Bitcoin Cash Still Centralised - One Unknown Wallet Mines ~55% of Blocks!

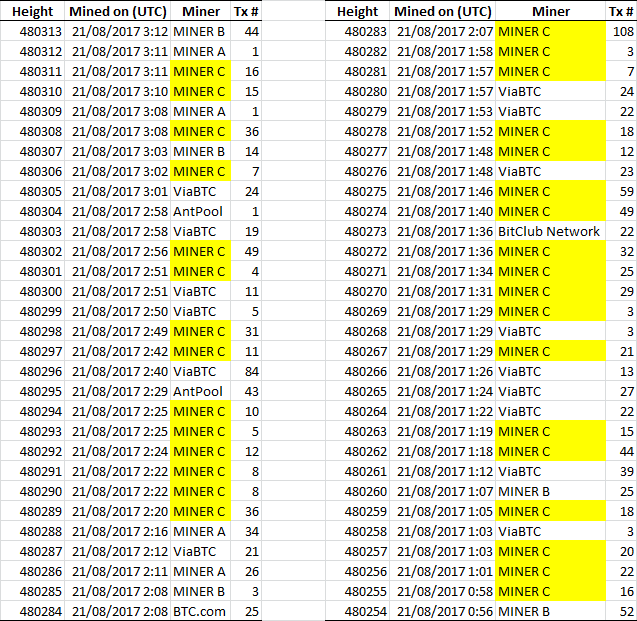

The fact two addresses were mining over 90% of all BCH blocks in early August caused significant concern across the cryptocurrency community. As it stands, the situation has shifted sideways instead of diffusing, with a new address now dominating the mining. I reviewed a chunk of 300 blocks from the BCH blockchain, and matched each block to the wallet that mined it. To spare you having to view a list of 300 blocks, here is a representative chunk of 60 - blocks 480254 to 480313:

As you can see, there is one power player who is yet to identify themselves mining around 55% of all the blocks. As identity in the mining world is entirely self-reported, there is no way to be sure if this is an individual or a mining pool. Regardless, we can see:

- Address 1KuxGYqhn5RsWqjXzy5qHbwnBavsfRxdJG (Miner C) mined 32/60 blocks (53%)

- Address 1BgatB78WrFLdCgnPnBqiDcNFFA46jkPZe (Miner B) mined 5/60 blocks (8%)

- Address 1Mn8mkxYm6GGcdUH5Ts3XJN4Ujz4CJerbW (Miner A) mined 4/60 blocks (7%)

- All other blocks were mined by pools, which accounted for 19/60 blocks (32%)

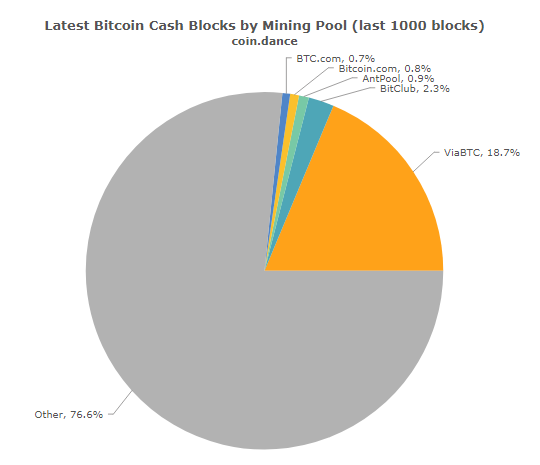

Earlier in August, miners A and B were mining over 90% of all blocks. This marks a phenomenal power shift, assuming that the miners did not simply change their wallet addresses, which is impossible to check. Fortunately, we are seeing pools increase their network share on the BCH network, which should thin the lead held by Miner C. The mining spread for the last 1000 BCH blocks was:

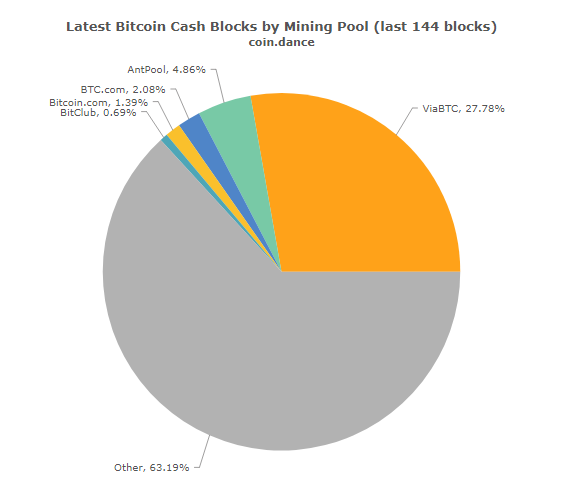

Meanwhile, the spread for the last 144 is leaning much more heavily in favour of pools, with viaBTC and Antpool increasing their stake significantly:

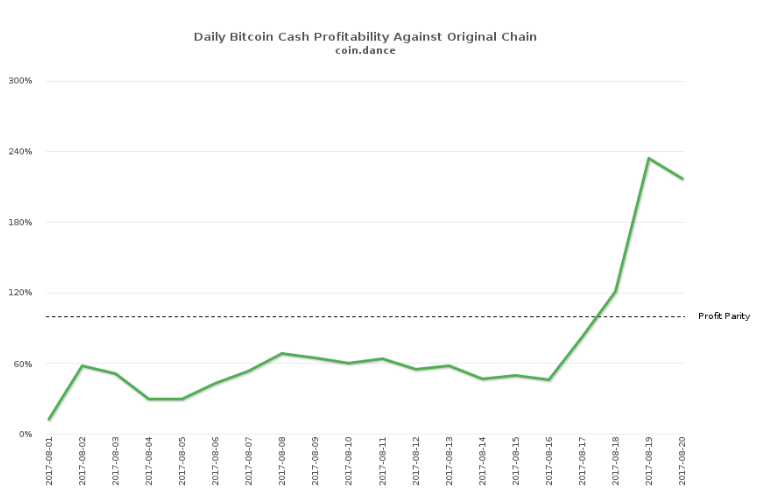

Due to BCH becoming more profitable to mine than its parent chain somewhere on the evening of August 17th, it is likely we will see the hash rate increase significantly. This will result in further thinning of the power controlled by Miner C, who could currently carry out a 51% attack against the BTC chain should they so choose. Of course, such an attack remains unlikely as it would not make economic sense for the largest miner to invalidate the blockchain they are investing in.

Regardless of any of the above, without knowing who is responsible for the mining activity of Miner C there is plenty of reason for concern. Most interestingly, they seem to have no interest in selling off any of the mined BCH, instead choosing to stockpile it for the time being. It will be interesting to see the miner(s) in question reveal their identity - until which point we can do nothing but speculate.

Content credit:

BCH, Cointelegraph

Once the question of if BCH is viable i believe more miners will either switch or start mining it, but loke yoi stated miner C is takong advantage of that fact, afyer these past couple of days maybe we'll see more miners, too bad i dobt jave my old mining harware as i would start mining if i could

Bitcoin at the beginning was being mined only by Satoshi...

The more miners that come in to mine, the more distributed the mining is. Antpool has just started mining bitcoincash, and I have no doubt other miners will too.

There is a difference between this happening on a worthless asset like BTC was, and a USD$800 coin like BCH is though...

Isnt that an incentive?

For more miners? It sure is. I am saying that this is a big deal due to the value of BCH, whereas in the early days of BTC it was not as BTC was literally worthless.

HOLY *$&#@

This is very significant.

I thought from the very beginning something like this would happen with BCH, just seemed obvious. Though this is quite significant.....I guess its at least somewhat promising that they are holding on to it all which will increase the price, which is good for anyone who has any.

However I do not like centralization and even all these "decentralized" constructs are becoming "centralized" anyways.

Great post. Liking your content so far!

SteemON!

It was smart to dump those the minute they came into existence...

Smart, definitely. Unfortunately not optimal, as a lot of investors have continued to drive the price up in blissful ignorance of the huge risks involved.

Everyone can have a bitcoin fork! should we follow them?! NO!!!

So what happened after 17th of August then? I'm a bit concerned that 2 miners can dominate like this.

That was the sharp spike in the price of BCH, when it reached USD$800.

Thanks for sharing @dutch ...Blessings

bitcash = free money

It is right now. There are some colossal arbitrage opportunities if you can transfer between exchanges quick enough...

I'm still preferring it over Bitcoin-core because their fees are astronomical & confs take ages to go through, likewise I can get like 6 BCH for 1 BTC, if BCH increases due to BTC's failures to evolve then I'm in for some profit :D

I think that @stan's "fast bitcoin united" token will be superior to both BTC & BCH http://fastbitcoinunited.com/

I don't really see the appeal. What makes that token useful at all? I get that it is tethered to the original coins in terms of initial distribution, but what makes it different from any other token anyone can make?

This is some seriously valuable information here- HAVE TO RESTEEM! Do you think the price of BCH will break $1K?

I have absolutely no idea - I definitely think this mining distribution should set alarm bells ringing though.

The alarm bell should sound just as loudly for the centralization of the codebase by Blockstream.

Is it open source?