US Stock Markets & Cryptos Crashing... Is This The Big One?

After the 666 point drop on the 33rd day of the year on Friday, which I said likely was a signal that things were going into play, the Dow Jones Industrial Average (DJIA) lost as much as 1,597 points by mid-afternoon on Monday.

The Dow ended up closing down 1,175 points, or 4.6% which was the largest single-day decline for the blue-chip index on a points basis in history.

But, the Dow, like most things, has been inflated higher due to historic Federal Reserve money printing since 2008, so a 1,000+ point drop now with the Dow near 25,000 is nothing like it was even in 2009 when it was under 9,000.

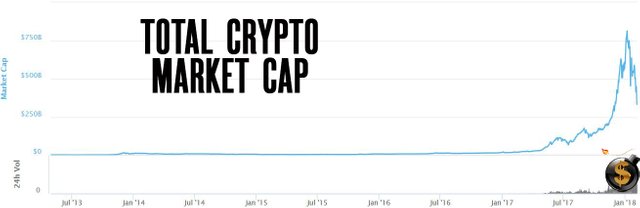

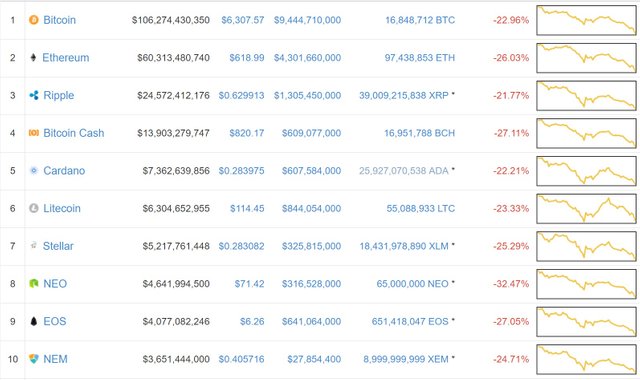

Meanwhile, the cryptocurrencies continued to get routed and have not fallen below $300 billion in market cap after being above $800 billion just one month ago.

Bitcoin is now below $6,500, Ethereum is close to $600 and every other cryptocurrency in the top 50 in market cap was massively in the red again today.

I’ve been saying for the last two months to be taking profits. This is why. I also said on Friday that it still isn’t time to buy. I’ll be updating subscribers (subscribe HERE) first when I think we are close to the bottom.

This afternoon I joined Kerry Lutz on the Financial Survival Network to discuss where things are at in the cryptocurrency space and where things may go from here.

You can see it here:

As you may have heard, Anarchapulco & Cryptopulco, from February 15-18th is completely sold out at 1,500. But we will be livestreaming the entire conference. You can find out more HERE.

The Dollar Vigilante Investment Summit still has spaces available, however, and will be held on February 19th. So, even if you couldn’t get tickets to Anarchapulco you could still come down and watch the livestream by the pool, enjoy the evening festivities and then attend the TDV Summit where cryptocurrencies will definitely be a hot topic of conversation!

I wonder how many people panic-sold into one the $6k support zone, yesterday?

Great read! So you’re saying crypto is about to explode and start seeing green again?!

Let us hope so bahahaha!

People shouldnt get too happy, there is still a long way to go for the crypto and stock market to corrrect their selves and us star seing more profits. This is the time to buy no doubt abot that but but is also time to look at your portfolio and and see what needs to stay and needs to go. I think the best bet now is buy buy buy winners and set up an exit point to profit from it and see the next face in btc

cool logo man

Not sure if serious...

Hi Jeff, how's it going Miles?

I have bought over a $100k over this correction and adding more with further drops.

This is the opportunity of a life time to get real money into the game!

Not the end. Just a healthy correction. Don't be a weak hand. The whales want to shake you out of the market and buy your crypto cheap...

The price in 'dollars' can do whatever it wants. I don't care because I just keep mining it using the BitClub Network that I joined under Jeff. http://bitclub.network/dibble1

I have a theory...

Now don't get me wrong I believe bitcoin will succeed

But there was some heavy coin hopping going on to inflate all these prices...

bitcoin moved into ethereum, ethereum spawned ethereum classic, ethereum then pumped up a bit,

Then Monero shot up

For a while nothing, until end of december Dash started to go up

At the PEAK of Dash's price Ripple started to go up as Dash was going down

Then at the peak of Ripples price Ethereum started its run as Ripple made its way down...

check out the pattern for yourself on coinmarketcap, the charts prove what I am saying...one day Ill make a more detailed post with pictures and dates and everything

That’s a really interesting theory! I’m looking forward to hearing more about it

The banks are running scared. They will attempt to sabotage any threat to their criminal existence.

Simply a short correction in equities that was long overdue. Last correction was in Nov 2016. Every day since has been green, some breathing room was due. The short VIX funds being wiped out was fascinating, however.

Cryptos is another story entirely. Weak, uninformed hands being squeezed and they are performing beautifully for their long-term compatriots. For now, cash remains king but a buying opportunity seems to be emerging on the horizon this spring.

Bouncing back now. I don't think this is the big one. There was no catastrophic fundamental news other than worry about interest rate rises. This is likely a small correction, but when interest rates do rise, that's when things will go to the wall.

I think this might be different than last time, people know this is the big one and big investors were pulling money out of banks way before the general public was aware of the damage last recession. I think that they might try to get ahead of the deflationary event and take profits before official numbers go to print.

I think that even if there is a recovery numbers in a lot of key cities show that real estate has already been faltering, U6 has been terrible and tells us way more than U3 does. The flight to safety is just beginning, get ready people.

Yes you could be right, although the flight to gold (the ultimate safety) is a bit muted so far. Having said that it's risen steadily since 2016. Silver is looking very lacklustre at the moment though. It's got some work to do to catch up.

TFW you see one of your memes being shared about.

Well done sir!

I am going to use that one a lot if you do not mind, since it is one of my favorite ones out there by a large margin.