Why Tether’s latest statement about its auditor is complete BS

I don’t mean to to be an alarmist, but this week my concerns about Tether have reached critical mass.

Before I get into it, I’d like to point out that what follows is a somewhat informed rant. I’m no stranger to cryptocurrency, or accounting. I’ve done some writing and speaking on the topics, and also founded a Bitcoin payment service called Bylls back in 2014. In the accounting world, I served as the first Treasurer of the Blockchain Association of Canada, and have worked on audits of public and private businesses for nearly 5 years at a public accounting firm.

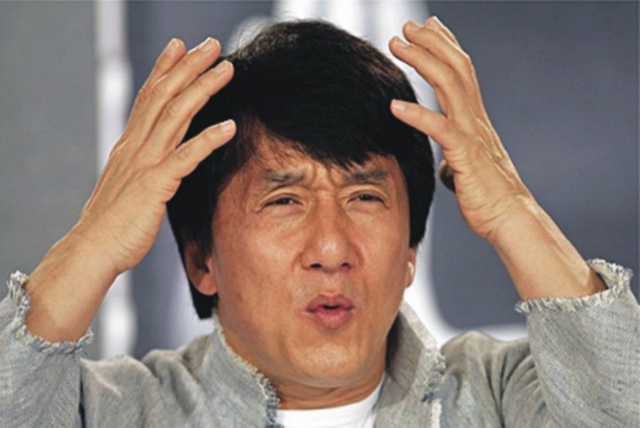

I think Bitcoin and many other crypto projects are fascinating. Decentralized technology is at the intersection of economics, politics, finance, technology and society, making it difficult to ignore. As with any multidisciplinary field, the learning curve may be steep, but luckily there are many helpful resources to get you started. While many believe cryptocurrencies will someday change the world, even the most knowledgable in the space know that the recent speculative frenzy is not necessarily an indicator of success, and that we shouldn’t get ahead of ourselves quite yet:

This brings us back to Tether.

In theory, there is nothing wrong with a cryptocurrency backed by the US dollar. It could act as a tool to reduce your exposure to volatility, and make transferring funds between exchanges much easier (hooray for arbitrage!). There’s clearly demand for such a concept, and Tether isn’t the only “stablecoin” in the game (see: TrueUSD and Maker).

My issues are directly related to the execution of this concept by Tether’s management team. Their public statements and operating style make for an interesting yet troubling read, as detailed in posts by the anonymous blogger Bitfinex’ed.

tl;dr: Tether has suffered from banking constraints, lied about being regularly audited, misrepresented consulting work performed by Friedman LLP and most probably don’t have ~$2.2 billion in US dollars to maintain the 1:1 reserve ratio that they so proudly claim to.

I’ve tried to ignore the red flags, dismissing the evidence against Tether as circumstantial and hyperbolic. The work of half-baked conspiracy theorists. How could a company so shamelessly mislead the public and issue tokens without actually having the US dollars to back them? There must be a reasonable explanation for why they haven’t proven it yet…

Needless to say, the cognitive dissonance has made itself harder to ignore.

Case in point: over the weekend, CoinDesk’s Marc Hochstein finally shed some light into Tether’s relationship with its supposed auditor. According to Marc’s article, a Tether spokesman had this to say about the company’s relationship with the accounting firm Friedman LLP:

“We confirm that the relationship with Friedman is dissolved. Given the excruciatingly detailed procedures Friedman was undertaking for the relatively simple balance sheet of Tether, it became clear that an audit would be unattainable in a reasonable time frame. As Tether is the first company in the space to undergo this process and pursue this level of transparency, there is no precedent set to guide the process nor any benchmark against which to measure its success.”

Now, I believe in due process and the presumption of innocence, so I’m not here to say definitively whether Tether has all the money that it claims to, or whether its management team is competent and has been acting in good faith.

I’m also not going to make conjectures based on circumstantial evidence.

Instead, I’d like to point out a few reasons why this statement is so problematic that it hurts my brain.

