in a transparent blockchain. It's possible to trace the transaction history of certain funds back to drug deals, hacks, money laundering services, etc. The ONLY way to have fungibility in a cryptocurrency is by implementing DEFAULT anonymity features. When all transactions are untraceable, it's impossible to follow the money trail and thus impossible to blacklist funds.

So in my humble opinion, the ETH and BTC hacks are VERY bullish for cryptocoins which have anonymous features by DEFAULT. There aren't many coins in this category, and Monero is without a doubt the best tech. It enforces Ring Signatures for every transaction.

It's already alive and kicking since 2014. It's stress tested, hacked, forked and scrutinized by a lot of people. It's solid tech. If you don't believe me, just do some f*cking research. You may start by reading the MRL papers or just ask some questions on our reddit :)

I am trying to raise this issue since 2014, but not many people seemed to care. Well, with these 2 high profile cases, soon a lot of people will care. This will finally result in awareness surrounding fungibility.

I want to be able to use and own REAL DIGITAL CASH. Not some traceable digital tokens like BTC or Ethereum Classic. Humanity deserves more than that. We owe it to ourselves to develop and be able to use the best tech available!

It's NOT about anonymity folks, it's about fungibility!

Read this article over and over again until this sentence makes sense to you...

...or if you really don't want to put in the effort needed to understand the problem, you can just try to figure out this joke:

Cha! good ol monero!

Nooooo, please not monero.

It got its flaws and has an army of trolls.

Good info !

Interesting : I did not find this Bitcoin address in the news : what is your source of information on that BTC address been the one used in the Bitfinex hack ?

I might have to update my post

This is my source: https://www.reddit.com/r/Bitcoin/comments/4vupa6/p2shinfo_shows_movement_out_of_multisig_wallets/d61m5rh

This is an amazing article and well written. Great insight and legwork. Fungibility is a real issue that needs to be addressed in btc and etc (eth is no longer relevant).

good post @dnaleor 8]

Upvoted

Disagree, the coins are not hard (but not easy) to move. A little more research in this area for your article would have been nice. It's not like they'll be aim to get the funds out in one withdraw. He's clever, he's thought it out.

Keep up the great work @dnaleor

Upvoted

And again a hacker made money by simply shorting the hell out of BTC. From about 600-470 EUR in just a few days

no more hacking

Keep up the great work @dnaleor

Upvoted

Keep up the great work @dnaleor

Upvoted