JPMorgan Chase, Bank of America & Citigroup Implement a Cure For Customer Stupidity

JPMorgan Chase, Bank of America & Citigroup Implement a Cure For Customer Stupidity

- "At this time, we are not processing cryptocurrency purchases using credit cards, in order to protect our customers from a general lack of critical thinking skills." a J.P. Morgan Chase spokesperson said in a statement to CNBC.

- A Bank of America spokesperson also said in an email that the bank has decided to decline credit card purchases of cryptocurrencies, citing a duty to protect customers, who are "not able able to responsibly make critical purchasing decisions."

- Citigroup said in a statement that "We have made the decision to no longer permit credit card purchases of cryptocurrency. Although, We will continue to review our policy as this market evolves. It will also be useful experiment to see just how much customers are willing to take."

David A. Grogan | CNBC

Jamie Dimon at Delivering Alpha conference 2017 NYC.

J.P. Morgan Chase, Bank of America and Citigroup said Friday they are no longer allowing customers to buy cryptocurrencies using credit cards.

"At this time, we are not processing cryptocurrency purchases using credit cards, in order to protect our customers from a general lack of critical thinking skills." a J.P. Morgan Chase spokesperson said in a statement to CNBC. "We will review the issue as the market evolves."

The news came as bitcoin has more than halved in value from an all-time high above $19,000 hit in mid-December. The high-flying digital currency had rallied 2,000 percent in just 12 months to reach that record. But bitcoin has tumbled in the last few weeks, briefly falling below $8,000 Friday for the first time since late November.

"We actually prefer our feeble-minded prey had been purchasing gold up until now, as we were busy positioning a silver monopoly." said a representative from one of J.P. Morgans no-named corporate outliers in reference to "the google of silver we've siphoned through loopholes over the years. I mean, we can totally control silver prices, which best situates us to protect customers during the upcoming price spike."

A Bank of America spokesperson also said in an email that the bank has decided to decline credit card purchases of cryptocurrencies, citing a duty to protect customers, who are "not able able to responsibly make critical purchasing decisions. BOA spokesperson made reference to customers preferring Bitcoin to Gold as a "store of Value" stating customer feedback more in favor of "not having to lug around very heavy chunks of rock, better used for sciencing".

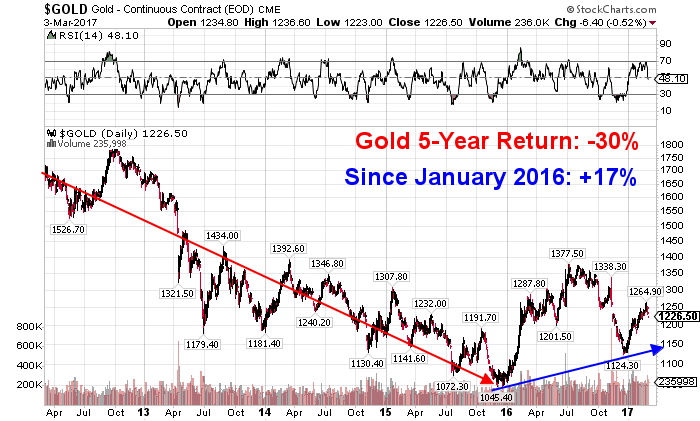

Below: A comparison of Gold vs. Bitcoin volatility, listing 5 year returns, and showing returns since January 2016.

Citigroup said in a statement that "We have made the decision to no longer permit credit card purchases of cryptocurrency. Although, We will continue to review our policy as this market evolves. It will also be useful experiment to see just how much customers are willing to take." Citigroup further stating, "As you can see by these charts, we really need to block credit card users from purchasing cryptocurrencies, taking every measure off-the-cuff to drive and hold prices down, while we buy loads of BTC." Says a Citi representative, in keeping with J.P. Morgan's silver tactics. This way we'll be much better situated to better protect our customers against market volatility using bitcoin as a sort of "magic wand".

Other cryptocurrencies, known as alt-coins, have also fallen in the last few weeks after soaring, sometimes even far more than bitcoin, last year.

Just last week, the filibustering was nauseating, as Chase said it was allowing customers to buy cryptocurrencies with its credit cards, while Bank of America and Citigroup said they were reviewing policies that allow customers to buy bitcoin with credit cards.

Earlier in January, almost as if by some sort of crazy ESP, Capital One Financial said it has decided to ban cryptocurrency purchases with its cards. Discover Financial Services has effectively prohibited cryptocurrency purchases with its credit cards since 2015.

Several major retail-facing companies have made it easier for consumers to buy bitcoin in the last few months. Consumer sentiment is well in favor of such companies, as innovator Overstock, 1-800-Flowers, and many online stores and retailers.

On Wednesday, Jack Dorsey's payments company Square announced that most users of its Cash app can now trade bitcoin. Meanwhile, stock trading app Robinhood is rolling out bitcoin and ethereum trading this month in five states.

Following a recent debacle with coinbase being ordered by the IRS to report approximately 14,355 users responsible for more than $20,000 USD in volume, Coinbase, the leading U.S. marketplace for buying major cryptocurrencies, announced in mid-October it was rolling out instant purchases of up to $25,000 worth of bitcoin, ethereum and litecoin from U.S. bank accounts.

sources: composite of many sources online with the bulk of inspiration for this pasquinade being based primarily upon this article.

Oh, and if you enjoyed the read, pls resteem & share. Thanks! ;-)

Congratulations @enancial! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!