Will ICOs Take Down Wall Street The Way Bitcoin May Take Down Central Banks and Fiat Currencies?

I’ve said it many times in the past. Blockchain technology is the biggest evolution since the internet.

We’ve seen bitcoin quickly become a challenge to fiat currencies and central banks.

We’ve seen Ethereum change the very nature of apps into dapps or decentralized apps. And, it’s barely even begun yet.

And now we are seeing ICOs, Initial Coin Offerings, change how companies are formed and funded.

ICOs, similar to bitcoin, threaten entire industries.

It threatens the traditional investment banking industry… could that be why Jamie Demon hates it so much? Ya think? Over $3 billion has been raised by ICOs in the second quarter of 2017 surpassing the total funds raised via traditional equity financing for the first time.

It threatens the traditional stock exchanges.

And it certainly threatens the government regulators.

And the businesses that are being built with the ability for their tokens to be tradeable without third parties will threaten almost every other traditional business sector in the world.

To say all of this is a massive paradigm shift is an understatement.

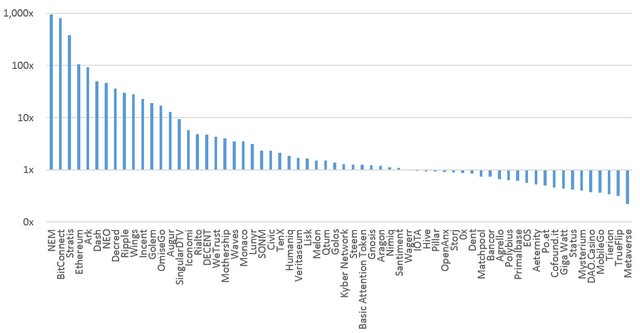

ICOs have proliferated in the last year and, so far, on average, they have performed very well for investors.

ICOs remove the stranglehold on investment capital that has been monopolized by the big investment banks and made prohibitively expensive and restrictive by criminal government regulators.

The Chinese government has, as we’ve seen, been one of the first to, as Christine Lagarde puts it, “banned the initial, um, offer of, um, bitcoins.”

And, I have zero doubt that the criminal SEC will soon violently attack those who peacefully and voluntarily participate in the ICO market.

But, like with bitcoin, they can’t stop it. They can only do what all governments do; threaten violence and extort people who try to make the world a better place.

So, there will definitely be a lot of bumps along the road… the same as there will be for bitcoin… as governments and central banks try to stop progress from occurring.

And, there will be plenty of failures, scams, and drama as always occurs in the free market.

But, there will also be investment opportunities potentially of a lifetime.

We’ve covered numerous ICOs in The Dollar Vigilante newsletter (subscribe here) and have done fantastically well on all of them except one. I’m looking at you EOS (more on that coming out soon in an interview with Dan Larimer).

But, from time to time on Youtube, I’ll also interview the founders of ICOs I find interesting as I have found very few people are covering the ICO space very well.

The first is one called Decent.bet (DBET).

They have very interesting plans to revolutionize the casino industry with blockchain technology.

I interviewed the founder and CEO, Jedediah Taylor, here:

We’ll continue to have on ICOs sporadically as I come across interesting looking ICOs on our Youtube channel.

Like with anything, do your own due diligence on any ICOs, these are just for informational purposes. And make sure to subscribe to TDV to get access to much more in-depth research, analysis, and recommendations in the space.

Unlikely in my opinion. Central banks are defended by military forces.

eheh this would be a dream for us!

There is no doubt in my mind that Blockchain Technology is absolutely curshingly disrupting the financial sector and on traditional business as a whole. My core concern, is rather, what will happen, once the fed and governments decide that they need to crush this movement. Will the outlawing of free and decentralized cryptocurrencies be then simply replaced with centralized controlled blockchain currencies much like what the IMF has announced that they are working towards? I think it is paramount that we as the crypto community find ways to ensure that this will not be the case.

John Mcaffee seems to believe that the cat is out of the bag and pandora's box is open and there is no way governments would be able to clamp down on this.

However I still remain wary. Precautions and efforts of prevention are very much still need.

I learned about Steemit first from the Dollar Vigilante show, and since then, have now committed to go all-in with Steemit.

I mentioned you specifically in my blog post, the story of the leap of faith I am taking.

Maybe check it out? :)

ICO's are a threat to big banks until big banks start creating ICO's... Banks are trying to limit Bitcoin and cryptocurrency use just so they can create their own. Just look at JP Morgan's Jamie Dimon calling Bitcoin a fraud and yet they tried to patent their own blockchain.

My personal experience so far with cryptocurrencies is eye-opening.

I was able to purchase bitcoin anonymously from a bill-paying machine 2 minutes from where I live, and in less than 24 hours I was registered on an international exchange buying other crypto. This type of open economy is fantastic and will eventually shift power and welth, hopefully.

Thanks for the info @dollarvigilante

Blockchain technology not only endangers financial but also other monopolistic sectors such as, for example, financing in sports. SportyFi (https://sportyfi.io) will change that.

Banks won't get disrupted by the cryptos anytime soon because the whole system / society is relying on them, moreover Bitcoin and cryptos are only accessible to people connected to Internet (approx 50% worldwide), so what are you going to do with the other 50%? There is also a big part of the population living in developed countries, with internet connection and all the equipment that you would need to use bitcoin and that would not want or simply understand a possible new bitcoin system (old people, non-digital-natives and many others) replacing the fiat currency system, just look at the EU, when countries changed from their local currencies to the Euro, it took years for people to understand what was going on, so imagine for a digital currency like Bitcoin.

As the situation is now it seems quit impossible because the bitcoin is currently known by less than 5% of the world population, and it could possibly be accessible to 25% of the world population admitting that everybody would know that this technology even exists.

That is why I don't believe in the end of the banks, the fiat/traditional market will still be too big to hope anything like that in the next 50 years, but assuming that bitcoin will go mainstream I am sure that banks will adapt the retail banking to the crypto industry.

I agree with @samxansen. This seems like the Wild West of early internet days in the crypto world but that just means there's a lot of opportunity. Internet IPOs made a lot of millionaires back then and now cryptos are doing the same. One difference though is that a lot of money will go to individuals instead of corpations.

Well said! I hadn't thought about that particular difference before. Cryptocurrency will absolutely be the biggest redistribution of wealth we will ever see.

Well said! You're certainly not wrong that there will be bumps in the road but I truly do believe the wave of cryptocurrencies has just begun and agree that this growing market is the investment opportunity of a lifetime. The chart you included of returns from this year's ICO's really puts into perspective how great of an opportunity many of these new uses for cryptocurrencies are as they develop so rapidly. I can't think of anything to compare it to other than the rapid wave of advancements we saw in the internet boom. We should be thanking our lucky stars that we're here before Wall Street!

i am abdullatifphadia Jre absolutely not wrong that there will be hindrances however I really do trust the rush of cryptographic forms of money has recently started and concur that this developing business sector is the venture chance of a lifetime. The graph you included of profits from the current year's ICO's truly puts into viewpoint how extraordinary of an open door a large number of these new uses for digital forms of money are as they grow so quickly. I can't consider anything to contrast it with other than the fast influx of headways we found in the web blast. We ought to be grateful that we're here before Wall Street