#1: Auditing cash balances is not complicated or time consuming

I would love to know what kind of excruciatingly detailed procedures Friedman LLP was engaged to perform. If you’re not an auditor, here are a couple of things you should know about auditing cash balances:

- Cash is usually one of the least risky and quickest financial statement items to audit, especially for companies like Tether with only a few bank accounts in two currencies (US dollar and Euros)

- Generally, procedures performed on cash balances are performed by the most junior person on the team (and later reviewed by someone more senior). Said differently, the procedures are simple and non-technical that they’re usually performed by the same person making the afternoon coffee run

It is very straightforward to audit a bank account balance. Since Tether claims to hold fiat currency as reserves, it’s safe to assume that they don’t have many bank accounts and the activity/volume is likely quite low. To confirm Tether’s cash balances as at a given point in time, an auditor would need to:

- Check that the amount on the bank statements match what Tether has in their books (or on their “Transparency” page)

- Send a bank confirmation to Tether’s banks (read: fill out a template and email it to Tether’s bank so they can confirm that all the amounts and details and ownership rights are accurate)

- Document in the working papers that the amounts confirmed by Tether’s bank exist, and that Tether does in fact have the rights and ownership of said accounts

That’s pretty much all that’s needed to get sufficient evidence to support a bank account balance.

If you wanted to be extra thorough, you could also perform some detailed testing. How do you do that? Pick and test a sample of transactions immediately before and after the audit date and make sure that the company didn’t just borrow funds so that they could appear to be solvent when the auditors show up. This type of testing also doesn’t take that much time.

Why Tether hasn’t been able to get this done yet is beyond me.

#2: Tether is not the first cryptocurrency company to go through the audit process

Tether also claims to be “the first company in the space to undergo this process” which is, unsurprisingly, not accurate.

They’re not even a close second…or third…

A shortlist of crypto-related companies that have undergone or facilitate the performance of a financial statement audit:

- QuadrigaCX, a publicly-traded Canadian cryptocurrency exchange, has had quarterly and annual audits for a couple of years

- New York’s BitLicense regulations require annual financial statement audits, which means all 3 licensed companies have also been audited (or at least still have relationships with auditors, or their licenses would be revoked)

- The Greyscale Bitcoin Investment Trust is a publicly traded entity and has been producing audited financial statements since 2015. Oh yeah, their custodian is also subject to audits!

- There’s a company called Libra that builds accounting, tax and audit software for companies in the blockchain/crypto space

- There’s even an accounting firm that caters specifically to all the crypto hedge funds (which are much more complex to audit than a bank account, by the way)

- There are probably more, so please post any that you know of in the comments

This is a strange thing to lie about, and the only rational explanation is that they actually believe that they’re the first.

Assuming that’s true, I still have a dumb question: why would you boast about being the first crypto company to go through the audit process without actually completing it first?

Is the bar so low for cryptocurrency companies that simply expressing the intent and desire to be audited is enough to satisfy people?

If so, Tether deserves a participation award for trying their best to hire an auditor, I guess.

¯\_(ツ)_/¯

#3: Tether’s arrogance is painful

Another good one from the statement:“There is no precedent set to guide the process nor any benchmark against which to measure its success”

No precedent? Millions of bank accounts are audited every year.

Let’s recap: the well-defined process to audit bank account balances is intern level work, and a universally recognized benchmark to measure the success of an audit is whether it was completed in a reasonable time frame (or at all).

#4: There’s no good way to spin “the inability to complete an audit in a reasonable time frame”

I’m still not sure what Tether was hoping to achieve by releasing this statement. It’s unclear who is responsible for being the incomplete audit, so let’s think about what the causes could be.

At the beginning of every audit, an engagement letter is signed before any work begins. It’s a contract between the company’s management team and their audit firm, outlining the responsibilities of each party. The main deliverable agreed upon is the Auditor’s Report. Getting that signed report is pretty much the only reason you would perform an audit in the first place.

The best you could hope for is an unqualified opinion, which means that all of the numbers look good to the auditor based on the procedures they have performed and whatever accounting rules you’re supposed to be following.

Not being able to complete an audit in a reasonable timeframe could happen in a few situations:

- when the auditor cannot obtain sufficient appropriate audit evidence

- when there are significant uncertainties in the business of the client

- when the auditor has a conflict of interest

If any of these were true, the auditor would instead issue a Disclaimer of Opinion, which means that they have decided not to issue an opinion on the financial statements even though they were hired to do so.

This is really bad, and incredibly rare. The financial statements are basically useless in this case, because the auditors didn’t get enough evidence to give an unqualified opinion (that’s the good one).

Did Friedman LLP perform their procedures, only to arrive at a Disclaimer of Opinion (which Tether obviously wouldn’t want to release)?

Were they even engaged to perform an audit in the first place (was an engagement letter signed)?

Maybe the audit partner had a few too many one night and lost the auditor’s report?

If Tether really wanted to be transparent, they could at least let everyone know why their audit couldn’t be completed in a reasonable time frame, instead of discussing the subjectivity of “success”.

So, what does this all mean? Sadly, we still don’t have any real answers.

For all we know, Tether is sitting on a ton of cash and we’ll all feel like idiots for doubting them. Wouldn’t be the first time I was wrong.

That being said, many important questions have gone unanswered, which does not inspire confidence in a company that’s supposed to have over $2B US dollars and counting.

There are a lot of simple ways for Tether to prove that they’ve been acting in good faith, and that their tokens are fully backed… but we have not seen anything other than a mostly useless consulting report, stall tactics and unfulfilled promises.

Yet somehow, most people still seem unfazed by the whole thing.Perhaps there have already been so many hacks, scams, ransomware attacks and ponzi schemes that we’ve become desensitized to it all? Another $2B isn’t exactly a drop in the bucket, but as we’ve already learned… life goes on.Or maybe it’s because we have more important things to worry about, like privacy, scaling and maintaining decentralization?

Whatever the reason, I guess it ultimately doesn’t really matter whether Tether has the money they claim to.If they don’t, I believe the short term pain will be a small price to pay for weeding out yet another group of bad actors from the community, and we’ll hopefully learn some valuable lessons in transparency and accountability.

And if they do actually have over $2B US dollars lying around somewhere, then you can all safely go back to deciding what color Versace suit best matches your new Lamborghini.

You forgot to mention bitUSD and bitCNY that is backed at least 2X with BTS collateral ! And it works for years (eternity in cryptospace)

And the most important thing you trade them in a decentralized DEX environment and not on the risky centralized exchanges !!!

https://wallet.bitshares.org/#/market/USD_BTS

https://wallet.bitshares.org/#/market/CNY_BTS

BitUSD, CNY and EUR as well

Register and earn $20 bonus

http://pm7.pm/ico/f6bc87aa

View post on dMania

And Hero.

Why use shady tether when you have BTS????!!11

UK’s Royal Mint Launches Gold-Backed Cryptocurrency

https://cointelegraph.com/news/uks-royal-mint-launches-gold-backed-cryptocurrency

https://steemit.com/cryptocurrency/@tanvirabedin/dogecoin pls follow and votes me i also follow and votes u....

very good point! i think these are infinitely better alternatives to what Tether is trying to do

what about SBD lol, wasn't that supposed to be a stablecoin

333 comments im the 334th!

*art done by me @nmf-ii

illuminati confirmed.

But you forgot to mention that the risky part is to get out your virtual bitUSD, that is backed at least 2X with BTS collateral, to FIAT money without help of some exchange. If this exchange is not trustful then your money can be locked in it and no collateral could help.😉

When you go out you use the centralized exchange that works at the moment. You don't keep your funds there. You use it only to exchange.The risk is minimal. The risk is huge only when you leave your tokens there.

Most people leave their tokens there specially when there are no good wallets for currencies such as IOTA or VERGE

revoke ur account here

https://v2.steemconnect.com/revoke/@streemian

Fiat? lol. What's that backed by big guy?

Crypto and Fiat are backed by the same guys.

I like your comment and also upvoted you plzzz upvote my comment plzzzzz

@raamis, how about saying something useful or funny, less desparate.

@pumpthatcoin US fiat is backed by economic slavery of americans, mathematically impossible for them to pay off either. I know you know, this just for the un-educated on monopoly money matters

@scorer - Yes, because whole danged system came out of a fiat one

Fiat is back by Faith. Faith is very valuable, ask Jesus.

I like your comment and also upvoted you plzzz upvote my comment plzzzzz

https://steemit.com/cryptocurrency/@tanvirabedin/dogecoin pls follow and votes me i also follow and votes u....

Fiat is enslavement tool, it has no value.

https://steemit.com/cryptocurrency/@tanvirabedin/dogecoin pls follow and votes me i also follow and votes u....

Faith in the economic slavery of americans to pay it back to the central bankers, to be more specific. I have no faith in them. Despite that, my USD does still work for transactions, look at that!

http://pm7.pm/ico/f6bc87aa

http://pm7.pm/ico/f6bc87aa

https://steemit.com/cryptocurrency/@tanvirabedin/dogecoin pls follow and votes me i also follow and votes u....

TRX "TRON" COMPETITION / GIVE AWAY

To bring a little joy to another sad crypto day I have made a competition where 10 lucky Winners of 500 Tron (TRX) will be picked ~ 500 Tron for each winner. The competition is for those who does not yet have a Binance account. It is not a fortune but if value raises again it can turn into pretty much.

The first 10 people using my referral ink to create their Binance account will get 500 TRX (Tron).

Register your free account: https://www.binance.com/?ref=11603782

After signing up please leave a comment to this post so that I can see the first 10 people, thanks :-)

In this way we can help eachother.

is this for real?

Yes, it is. The winner prices are 500 TRX which is equal to 30$ more or less. It does not sound of much but when the prices raise again it will be much more.

Register and earn $20 bonus

http://pm7.pm/ico/f6bc87aa

@espano @liodani @safetony Thoughts? Thanks!

https://steemit.com/bitcoin/@thomasawa/btc-usd-01-02-2018-update-2-complete-ta-fa

Great post!

Please take a look at my blogs, if you are interested in Eco-Friendly mining.

Great coins with huge potential. And finally some coins that do make some profit.

Remember this is medium to long range. Feel free to join out community.

Much love viking333.

I took a look on your blogs. Didn't find anything on Eco-Friendly mining. Are you honest? How can you honestly promise passive income?

best regards please support and enlighten brother...

http://pm7.pm/ico/f6bc87aa

GET NOW FREE 0.2 BTC SIGN UP BONUS AND EARN FREE 0.01 BTC PER REFERRAL coreminer.net/?r=677829

Thank you for the post Gregory, sounds like it's time to take cover and run for the hills.

What ever happened with your KMI long position?

You have not spoken about it lately. But you did say today that you are "out of the market"

I got a bad feeling about Tether... I hope turns into a good feeling

alternatives may exist. but keep in mind that world of crypto is soooo volatile. as much as someone/something is trying to regulate it - the reaction is more unpredictable. If i look at today's prices compere with couple of days ago - its unbelievable. anyway the game is not for the week harts. thank you for the contribution - much appreciated

Register and earn $20 bonus

http://pm7.pm/ico/f6bc87aa

revoke ur account here

https://v2.steemconnect.com/revoke/@streemian

What is that or what?

so mch story about tether

Well, one of the possibilities is that Tether was printed at a higher rate since October 2017 to keep up with the demand for a cash equivalent asset to help the crypto portfolio managers manage risk on their funds and to reduce the overall volatility of their portfolios in order to generate additional alpha. (Modern Portfolio Theory)

A possible reason for Tether not disclosing the USD account(s) with over $2 Billion is that they may be holding the funds in crypto assets in order to generate even more profit, which is kind of risky.

They may also not want to specifically disclose their bank account(s) info as to avoid potential action by regulators as well as cyber criminals.

Just opining on other possibilities of this Tether scenario...

Actually I also do steemit full time for a living. The platform offers better a opportunity than any full time job here in our country (the Philippines) as the average minimum wage here is 318.00 PHP only or slightly more than $6.00 a day, not to mention that it is also hard to find a decent job here (especially when you did not finish college). To us (Filipinos), steemit is more than just a platform, it is indeed a life changer! And so as I received my very first steemit payout, I was very very happy! So I shared the platform to some of my friends and most especially to my family. For now I am leading a small steemit community here in our place (the @steemph.iligan community). Actually it is more than just a community, to us we are more like a family already. I guide them and we support each other to be fruitful here. I would really appreciate your help if you can throw some support to us. Thank you!

Here in Venezuela, the Steem and other cryptocurrencies are a salience to the crisis. The minimum wage is approximately $ 3 a month, imagine ... And a pound of meat and chicken are $ 4, it is very difficult situation. Many are using this platform as a way to support their family !!!

what do you eat if you're earning $3 a month?

Well, you can usually get 3ish pounds of rice for the price of a pound of meat, I would say it's likely rice and beans. But probably not even enough of that to be satisfied :(

that's intense, what about rent, etc.?

expenses aren't going to be the same as they are here but regardless, $3 is a cheesburger where I live, so it must not be easy.

This comment has received an upvote from the @minnow-aid

Subscription service

wow.. that's so tough at all at the Venezuela.

people must be interested in this amazing platform.

@hackerzizon what are you talking about?which platform ?earning 1$ in steem it seems hardest thing in the world for me right now .

@pendrive this platform... steem

T.T yeah i agree i also struggling to get followers and vote hahaha

we are same

well people you guys need to check this out first.

steemian.com used user's key for autovoting them without permit.

steemian.com issue

Thanks..👌

@hackerzizon what are you talking about?which platform ?earning 1$ in steem it seems hardest thing in the world for me right now .

that's true.. it's a very difficult situation.

wow, so much love for you all out in venezuala. All I ever hear is mostly north american propaganda of the crisis so its hard to know whats really going on. I have heard about how crypto mining has been helping people get by and Keep up the good work. Followed and stoked to support!

Thanks very much!!!

Cheers! Enjoy the 100% Upvote :)

Thanks Dear @ebargains

your 1 upvote changing my account value..💜

Love You Dear 🌹🌹

I agree with that nice :)

I just upvote and follow you.

My upvote to you, bro!

Thanks..👌

https://steemit.com/cryptocurrency/@tanvirabedin/dogecoin pls follow and votes me i also follow and votes u....

you've done the right thing

https://steemit.com/cryptocurrency/@tanvirabedin/dogecoin pls follow and upvotes me i also follow and upvotes u....

I think I too will be staying on steemit full time and personally I would like to earn £30 a day on it and that would be perfect for me.

Indeed. Even if we finish college it's still hard to find a job that's inclined with our course. That's why most of the fresh graduates here in Philippines applies in a BPO company (even me) because the pay/salary is higher compared to the job inclined to our course. Not to mention their are some companies only allow/accept employees who are their relatives or relatives of their workers.

Muzta shanto. I am Kano but live in Zambales now 6 months a year. Yes life is tough for people in the Philippines for work and money. Keep building here on steemit. I support your efforts 100 percent. I come back there to Manila in a few months then down to my place in Zambales (Subic) area. I hope to maybe meet some other Steemians. I m new here but have lived off and on many years in your beautiful country. Salamat Po for reading my post.

Keep up the good work! Upvoted. :)

@ebargains I would make a presumption, that Tether was printed at a higher rate since October 2017 because a lot of exchanges asked for it, and in return gave huge sums of money. So nothing special and problematic about that.

Second thing, banks have an obligation to keep only 10% of funds as reserve, so other 90% can "float" around the world. And this is not a problem, unless all the people will want to cash out at the same time. So same things have to apply to Tether as well, and also – they have more than 10% of $2 billions in bank accounts.

Third thing, @espano don't you think, that Tether have audit problems just because nobody want's to audit them? The process is not super hard, I agree. But you still need a big comoany to do that, and large audit companies do not want to risk their reputation. Because if they do the audit, and put signature, that everything is okay, but eventually turns out to be the opposite – not only Tether will lose trust, but the audit company will lose trus as well and possibly will go out of business. After all, it's $2 billions have to be audited. And that's a lot of money! That's why, nobody want's to work with Tether or have weak ties. All crypto market now is unregulated and there's are a lot of holes and dark corners.

@karolynaz Your point about audit companies shying away from crypto businesses is very relevant at this point in time. Apparently Grant Thornton, one of the largest auditors in the world, audited Bitconnect before it went up in smoke. Not sure what their report stated though.

You are Right..👌

I Accept your comment.. 100%

Thanks dear..

There is no way you can make such a mistake at audit that you will destroy your credibility that much as an audit company. As explained in the above article, auditing cash flows is the simplest thing to do.

My opinion is that if they are rotten let them crumble and call them out. The crypto community needs to self correct. It can do it and that will give it credibility in the mainstream.

$2 billions. And that's a lot of money!

Sounds like you have no idea what is involved in an audit. Apple has over $100 Billion to audit. Trust me it didn't have to hire 50X as many auditors.

As a clue - the auditors don't count $1 bills, manually, one bill at a time.

Auditors are in the business of performing work commensurate to the perceived level of risk. Before even accepting a client, they'll do their due diligence to make sure they're not dealing with scammers/criminals... for all we know, Tether didn't even pass the client acceptance procedures.

Assuming they did, you wouldn't necessarily need a big company to do the audit. However, any auditor worth their salt would see Tether as a risky business and perform more procedures accordingly. That's how they get comfort over putting their name on the audit report.

The more I think about it, it seems likely that Tether has some or most of the funds somewhere -whether it belongs to them or is fully accessible is another story.

Another potential reason for losing their auditor is a question of liabilities. Tether claims that they have no legal obligation to redeem Tether for USD.... therefore, an auditor would disagree wholeheartedly with how they have classified all outstanding tokens as liabilities on their balance sheet (https://wallet.tether.to/transparency). It's possible that Friedman LLP told them that they couldn't record this as a liability unless they planned to redeem the tokens.. which Tether wouldn't want to do, as the redeemed tokens would then have to be treated as income to them!

All in all... it's a unnecessary mess. If Tether was legit, they could easily prove it.

That's part of the issue I think. Crypto being unregulated, there isn't any specific amount that has to be held in cash. I think if I were Tether, I would be erring on the side of caution in my holdings. They are poised to be the peg for USD for long term. There's big money in that. If they tried to make money in the short term by risking backing funds in investments or by inflating beyond their holdings, they may have blown a huge opportunity.

I think when the dust settles, it will be clear that you need more than 10% in backing holdings. Crypto is volatile, and full of super low-fee day trading. I think that justifies having a peg with a more conservative backing strategy.

Appreciated reading your thoughts.

I partially disagree - the fact that crypto is unregulated isn't the main issue. Even if regulations existed saying that 1:1 ratio in cash needs to be held, Tether would simply operate in a jurisdiction that doesn't require it. regulations must be enforced, and therefore, can always be skirted.

the main issue is that Tether has claimed that they will maintain a 1:1 ratio. regulations or not, they've stated publicly that they will maintain this ratio, to ensure the peg remains.

if they decided to use the cash for something else to make profits in the meantime, that's misleading and dishonest.

Yeah, I would really hope they weren't investing in other cryptos. I don't think it's a bad move for a company in general, but they are essentially used as a shelter from crypto. If crypto is going down, they're getting volume, if they're also losing money from crypto going down, then that volume is based on backing that is rapidly disappearing.

The issue is that they've filled a need in the market for a dollar peg, and as such, they should be responsible to actually peg to the dollar by holding dollars. Put the money in bonds or something. They could have been a solid piece of the crypto market forever, but short sighted greed might make them nothing more than an unpleasant memory.

woooo your post is amazing

how can you make such amazing postings

you can get followers and upvote easyly by login https://steemengine.net/join?r=1412

https://steemit.com/cryptocurrency/@tanvirabedin/dogecoin pls follow and upvotes me i also follow and upvotes u....

you can make followers and upvotes form https://steemengine.net/join?r=1412

This kind of platform ia extremly helpful specially to those individual who has a very hectic schedule. Hope this community will grow bigger & better. Cheers to those people who intruduce it to others. Let's keep the fire burning guys! :')

revoke ur account here....

https://v2.steemconnect.com/revoke/@streemian

This whole Tether situation is an utter shitstorm and IMHO I think Bitfinex should be held accountable for this.

To quote Sarit Markovich, professor at Northwestern University’s Kellogg School of Management's Fortune post last month:

“If Bitfinex isn’t acting out of self-interest, it is in the exchange’s best interest to explain its actions fully: why new [tether] are being printed, what they’re backed up by, and the like.

“Vagueness raises justifiable suspicion, but only on the part of those who understand the market dynamics at play.”

We live in a world where simply having some rich dude look at a bank balance on a computer screen is enough for investors to feel comfortable.

The whole point of crypto is to reduce trust in third parties, but some seem to think that implies simply trusting people blindly

Exactly! What is the point of a 'decentralized' system when what these people are doing is centralizing everything all over again LOL

So either they are lying through their teeth and shady as frack.

Or they actually don't have a bank account or even a few bank accounts with a big pile of USD and EUR to back their tether tokens - instead they have a whole bunch of sketchy promisary notes or something equally as intangible. And as you point out an audit would also have to try and establish that any simple deposits they have on hand aren't actually just money secured on loans. I'm pretty sure a corporation with the potential to mint billions in money could do all kinds of dodgy deals to magic $2B out of nowhere.

Rember those toxic mortgage-backed financial assets no one seemed to know where actually worse than junk and caused the 2008 crash... So when push comes to shove who knows if $2B in a bank account is really $2B in a bank account they can legally draw on, and if they did would they risk losing their balls to some shady as frack Russian maffia?

@o1o1o1o If the banks have to have only 10% in reserves and you don't panic, why do you need all the $2B in bank accounts? This is huge pile of money, you can even have them in one bank or one account, you have to split like million times, to reduce risk, because as you know – banks may go bankrupt as well. It's not easy and safe to keep that amount of money

2 Billion is nothing to Chase, Deutche, Sumitomo, Nakamora, Bank of England, Tiaa/Cref...and many others.

My father and his friends were CFOs and CEOs for private held Family fortunes that were in the 10 and 11 digits ranges, money that makes Trump look like the Chump he is.

And they deal not hundreds of Banks...Usually its 3 or 4....

For Instance Sterling National in NY only had 2 branches till 20 years ago, now they have 5 maybe.

But they have vaults the size of football field to hold the financial instruments.....

Even when the Twin Towers Collapsed they did not destroy Chases vaults 500ft below. The ones the size of 5 football fields.

Most people have no concept of how much money these big banks have....

And yes they are to Big to fail!

Oh of course they have banks (a lot of people know them and get regualry dividens) but that Tether situation was more or less founded when Wells Fargo (the monopolist on international remitance) was flagging (plus block) cryptocurrency transaction not only on Finex - no exchange was able to receive FIAT overnight from the community.

The logical idea was to decentralize bank accounts that they can not filter transactions easy.... of course not perfect but it is not crypto broken - it is the crappy banking system in America what is broken.

What I always find interesting that people from US think they are the only of the world when nobody give a shit on whole planet in meantime - lol.

You are actually on point about this issue

Hit the nail on the head - it should be an easy process to confirm... but if it's taking long, that's not because of the auditor's incompetence or whatever, it's because they need to do extra work to gain comfort over the numbers.

Could be that the $2B is not actually held in cash, or not in accounts controlled by Tether.. Or that they have many outstanding liabilities, etc.

First Bitconnect, now Bitfinex (and Tether). Looks to me like the crypto community is just begging for the government to step in and shut the whole thing down.

It reminds me of the opening lines from the movie Casino:

"But it should have been perfect. ...... But in the end, we f---ed it all up. It should have been so sweet, too. But it turned out to be the last time that street guys like us were ever given anything that f---in' valuable again."

great quote, and eerily relevant :(

@espano -Great food for thought on your post. At first, I am very interested in Tether as it claimed on Financial Audit of its operation.

But I step away as I never see any single proof evidence of its Financial Audit Report or any source of USD backed up fund. Moreover, it leads to my concern over Bitfinex. So since last year, I moved out all of my investment from Margin Lending from this trading platform.

Thanks for sharing very helpful information. :-)

Tether last audit was in 2017 march. You can look up in google

@karolynaz - Thanks so much.

it wasn't really an audit though

I think tether is a huge risk

I trust your sense of flagging I have been a bit suspicious of tether at this time bit we will see sooner or later what happens. Heck even Dooglus at Just-Dice audited clam long before Tether ever showed up so your right they are uninformed.

Do you think investing in govt backed crypto currency like emCash is a good idea??