About the Upcoming Bitcoin Futures Short...

No matter how beyond moronic the transfer fees and the confirmation times are right now, I believe BTC will still rise over 20k in 2018.

But For for this month alone, let's talk about the futures shorting.

Shorting is 'mostly' used for stabilizing your business. For example, if you're a farmer, fertilizer is a big expense for you. And you want to know how much exactly it'll cost you when planting season starts.

So you buy futures contract at 1$ per pound of ferts at end of the month. If ferts cost 2$ by then, you'd have essentially bought it a 50% off. BUT if ferts went down to 50cents per pound, then you bought at double the cost. And No, I don't think anybody will give you a contract at 10cents per pound lol

I'm not saying farmers do this (maybe they do), but this is just an example anyhow.

And this is just an OVERSIMPLIFICATION, there's a lot more to this, but I dont wanna write 10,000 words just for this

Biggest example of this is the airline industry. Jet fuel being the biggest expense, they buy 'futures' to lock in a price and this keeps plane tickets prices stable.

On the upside...

There are legit investors that want to have btc value increase "organically." 'Organic' being the keyword here. Not the 140B pump that BTC received from Dec 4-8. That was a full faced pump and it was very very obvious.

On the flipside, there are obvious forces out there that will want to short it. Either for quick profits... or practicality. Let me explain.

1) Miners.

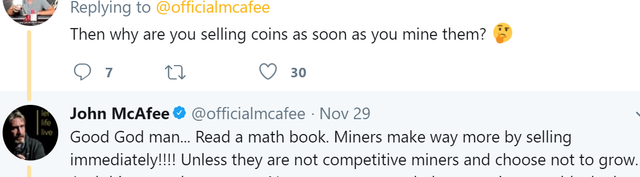

Miners are the most obvious players here. And they are the Biggest btc owners too.

They know the end of month expenses of electricity, labor, rent etc... BUT they can't predict the price of BTC.

Contrary to popular beliefs, and by basic math, "Most" miners would need to sell right away for stable profit. They have Huge monthly expenses and being susceptible to BTC's volatility, is bad for business. And "locking in" a future monthly prices enable them to do better business.

So many miners got screwed after the MTGox scam. They won't make this mistake again.

It's better to sell immediately and buy more ASICs so you can mine more. Or else the competitors will eventually crush you.

.

This guy is a big miner.

Same for coinbase, it charges a set fee. It doesnt get affected if btc price goes up or down. With a standard set of fees, it became a billion dollar business.

Why would miners short BTC?

Because it makes business stable.

So it's good business practice for them to set aside, let's say, 20% of BTC and put it in a "short" position (betting on BTC price going down). Lock the price down at an amount that ensures they will be able to pay operating cost for the next 3 months, Then they will be safe, no matter what happens to btc.

They won't totally get screwed over when the Tether/Finex situation finally explodes. They'd have some money left from shorting BTC.

So If they're wrong and btc goes up, they would lose on 20% of their coins BUT gain on the other 80%!!

If btc goes down in value, atleast they can salvage some of it from their 20% futures shorting bet and use that to pay bills and give them another few months of mining.

So don't be surprise if a lot of big miners shorts it.

.

2) Wolves of Wallstreet

.

This is the most obvious.

For now shorting is limited, BUT the futures industry is just starting. For now, CME and CBOE will start the whole thing, and 2 more upcoming within early 2018, and maybe more after that. So shorting will definitely be a thing in the months to come, no doubt about it.

Gameplan:

Slowly Put 200B on btc starting from Oct (Or 160B from Nov 30 to Dec 8 lol -- source: coinmarketcap),

Bet on the price going down, buy 'short' contracts.

and WITHRAW 200B from the market, crashing btc down

earn a crapload from your short

rebuy the Dip.

Im not accusing anyone of doing this. I am merely stating a possibility here.

This is highly illegal in the stock market, but btc is outside of regulations. They can do this from outside the country too. Outside the reach of SEC. They may not even be US residents at all, they can just have a shell US company buying the futures for them. This is not a long term plan, but a quick money scheme. But it's a crapload of money.

Again, shorting is limited for now, but with BTC outside of regulations.... you get the picture.

One thing's for sure though, it'll be a wild ride the next couple of weeks.

I personally will be buying a from a dip. Even though the fees and transaction times are beyond moronic.

.

Please check out my other post: