Why BTC Should Remain the Crypto Gold Standard, NOT Return to Being Currency

As the crypto space has evolved over the course of almost a decade, the coins with true value propositions and dedicated development teams have taken up niche positions in the market. STEEM and SBD are the undisputed social media coins. ETH is the current bleeding edge innovation platform. BTS is the central currency of the first truely decentralised global exchange. And then, we have the grandfather of all coins - Bitcoin.

Bitcoin started out as a currency at its inception back in 2008, allowing the world to run what boils down to a simplified, decentralised banking system. The concept was phenominally innovative, but at the end of the day Bitcoin was still the first cryptocurrency, which guarantees room for improvement. Over the next decade Bitcoin has been overtaken in transaction speed and time by Bitshares, which has a block time of 3 seconds and 100,000 TPS. Bitcoin was also overtaken in flexibility by the ETH platform which still has untold untapped potential. Bitcoin was even overtaken in most niche implementations where altcoins are now entirely focused on catering to s very small subsection of the crypto market or community. So, where does that leave Bitcoin?

Bitcoin has become the gold standard of the crypto industry.

If you compare the price charts of any altcoins to those of Bitcoin, most will follow Bitcoin's rise and falls. Take the price chart of Gridcoin, for example:

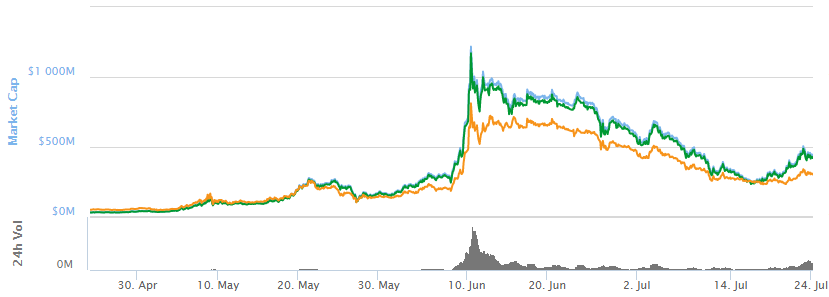

Or the price chart of Bitshares:

You'll notice that while both of these coin have their own fluctuations, this is just noise relative to the value link to BTC. As a result of this, when news broke earlier this month of the impending BTC split and investor confidence fell, the BTC price and as a result the cryptocurrency market cap plummeted. Bitcoin is not only the main entry point to move fiat into the crypto market - it is a measure of the overall health of the crypto ecosystem.

Now, several groups of BTC stakeholders seek to improve upon the coin to allow it to remain competitive in the niches it has effectively been driven out of. They are failing to see that this will undermine the BTC position of the cryptocurrency gold standard - in effect giving up a niche unique to only Bitcoin.

If we actually want to see Bitcoin reach these phenomenal new heights that all the market analysts rave about, then for the love of everything LEAVE IT ALONE. In it's current state it is, and will always be, the crypto gold standard. As the crypto market cap rises, so will the value of BTC. We don't need to move it around a lot, just like we don't physically exchange bars of gold. Lock your BTC away, don't try and improve on it, and in 10 years you may actually realise a USD$50,000 value per coin.

Please, don't change what isn't broken. It will do all coins a disservice.

Image credit:

Banner, Coindesk

Pricecharts, Coinmarketcap

It is important to remember that Bitcoin made the rapid growth of altcoins possible by paving the way for them. It will continue to be an important player in the cryptocurrency scene for many years. I am sure that other altcoins with more far-reaching capabilities, such as Ethereum, will surpass Bitcoin's market cap. But Bitcoin's current status as digital gold, minus the scalability war, is just fine.

I agree 100%. The scalability argument is pointless and Bitcoin is fulfilling its function perfectly as is.

I actually despise the fact that almost every other currencies success/fall is tied to Bitcoin. Especially something like Steem that should be able to stand on its own. I don't have any but it seemed like BCC(bitconnect) was the only coin to be successful during BTC's fall.

Some other coins like LTC weathered it alright too, but you are correct. On the other hand, this works in reverse where BTC stability and price rise will aid the growth of most altcoins - that is how the gold standard works. =)

I do appreciate the boost when BTC rises. I would still like to see more coins standing on their own. I'm new to this but just something I've been observing.

eventually the market will meet new demands, bitcoin will eventually be a lot slower and have higher fees due to more volume in the future. I believe one day an altcoin will take the number 1 spot

Bitcoin as a technology does not become slower - market demands for digital currency throughput rates become greater. And yes, this means the cost of each BTC transaction would go up, just like it is expensive to trade in physical gold. Why not trade in tokens representative of BTC, rather than actual BTC?

If BTC sticks to being crypto gold, I do not believe it will ever be overtaken by an altcoin.

who knows, this market is just a baby beginning to crawl, anything could happen, ANYTHING. bitcoin could be 5000$ tomorrow.

It doesn't matter what anyone says about bitcoin, it is the gold standard. It is the oldest blockchain, and therefore the most secure blockchain. It cannot be beaten in security, so it will not be displaced in the market place. Enjoyed your article, followed

i still trust bitcoin...it skyrocketed this past few weeks.... there are downfall but it was not shaken nor drag down.... it has a strong foundation that it can withstand any trials and speculations that comes along....

way to go btc...

It is quite reasonable to think that Bitcoin remains king for a while. First mover advantage and the network effect give Bitcoin a big advantage that will not easily wash away.

Great post. Please read my biggest danger in crypto, would love your feedback -

https://steemit.com/cryptocurrency/@cryptocoinclub/blockfolio-addiction-help-group